U.S. Residential HVAC Systems Market Size, Share & Trends Analysis Report By Product (Heating, Ventilation, Cooling), By Region (Northwest, Southwest), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-147-3

- Number of Pages: 169

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Advanced Materials

Market Size & Trends

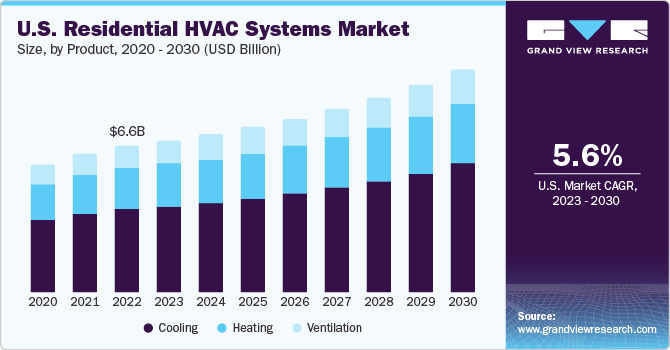

TheU.S. residential HVAC systems market size was estimated at USD 6.56 billion in 2022and is anticipated to grow at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2030. The market is driven by the availability of tax credits and rebate programs associated with energy-efficient systems purchasing. Moreover, several governments at various levels have established standards to improve the operation of HVAC systems. The governments have set forth some standards that aim at the manufacturing of energy-efficient equipment, reducing environmental hazards, and carbon footprints. In addition to tax & rebate programs, several governments offer benefits for encouraging customers to use energy-efficient products having low power consumption or the use of renewable energy products and subsequently attract demand. In addition, reducing power consumption by promoting the use of energy-efficient andrenewable energyproducts is another benefit offered by the governments.

As per the Bipartisan Budget Act of 2018, the revised tax credit would apply to residential renewable energy products till 2021. Approximately 30% of the total installation costs would be provided as tax credit benefits on products such as geothermal heat pumps and central air conditioning, among others. These aforementioned factors are anticipated to propel the market growth in the coming years.

Diverse climatic conditions across the U.S. can be considered as a prime factor favoring the consumer buying behavior for the HVAC systems. Furthermore, the U.S. is a huge country in terms of geographical size and the weather varies in states, cities, and coasts. The requirement to control building temperature regardless of external environmental conditions and stringent regulations set by the country's regulatory agencies to reduce electricity usage and carbon emissions are expected to play a significant role in consumer spending.

The Midwest and South had the highest percentages of homes utilizing AC in 2020, at 92% and 93%, respectively. The West Region, which includes households in a range of climate zones where residential air conditioning use was 49%, had the lowest percentage of households using air conditioning at 73%. The apartments had the lowest likelihood of utilizing air conditioning. Apartments in smaller buildings (2-4 units) used the air conditioning 80% of the time, but apartments in larger buildings (5+ units) used it 85% of the time. Approximately 90% of single-family detached homes, in contrast, had air conditioning. This increased market share of central air conditioning shows that the consumers are likely to spend on the centralized AC system.

Furthermore, remodeling of residential buildings can lead to a replacement of the HVAC unit due to the possibility of the interruption in the airflow ofHVAC systems和增加运行成本。此外,问题我n HVAC can lead to poor air quality, which may cause short-term headaches, fatigue, eye irritation, and dizziness. Thus, HVAC systems need to be repaired and regularly diagnosed for optimal performance. However, sometimes replacement can be a better option than repair due to the cost associated with repair and the fact that defects can reoccur. Increasing demand for the replacement and refurbishment of HVAC systems is expected to boost market growth.

Integrating IoT with residential HVAC systems enables companies to review outside data such as the number of people in a room, humidity level, and outside temperature, among other things. This data is used by HVAC systems to determine appropriate temperatures, change fan speeds, and increase overall system energy efficiency. Furthermore, IoT allows clients and HVAC firms to perform predictive maintenance, which reduces maintenance costs and prevents system failure.

Product Insights

Based on product, the cooling segment led the market with the largest revenue share of 56.5% in 2022.Air conditioning is a system for controlling and regulating temperature, ventilation, and humidity in closed spaces such as buildings & vehicles to maintain constant indoor temperature and improve air quality. Further, refrigeration is the process of removing moisture and heat from an enclosed, insulated colder area to a hotter space.

Furthermore, technological advancements such as remote systems, IoT-integrated HVAC systems, and smaller high-performance units enable cost savings and enhance energy efficiency and comfort, which is anticipated to increase the demand for new cooling systems over the forecast period. Moreover, the use ofIoTand electronic-printed circuit board communication with built-in sensors to improve connectivity is growing. These factors are likely to drive the cooling systems segment over the forecast period.

The heating segment is expected to witness a CAGR of 5.4% over the forecast period. Heating systems are part of HVAC units that are used to generate heat for building applications such as steam generation, vaporization, and drying. Heating systems, including boilers, furnaces, and heat pumps, among others, are widely used in residential applications.

Ventilation is the process of refreshing & replenishing indoor air to control and improve the air quality of the indoor space. Ventilation systems remove or control any combination of odors,carbon dioxide, airborne bacteria, dust, heat, and moisture. The ventilation segment includes products such as ventilation fans & ducts, air pumps, and humidifiers & dehumidifiers.

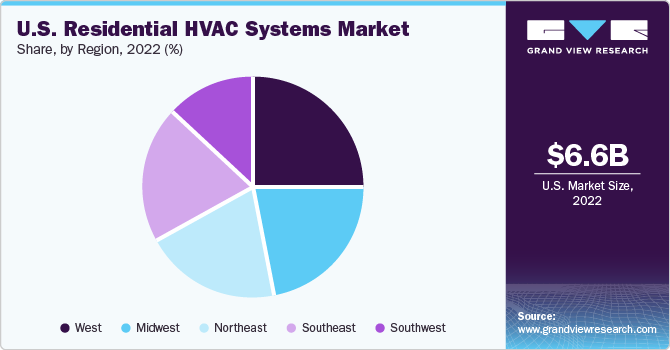

Regional Insights

The West region segment led the market with a revenue share of 25.0% in 2022. According to the U.S. Department of Commerce, the population in the West region expanded at a 9.2% annual rate in 2021. The region accounts for approximately half of the overall land area of the U.S. Furthermore, according to U.S. Census data, the four fastest-growing states in 2021 were in the West region. Idaho was the fastest-growing state, expanding at 2.9% between 2020 and 2021. This growing population is augmenting the regional residential sector, which needs more HVAC systems. Thus, the growing population is expected to drive the demand for U.S. residential HVAC systems over the forecast period.

The growing population in certain parts of the Northeast region is expected to drive the demand for residential projects in this region, which is likely to further drive the demand for U.S. residential HVAC systems in the Northeast region over the forecast period. The demand for residential HVAC systems is mainly driven by the expanding residential sector in the Northeast U.S. For instance, with roughly 54,555 mi2, New York is the largest state in terms of area. Pennsylvania comes in second with 46,055 mi2. The U.S. Census Bureau divides these states into two sub-regions. New Jersey, New York, and Pennsylvania comprise the Mid-Atlantic states.

Southeast region is expected to witness the fastest CAGR of 8.5% over the forecast period. The growing population is expected to drive the demand for residential projects in the Southeast region, which is expected to drive the demand for U.S. residential HVAC systems over the forecast period as HVAC systems ensure good building air quality and create a healthy, comfortable, and safe environment for users while increasing sustainability and minimizing energy consumption. These aforementioned factors are anticipated to propel the demand for U.S. residential HVAC systems in the Southeast region over the forecast period.

According to the U.S. Environmental Protection Agency, the Southwest's location and topographical extremes have a significant impact on its weather. Heat & cold waves, droughts, floods, blizzards, and even tornadoes are possible in the Southwest region. Growth has been a prominent feature of this region, which includes Arizona, Nevada, New Mexico, and Utah. These states have experienced significant in-migration in the last decade and are popular among retirees. The Southwest is expected to be a fast-growing region due to its pleasant weather and low living expenses. These aforementioned factors are expected to drive the demand for U.S. residential HVAC systems in the Southwest region over the forecast period.

Key Companies & Market Share Insights

Manufacturers of U.S. residential HVAC systems use a variety of strategies, such as product launches, expansions, and investments, to increase their market share and meet the shifting technological demands from various end-use sectors. For instance, in November 2022, in the Republic of Indonesia, Daikin Industries, Ltd. opened a new manufacturing facility for home air conditioners at the Greenland International Industrial Center (GIIC), which is close to Jakarta. The new production facility is being constructed in response to the rapidly increasing demand for air conditioners in Indonesia.

Key U.S. Residential HVAC Systems Companies:

- Carrier

- Daikin Industries, Ltd.

- Emerson Electric Co.

- Haier Group

- 江森自控

- LG Electronics

- Lennox International

- Mitsubishi Electric Corporation

- Rheem Manufacturing Company

- Trane Technologies plc

- Robert Bosch GmbH

U.S. Residential HVAC Systems Market Report Scope

Report Attribute |

Details |

Revenue forecast in 2030 |

USD 9.96 billion |

Growth rate |

CAGR of 5.6% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2030 |

Report Coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends |

Segments Covered |

Product, region |

Country Scope |

U.S. |

区域范围 |

West; Southwest; Midwest; Southeast; Northeast |

Key companies profiled |

Carrier; Daikin Industries Ltd.; Emerson Electric Co.; Haier Group; Johnson Controls; LG Electronics; Lennox International; Mitsubishi Electric Corporation; Rheem Manufacturing Company; Trane Technologies plc; Robert Bosch GmbH |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

U.S. Residential HVAC Systems Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. residential HVAC systems market report based on product and region:

Product Outlook (Revenue, USD Billion, 2018 - 2030)

Heating

Ventilation

Cooling

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

Northeast

Southeast

Midwest

Southwest

West

Frequently Asked Questions About This Report

b.The U.S. residential HVAC systems market size was estimated at USD 6.56 billion in 2022 and is expected to reach USD 6.80 billion in 2023.

b.The U.S. residential HVAC systems market in terms of revenue, is expected to grow at a compound annual growth rate of 5.6% from 2023 to 2030 to reach USD 9.96 billion by 2030.

b.The cooling product led the market and accounted for 56.5% of the total U.S. market share in 2022. Air conditioning is a system for controlling and regulating temperature, ventilation, and humidity in closed spaces such as buildings & vehicles to maintain constant indoor temperature and improve air quality. Further, refrigeration is the process of removing moisture and heat from an enclosed insulated colder area to a hotter space.

b.Some of the key players operating in U.S. residential HVAC systems market include Carrier, Daikin Industries, Ltd. ,Emerson Electric Co., Haier Group, Johnson Controls, LG Electronics, Lennox International, Mitsubishi Electric Corporation, Rheem Manufacturing Company, Trane Technologies plc , Robert Bosch GmbH.

b.市场是由税收cr的可用性edit and rebate programs associated with the energy-efficient systems purchasing. Moreover, several governments at various levels have established standards to improve the operation of HVAC systems. The governments have set forth some standards that aim at the manufacturing of energy-efficient equipment, reducing environmental hazards and carbon footprints.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."