U.S. Virtual Clinical Trials Market Size, Share & Trends Analysis Report By Study Design (Interventional, Observational, Expanded Access), By Indication (Oncology, Cardiovascular), By Phase, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-085-3

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Healthcare

Report Overview

TheU.S. virtual clinical trials market sizewas estimated atUSD 4.5 billion in 2022and is expected to grow at a compound annual growth rate (CAGR) of 5.45% from 2023 to 2030. The market for virtual clinical trials in the United States is driven by factors such as the increasing healthcare digitalization in the country, the rapidly growing adoption of telehealth, and rising investments in R&D activities. Moreover, technological advancements, along with clinical research organizations entering alliances with pharmaceutical and biotechnology companies, are also factors driving the growth of the virtual clinical trials market in the U.S.

The COVID-19 pandemic has led to the accelerated growth of thevirtual clinical trialsspace. Before the pandemic, very few CROs offered a full range of virtual clinical trials. However, the pandemic led to a disruption in the activities of many clinical trials due to factors such as social distancing and government-imposed lockdowns in majority of the countries. This highlighted the huge growth potential for virtual clinical trials. According to the American Association of Cancer Research, 99% of cancer researchers indicated that the pandemic interrupted their cancer research and clinical practice.

In order to grab this opportunity, many CROs have shown significant activity in this area in the post-pandemic period. They have actively worked through the pandemic by undertaking partnerships & collaborations, and acquisitions of home health services, eClinic software, andremote patient monitoring(RPM) providers, in order to bolster their virtual trial capabilities.

For instance, in November 2022, OncoBay Clinical, Inc., a leading oncology-focused CRO, partnered with physIQ. The partnership will enable OncoBay to utilize physIQ’s technology to monitor and evaluate the health and safety of cancer patients and treatment effectiveness in near real-time during the clinical trial process.

Traditionalclinical trialsare a slow, costly, and inefficient process. They also burden patients with financial and time-costing travel requirements. In order to cut down on financial and time constraints, many companies are now shifting towards virtual clinical trials. A virtual method lets people take part in any clinical trial from their homes, ensuring that the research can continue even when site visits cannot, hence representing a novel approach to collecting safety and efficacy data from participants of clinical studies.

Virtual visits and remote patient monitoring of in-person site visits offer participants a choice and provide assurance that they will not be subjected to unneeded dangers. Since more people may participate in research thanks to virtual technologies, recruitment, engagement, and retention all improve. Additionally, it makes it possible fordigital healthtechnology to capture real-time data continuously. At some point, virtual connectivity, monitoring, and management will be able to greatly reduce the effort, time commitment, and strain on the participants, CRCs, and investigators.

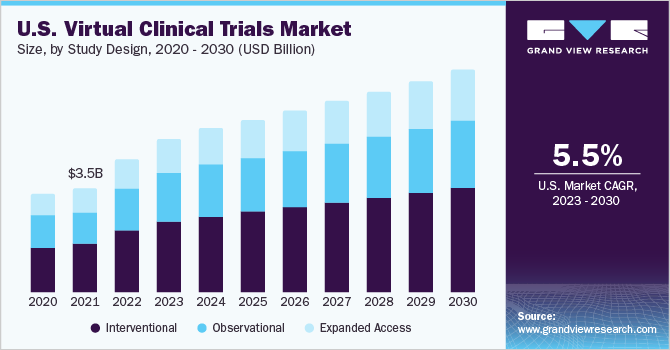

Study Design Insights

In 2022, the interventional trial design segment held the largest market share of 46.77% in terms of revenue. The category is being driven by the quick increase in the number of tests being conducted to create new drugs for a variety of ailments. The coronavirus outbreak increased the need for research and trials of novel medications and vaccines to address the issue globally, with the standard approach of clinical trials carrying a significant risk of infection. Consequently, the need for interventional study designs is increasing.

虚拟试验是慢性disea更适合ses and observational studies involving less interventional treatments, such as those in the fields of immunology, gastroenterology, dermatology, respiratory medicine, and endocrinology. Over the projected period, the expanded access segment is anticipated to have the highest CAGR of 5.7%. When the patient's potential benefits outweigh the risks, expanded access is an appropriate route. Therefore, it is projected that this segment would develop the fastest.

Indication Insights

The oncology segment dominated the market for virtual/decentralized clinical trials in the U.S. with a revenue share of 57.73% in 2022. The segment is also anticipated to contribute to the maximum share of the market during the forecast period. The segment growth is attributed to the rising cases of cancer globally and the increasing number of oncology clinical trials. For instance, according to a research study published by the American Cancer Society, in 2022, the total number of estimated cancer survivors in the U.S. was about 18.06 million.

Additionally, recruiting patients presents a significant challenge for cancer researchers. The success of this clinical study is at risk due to low enrolment rates, which could obstruct the development of new treatments and their beneficial outcomes. Therefore, it is projected that the low rate of recruitment and the requirement for a broader population for oncology clinical research will encourage the implementation of virtual clinical trials.

On the other hand, the central nervous system (CNS) indication segment is expected to undergo maximum growth during the forecast period. This is due to the increasing adoption of virtual clinical trials for this indication. According to a research survey published in November 2021, an increase in the adoption rate of virtual clinical trials by 11% was observed when it came to conducting CNS trials. Conversely, there was a decline in traditional site-based clinical trials by 14%.

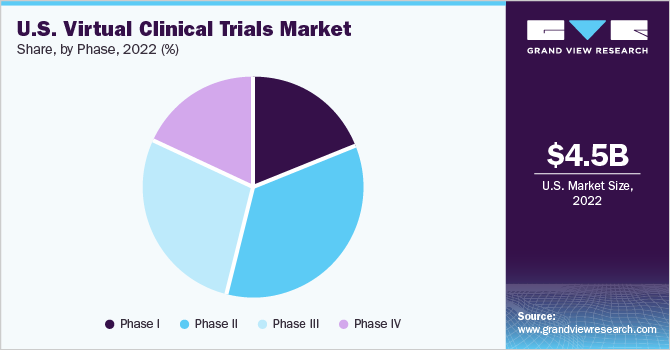

Phase Insights

The phase II trials segment dominated the U.S. virtual clinical trials market with a revenue share of 35.32% in 2022. This is because phase II trials play a crucial role, especially in oncology, and in the present day, oncology accounts for the highest number of ongoing clinical trials. For instance, according to a research study published by WHO, in February 2022, there were about 88,530 treatments that were under phase II clinical trials.

Phase III trials are anticipated to experience lucrative growth over the forecast period with a CAGR of 5.57%. This is due to the rising pace at which virtual clinical trials are moving, as a result of their advantages such as quick results and the accumulation of real-time data at an efficient cost. Therefore, many clinical trials that are under phase II are likely to move into phase III, which is anticipated to boost the growth of the segment.

Regional Insights

The Southern U.S. region dominated the market with the highest revenue share of 33.25% in 2022. This is due to a large proportion of clinical trials being carried out in this region. For instance, according to the National Library of Medicine, as of January 2023, there were about 38,837 active clinical trials, out of which the Southern region contributed to the highest number. States like Texas and Florida, which are the 2ndand 4thhighest in terms of conducting clinical trials, are part of the South U.S.

The West region, on the other hand, is anticipated to experience maximum growth over the forecast period at 5.6% CAGR. This is because California, which comes under this region, accounts for the highest number of clinical trials conducted in the country. The presence of several well-renowned universities, the well-established technological sector, and constant efforts to introduce innovative products and procedures are factors driving the growth of the virtual clinical trials market in the country, which is reflected in the overall region.

Key Companies & Market Share Insights

Key players in the market are focusing on realizing various strategic initiatives such as acquisitions, partnerships & collaborations, and mergers & acquisitions to enter the market, establish a strong position, and generate higher revenue for the company. For instance:

In April 2023, Science 37partnered with Amazon Web Services (AWS). The former will become a partner in the AWS Partner Network (APN) to help the company in reaching more providers and customers, thus improving the company’s capabilities in conducting decentralized clinical trials

In October 2022, Oracle partnered with the decentralized clinical trial company, ObvioHealth. As per the partnership, Oracle Clinical One Cloud Service has been integrated with ObvioHealth's ObvioGo platform to conduct clinical trials

In July 2021, ICON plc acquired PRA Health Sciences. This acquisition was carried out to create a world-leading healthcare intelligence and clinical CRO

Some of the prominent players in the U.S. virtual clinical trials market are:

ICON, plc

Parexel International Corporation

IQVIA

Labcorp Drug Development

Medidata Solutions

Oracle

Signant Health

Medable, Inc.

Halo Health Systems

Science 37

U.S. Virtual Clinical Trials Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 5.2 billion |

Revenue forecast in 2030 |

USD 7.52 billion |

Growth rate |

CAGR of 5.45% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors and trends |

Segments Covered |

Study design, indication, phase, region |

Country scope |

U.S. |

Regional scope |

Northeast; Midwest; South; West |

Key companies profiled |

ICON plc; Parexel International Corporation; IQVIA; Labcorp Drug Development; Medidata Solutions; Oracle; Signant Health; Medable, Inc.; Halo Health Systems; Science 37 |

15% free customization scope (equivalent to 5 analyst working days) |

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

U.S. Virtual Clinical Trials Market Report Segmentation

This report forecasts revenue growth at the country & regional levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. virtual clinical trials market report based on study design, indication, phase, and region:

Study Design Outlook (Revenue, USD Billion, 2018 - 2030)

Interventional

Observational

Expanded Access

Indication Outlook (Revenue, USD Billion, 2018 - 2030)

Oncology

Cardiovascular

Digestive Diseases

Musculoskeletal Diseases

Infectious Diseases

Endocrinology & Metabolic Disease

CNS

Others

Phase Outlook (Revenue, USD Billion, 2018 - 2030)

Phase I

Phase II

Phase III

Phase IV

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

U.S.

Northeast

Midwest

South

West

Frequently Asked Questions About This Report

b.The U.S. virtual clinical trials market size was estimated at USD 4.5 billion in 2022 and is expected to reach USD 5.1 billion in 2023

b.The U.S. virtual clinical trials market is expected to grow at a compound annual growth rate of 5.4% from 2023 to 2030 to reach USD 7.52 billion by 2030.

b.The South segment dominated the market with highest revenue share of 33.25% in 2022. This is due to large number of trials being carried out in this region

b.Some key players operating in the U.S. Virtual Clinical Trials market include ICON, plc, Parexel International Corporation IQVIA, Labcorp Drug Development, Medidata, Oracle, Signant Health, Medable, Inc., Halo Health Systems and Science 37

b.Key factors that are driving the market growth include increasing healthcare digitalization, growing adoption of telehealth and increasing investments in R&D activities