U.S. Pharma E-commerce Market Size, Share & Trends Analysis Report By Product Type (Vaccines, Specialty Care), By Therapeutic Area (Diabetes, Immune-system Diseases), By Type, By Market Type, By Platform, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-129-6

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Technology

Report Overview

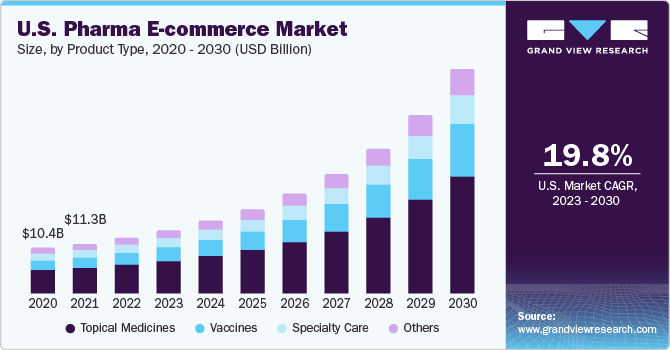

TheU.S. pharma E-commerce market sizewas estimated to beUSD 12.65 billion in 2022,预计年复合增长的恶性肿瘤h rate (CAGR) of 19.8% from 2023 to 2030. With a greater emphasis on virtual healthcare and telemedicine, there is a greater need for pharmaceutical e-commerce.Telemedicineplatforms commonly use online pharmacies to ease the delivery of prescription pharmaceuticals to the patient's location. Integrating pharmaceutical producers' goods into the telehealth ecosystem makes healthcare much more accessible and convertible for patients. Collaboration with telemedicine providers, on the other hand, can help pharmaceutical companies achieve market momentum and a competitive edge. Governments and other organizations have launched various initiatives to improve virtual healthcare and telemedicine offerings.

The increased incidence of ailments such as diabetes and various skin problems is driving the expansion of the topical medications market. The popularity of topical ointments and pharmaceuticals is boosting their sale throughe-commerceplatforms, owing to their ability to treat pain instantaneously and availability in various forms, such as sprays, gels, lotions, and creams. Furthermore, prominent pharmaceutical firms are releasing new OTC (over-the-counter) topical treatments to remain competitive in the market. For instance, Futura Medical gained approval in June 2023 for the OTC commercialization of their erectile dysfunction gel, Eroxon, in the United States, which enables the corporation to offer the medicine to clients without requiring a prescription.

Various pharmaceutical manufacturers in the United States have increased their online presence and made their products available to be ordered online through third-party and company websites, allowing pharmaceutical manufacturers to sell their products directly to customers and eliminating the need to rely on intermediaries such as wholesalers and distributors. This has allowed them to increase their profit margins and provide their products at a lower price to clients. Pfizer Inc.'s goods, for example, may be purchased online by US healthcare professionals via the PfizerPRO website. Vaccines and other healthcare supplies are among the items that may be acquired online.

The increasing emphasis of B2B healthcare purchasers on enhancing their e-commerce platforms is fueling segment growth. B2B customers of specialty medical care items are increasingly conducting online product research to examine all available choices and locate online providers of medical needs. Buyers choose an e-commerce supplier by analyzing the variety of specialized care items available through suppliers' online sales platforms, including price information, online quotes, and stock availability. Online distributors of specialist care items focus on customer-centric offers to attract potential business clients. Birdi, an online specialty drug distributor, provides free delivery, medical aid such as a pharmacist and nurse hotline, translation services, copay assistance, and a tailored refill program.

The rapid proliferation of pharma-specific e-commerce platforms in the United States is boosting vaccine sales through e-commerce channels in the nation. Medical research institutions are collaborating with e-commerce enterprises to make vaccinations available to target clients via prominent Business-to-Business (B2B) organizations. For example, in October 2022, Avian Vaccine Services, a business division of Charles River Laboratories (a pharmaceutical firm located in the United States), announced a global agreement with BioIVT, LLC (a pharmaceutical and life sciences company based in the United States).

Avian Vaccine Services' products would be made available online via the BioIVT Digital Portal under the terms of the agreement. Their clients will be able to quickly explore and buy from the extensive vaccination product range of Avian vaccines, such as antisera, cells, and other viral antigens, with these expanded e-commerce facilities. Furthermore, in January 2023, Arlington Capital Partners (a private equity firm located in the United States) bought Avian Vaccine Services from Charles River Laboratories, forming a new business, AVS Bio, which services the bioprocessing and biologic manufacturing sectors independently.

Product Type Insights

Thevaccinesegment is projected to witness the highest CAGR of over 21% during the forecast period. The growth of this segment can be hugely attributed to increased sales of COVID-19 vaccines, increased awareness of vaccination, and convenience of purchasing online. The shift in consumer behavior has prompted pharmaceutical companies and healthcare providers to expand their digital presence and improve their e-commerce capabilities, enabling easy access to vaccines online for the U.S. population. The ongoing efforts to combat various infectious diseases and emerging variants have also resulted in the growth of vaccine products globally and in the U.S.

The topical medicine segment occupied the largest revenue share of over 51% in 2022. This share of the segment can be attributed to increasing consumer demand for convenience and accessibility, which has led to increased online pharmaceutical purchases. Moreover, the growing awareness of skincare and dermatological concerns has increased demand for topical medicine. Moreover, consumers are effectively seeking medicinal solutions for various skin conditions, ranging from acne to anti-aging, contributing to the increased demand for topical medicines in the U.S.

Therapeutic Area Insights

The diabetes segment is projected to grow at the highest CAGR of over 22% during the forecast period. The rising incidence of diabetes, the increasing number of diabetes management mobile apps, and medical developments in diabetes treatment are driving the growth of the diabetic medication market in the United States. The widespread availability of diabetes drugs on e-commerce platforms is expected to increase demand for diabetic medicines via e-commerce channels. Diabetes pharmaceutical producers cooperate with e-commerce behemoths like Walmart and Amazon to reach a wider audience. For example, LifeScan, Inc., a diabetes management firm in the U.S., will launch the OneTouch Amazon shop in September 2020 to help patients manage Type 1 and Type 2 diabetes.

The immune-system diseases segment held the largest share of the U.S. pharma E-commerce market in 2022, occupying around 18%. The rising number of immune system disorders across the U.S. has positively influenced the market's growth. The increase in several immune system diseases, which includes asthma and severe combined immunodeficiency (SCID), among others, has been among the major diseases that have been on the rise, resulting in the increased purchase of pharma products for these diseases across online and offline channels.

Type Insights

The prescription medicine segment is projected to grow at the highest CAGR of over 30% from 2023 to 2030. The prescription medicines industry is expanding as people continue to favor prescription medications to avert health concerns. The reimbursement facility for prescription drug costs in medical insurance also contributes to the segment's growth. In the coming years, the actions being followed by the U.S. government to lower prescription drug costs are projected to push the prescription medicines segment's growth throughout the forecast period.

店头交易(OTC)市场中最大t revenue share of over 71% in 2022. The rising occurrence of mild diseases such as cough and cold, headache, minor burns, and backache is boosting demand for OTC medications. As a result, pharmaceutical firms are adopting various business methods to increase OTC drug sales. For example, Glenmark Pharmaceuticals Ltd.'s U.S. affiliate bought the approved Abbreviated New Drug Applications (ANDAs) for four generic OTC medications from Wockhardt Ltd. in June 2022. Cetirizine Hydrochloride pills (5 mg and 10 mg), Famotidine tablets (10 mg and 20 mg), Olopatadine Hydrochloride Ophthalmic Solution, and Lansoprazole capsules (15 mg) are among the four OTC medications.

Market Type Insights

The B2C segment is projected to grow at the highest CAGR of over 21% from 2023 to 2030, owing to the growing number ofB2C e-commerceenterprises in the United States, positive government policies fostering digitalization, and significant end-user demand for online sales channels. For example, Amazon, Inc. established Amazon Pharmacy in November 2020, an online e-commerce platform that allows users to acquire prescription and generic pharmaceuticals and receive them within two days. Customers may also use the site to compare prescription prices and choose low-cost pharmaceuticals if they do not have health insurance. Meanwhile, B2C pharma e-commerce platforms focus heavily on extending their product offers to reach a bigger audience.

The B2B2C segment occupied the largest revenue share of over 31% in 2022. The B2B2C model enables pharmaceutical businesses to establish corporate ties with online distributors while increasing income through online sales. Pharmacies use the B2B2C model to efficiently advertise their products and services by forming B2B partnerships with companies that specialize in online retailing.Pharma e-commerce companies can also benefit from the B2B2C model, such as a significant customer base, increased market revenue, and enhanced brand positioning.

Platform Insights

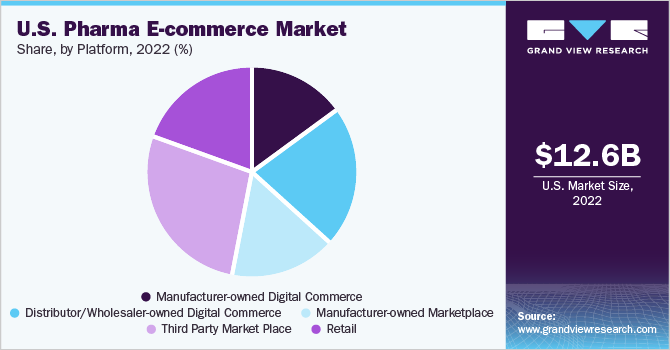

The manufacturer-owned marketplace segment is projected to witness the highest CAGR of over 22% from 2023 to 2030. The factors contributing to the growth of this segment include a better understanding of the product by the manufacturer, which enables them to offer comprehensive product information, guidance, and support to customers, thereby increasing brand loyalty. Moreover, these marketplaces offer a direct-to-consumer model, which helps eliminate intermediaries, thereby reducing the cost for the manufacturers and customers, enabling them to offer the products at a more competitive price and attract customers. Moreover, the manufacturer can ensure the product quality, authenticity, and compliance with their platforms' regulations, eliminating the fear of purchasing counterfeit medicines among the customers.

第三方市场细分大举行st revenue share of more than 26% in 2022. The high revenue share of this segment can be attributed to a wide range of pharmaceutical products available for customers to choose from. These marketplaces also help foster price competition among sellers, which paves the way for customers to acquire products at a cheaper rate. The convenience of browsing and purchasing multiple pharmaceutical products is another factor that has fueled the growth of the third-party marketplace.

Key Companies & Market Share Insights

The U.S. pharma E-commerce market has a fragmented competitive landscape featuring various global and regional players. Leading industry players are undertaking strategies such as product launches, collaborations, and partnerships to sustain in the highly competitive environment and expand their business footprints. For instance, in October 2022, Avian Vaccine Services, a business division of Charles River Laboratories (a U.S.-based pharmaceutical company), announced a global collaboration with BioIVT, LLC (a U.S.-based provider of biological products to pharmaceutical & life sciences companies). Under the agreement, Avian Vaccine Services’ products would be made available online through the BioIVT Digital Portal. With these enhanced e-commerce facilities, Avian Vaccine Services’ clients could easily browse and buy from the vast vaccine product portfolio of Avian vaccines, such as antisera, cells, and other virus antigens. Some prominent players in the U.S. pharma E-commerce market include:

Amazon.com, Inc.

Chewy, Inc.

CVS Health

Express Scripts

FSA Store Inc.

Healthwarehouse,.Inc

McKesson Corporation

OptumRx, Inc.

PillPack

Rite Aid Corp.

Sam's West, Inc.

The Kroger Co.

Walgreen Co.

Walmart Health

1-800 Contacts

U.S. Pharma E-commerce Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 14.37 billion |

Revenue forecast in 2030 |

USD 50.77 billion |

Growth rate |

CAGR of 19.8% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

Segments covered |

Product type, therapeutic area, type, market type, platform |

Key companies profiled |

Amazon.com, Inc.; Chewy, Inc.; CVS Health; Express Scripts; FSA Store Inc.; Healthwarehouse, Inc.; McKesson Corporation; OptumRx, Inc.; PillPack; Rite Aid Corp.; Sam's West, Inc.; The Kroger Co.; Walgreen Co.; Walmart Health; 1-800 Contacts |

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

U.S. Pharma E-commerce Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. pharma E-commerce market report based on product type, therapeutic area, type, market type, and platform:

Product Type Outlook (Revenue, USD Billion, 2018 - 2030)

Vaccines

Specialty Care

Topical Medicines

Others

Therapeutic Areas Outlook (Revenue, USD Billion, 2018 - 2030)

Diabetes

Immune-system Diseases

Cardiovascular Diseases

Neurodegenerative Diseases

Cancer

HIV/AIDS

Others

Type Outlook (Revenue, USD Billion, 2018 - 2030)

Prescription Medicine

Over-the-Counter (OTC)

Market Type Outlook (Revenue, USD Billion, 2018 - 2030)

B2B

B2B2B

B2B2C

B2C

Platform Outlook (Revenue, USD Billion, 2018 - 2030)

Manufacturer-owned Digital Commerce

Distributor/Wholesaler-owned Digital Commerce

Manufacturer-owned Marketplace

Third Party Market Place

Retail

Frequently Asked Questions About This Report

b.The U.S. pharma E-commerce market size was estimated at USD 12.65 billion in 2022 and is expected to reach USD 14.37 billion by 2023.

b.The U.S. pharma E-commerce market is expected to grow at a compound annual growth rate of 19.8% from 2023 to 2030 to reach USD 50.77 billion by 2030.

b.The topical medicine segment dominated the U.S. pharma E-commerce market with a share of 51.4% in 2022. The growth of this segment can be attributed to increasing consumer demand for convenience and accessibility, which has led to increased online pharmaceutical purchases.

b.在美国制药公司也经营的一些关键球员mmerce market include Amazon.com, Inc., Chewy, Inc., CVS Health, Express Scripts, FSA Store Inc., Healthwarehouse,.Inc, McKesson Corporation, OptumRx, Inc., PillPack, Rite Aid Corp., Sam's West, Inc., The Kroger Co., Walgreen Co., Walmart Health, and 1-800 Contacts.

b.Key factors driving the U.S. pharma e-commerce market growth include better convenience, various brand choices, prescription medicines, and availability of genuine products, especially from pharma manufacturer websites. Telemedicine platforms using online pharmacies have also paved the way for easy delivery of prescription pharmaceuticals. The increasing incidence of illnesses, which includes skin ailments and diabetes, is also fueling the market growth.