U.S. Tendon Repair Market Size, Share & Trends Analysis Report By Application (Bicep Tenodesis, Rotator Cuff Repair), By Product Type (Implants, Suture Anchor Devices), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-955-1

- Number of Pages: 86

- Format: Electronic (PDF)

- Historical Range: 2016 - 2021

- Industry:Healthcare

Report Overview

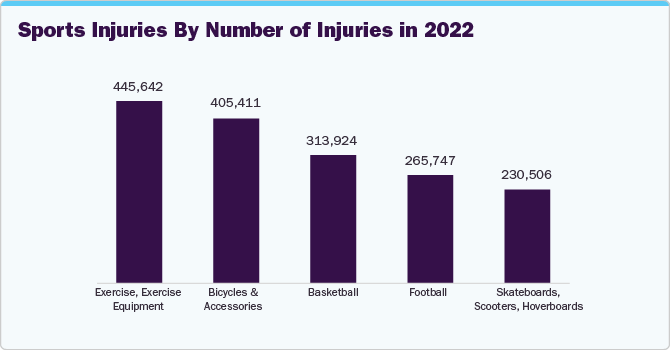

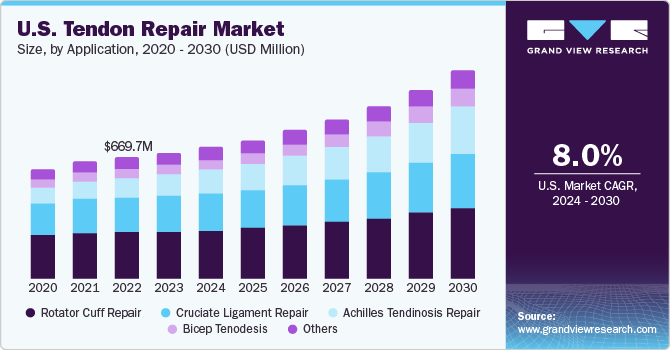

TheU.S. tendon repair market sizewas valued atUSD 669.7 million in 2022and is expected to grow at a compound annual growth rate (CAGR) of 7.5% from 2023 to 2030. The growth is attributed to the increasing target population, the rising incidence rate of sports-related injuries, and advancements in sports medicine. Moreover, the growing improvement in technologies used for tendon and ligament repair is further propelling the growth of the overall market.New and improved versions of existing technologies have been developed by forerunners in the industry to improve surgical outcomes and achieve longevity of the surgical procedure.

The COVID-19 pandemic posed multiple challenges for U.S. healthcare services. Many industries across the nation faced or are still facing supply chain disruptions and issues with the sales of products owing to the effects of the pandemic such as lockdowns & postponement or cancellations of surgical procedures. The pandemic negatively impacted the market’s growth and resulted in a reduction in surgical activity to minimize nosocomial contamination. Due to the COVID-19 pandemic, many hospitals imposed restrictions on non-essential surgical procedures. In March 2020, the CDC and American College of Surgeons (ACS) recommended canceling or delaying non-emergency surgical procedures. This action, while significant for social safety, greatly impacted millions.

Moreover, the rising adoption of orthopedic robotic platforms in hospitals further accelerated market expansion. For instance, in March 2022, SRV Hospital, with Lokmanya Hospital, Launched a new center for excellence in robotic orthopedics. The newly launched center is equipped with Smith+Nephew’s handheld robotic device for knee surgeries. In addition, several key players such as Smith & Nephew, Stryker, & DePuy Synthes are shifting focus and developing robotic surgery. For instance, in October 2022, THINK Surgical, a leader in orthopedic surgical robots, announced that KDB investment Global Healthcare Korea invested USD 100 million in THINK Surgical to allow the faster launch of novel products.

此外,技术用于骨科飙升ry, especially for tendon and ligament repair, have been continuously improving. Manufacturers in the industry are constantly focusing on developing new and improved versions of existing technologies and improving surgical consequences to achieve durability of the surgical procedure.New technologies such as tissue grafting, the use of scaffolds, and other tissue matrices for the regeneration of native tissue are being successfully used to impart greater mobility & flexibility to the repaired limb.

However, one of the major factors restraining the growth of the market is the preference for alternative treatment.Nonsurgical treatments are often preferred due to them being less invasive and cost-effective. Treatments like oral Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) have been in use for decades as a first-line treatment for tendinopathy. Moreover, surgical intervention for tendon ruptures and tears is costlier and requires more recovery time, which may further impede the market growth.

Application Insights

The rotator cuff repair segment held the largest revenue share inU.S. tendon repair in 2022 and is anticipated to grow at a steady pace over the forecast period. The dominance of the segment is attributed to an increase in physical activity among children and adults, an increase in interest in professional sports, and an increase in the number of athletes who require foot and ankle tendon repair.

引入新的袖口旋转过程is expected to facilitate surgery rates, thereby reducing invasion and time for surgeries. For instance, in February 2022, UAB Orthopedics introduced a newer approach to rotator cuff repair through the launch of a subacromial balloon spacer procedure. With this procedure, patients can safely rehabilitate their shoulders with the help of physical therapy.

The Achilles tendinosis repair segment is expected to show the fastest CAGR over the forecast period. The Achilles tendon has become a major concern for athletes and other active individuals with chronic conditions. Thus, managing and repairing this condition is important to avoid further complications like tendon rupture and chronic pain.Healthcare organizations, hospitals, and manufacturers in the tendon repair market are taking collaborative measures to tackle the situation.

For instance, in October 2022, physiatrists in the Department of Rehabilitation Medicine and surgeons at HHS at Weill Cornell Medicine collaborated to manage Achilles tendinopathies, offering proper diagnosis and surgical & nonsurgical treatment options for tackling this condition. In addition, in March 2022, Acumed LLC with the use of Acu-Sinch Knotless technology launched Ankle Syndesmosis Repair System.

产品类型的见解乐鱼APP二维码

The suture anchor devices segment captured the largest revenue share in the U.S. tendon repair market in 2022 and is projected to exhibit a lucrative CAGR throughout the forecast period. The dominance of the segment is due to the increasing use of anchor devices in tendon repair surgeries. They are a primary choice in arthroscopy procedures due to their higher strength possessed by them.

Suture anchors can be knotless or knotted based on the type of injury it is being used for. Moreover, key players are focusing on developing sutures to provide better surgical procedures to the target population. For instance, in September 2022, Mesh Suture, Inc. received FDA approval for a non-absorbable polypropylene mesh suture, which can be used for soft tissues including tendons, ligaments, fascia, and muscles.

The implants segment is expected to show the fastest growth rate over the forecast period. The growth of the tendon implants market is due to an increase in the number of sports injuries and a rise in the geriatric population.Implants are routinely preferred over allografts and autografts because the use of implants is usually associated with faster recovery time, lesser compatibility issues, and reduced surgical procedure time.

Moreover, the increasing demand for tendon repair techniques is further propelling the need for the introduction and development of newer products by key manufacturing with high mechanical capabilities. In January 2023, Arthrex, Inc. received FDA approval for an ACL TightRope implant, used in the surgical treatment of orthopedic injuries for pediatric use.Furthermore, the increasing research on tendon repair techniques and solutions has also made them more accessible to patients.

Key Companies & Market Share Insights

The key players operating in the field of tendon repair technologies are constantly focusing on introducing and changing existing product lines that enhance patient outcomes and substantially increase the efficiency and effectiveness of healthcare in the U.S. For instance, in March 2023, Smith+Nephew launched the UltraTRAC QUAD ACL Reconstruction Technique consisting of the X-WING Graft Preparation System, a family of ULTRABUTTON Adjustable Fixation Devices, and QUADTRAC Quadriceps Tendon Harvest Guide System. With this launch, the company expects to expand its ability to surgeons’ graft preferences. Some prominent players in the U.S. tendon repair market include:

Stryker

Arthrex, Inc.

CONMED Corporation

Integra LifeSciences

Smith+Nephew

TendoMend

Alafair Biosciences

MIMEDX Group, Inc.

U.S. Tendon Repair MarketReport Scope

Report Attribute |

Details |

Revenue forecast in 2030 |

USD 1,149.0 million |

Growth rate |

CAGR of 7.5% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2016 - 2021 |

Forecast period |

2023 - 2030 |

Report updated |

May 2023 |

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Application, product type |

Country scope |

U.S. |

Key companies profiled |

Stryker; Arthrex, Inc.; CONMED Corporation; Integra LifeSciences; Smith+Nephew; TendoMend; Alafair Biosciences; MIMEDX Group, Inc. |

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

U.S. Tendon Repair Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2030. For this report, Grand View Research has segmented the U.S. tendon repair market report based on application and product type:

Application Outlook (Revenue, USD Million, 2016 - 2030)

Rotator Cuff Repair

Achilles Tendinosis Repair

Cruciate Ligament Repair

Bicep Tenodesis

Others

Product Type Outlook (Revenue, USD Million, 2016 - 2030)

Implants

Suture Anchor Devices

Grafts

Matrix/Scaffolds

Tendon Repair

Tendon Protection Matrix/Scaffolds

Screws

Others

Frequently Asked Questions About This Report

b.Major players in the market include, Stryker Corporation, Arthrex, Inc., CONMED Corporation, Integra LifeSciences, Smith+Nephew, TendoMend, Alafair Biosciences, and MIMEDX

b.The market growth can be attributed to the rapidly growing geriatric population and soft tissue injuries related to advancing age. In addition, the increase in sports related injuries has also contributed significantly to the propulsion of the tendon repair market in the U.S.

b.The U.S. Tendon Repair market size was estimated at USD 669.7 million in 2022 and is expected to reach USD 691.0 million in 2023.

b.The U.S. Tendon Repair market is expected to grow at a compound annual growth rate of 7.5% from 2023 to 2030 to reach USD 1,149.0 million by 2030.

b.The largest product category as of 2022 was suture anchor devices, with a revenue share of 34.7%. These are increasingly preferred due to their strength of fixation as well as rigidity and support they provide to the injury site.