User And Entity Behavior Analytics Market Size, Share & Trends Analysis Report By Component, By Deployment, By Enterprise Size, By Vertical, By Region, And Segment Forecasts, 2023 - 2030

- 报告ID: gvr - 4 - 68040 - 094 - 0

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Technology

Report Overview

The globaluser and entity behavior analytics market sizewas valued atUSD 1.21 billion in 2022and is expected to grow at a compound annual growth rate (CAGR) of 33.4% from 2023 to 2030. User and entity behavior analytics (UEBA) is a kind of cyber security solution that analyze the everyday behavior of users and entities such as network, application, end-point devices, data repositories, and hosts. User and entity behavior analytics use statistical analysis,machine learning, and deep learning technologies to detect deviations and anomalies in everyday user behavior patterns and share alert signals to the security operations team in case of the risk score passes a designated limit with a high potential of cyber-attack in corporate systems and networks.

As cyber attackers and hackers are becoming more sophisticated, they can easily break into traditional defense systems such as firewalls, secure web gateways, and other preventive tools within the organization techniques. User and entity behavior analytics act as an essential tool in modern organizations as acyber securitydefense mechanism, as many legacy tools quickly become obsolete.UEBA not only tracks security events but also monitors devices by tracking all the performing activities of users and entities across the system. UEBA focuses on insider threats, such as employees’ compromised devices, identifying who has gone rogue, and tracking people who already have access to users’ systems with a high potential of carrying out targeted attacks on servers, devices, and applications of the organization.

Employees are actively using insecure servers, applications, and platforms due to growing trends ofbring your own deviceand remote work scenarios, which is offering an easy window for attackers and hackers to get into the systems of users and applications. User and entity behavior analytics run algorithms to analyze everyday activity patterns, trends, and behavior of the user to identify the slightest variations from the usual activity patterns. Thus, helps security monitoring teams take fast responses against potential cyber threats and supports the user and entity behavior analytics industry growth.

The rising use of advanced technologies such as IoT, web applications, and connected devices in industries such as BFSI, healthcare, government, retail, and manufacturing is increasing the demand for highly efficient security solutions. These industries generate and store highly confidential data and information in their systems and often face higher security breaches acrossservers, networks, and endpoint devices. Therefore, the demand for modern and advanced security solutions such as behavioral analytics and threat identification system is constantly growing among the various end-use industries.

Key companies in the market are taking various strategic initiatives, such as partnerships, new product launches, and mergers and acquisitions, to expand their geographical presence and enhance their product offerings. For instance, in February 2023, LogRhythm a security solution provider announced a strategic partnership with ABPSecurite, a network performance and cyber security value-added distributor. In this partnership, ABPSecurite will distribute LogRhythm’s offerings including SIEM, UEBA, and Axon through its sales channel in Singapore.

Component Insights

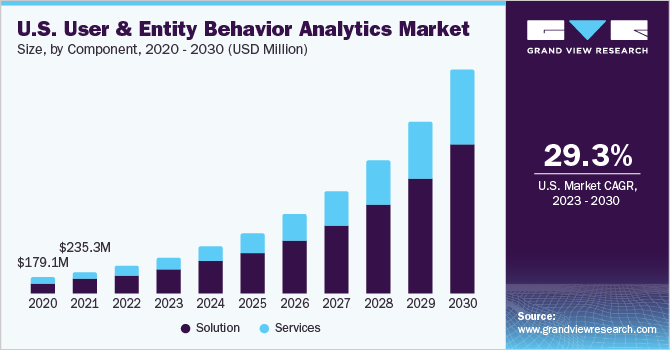

解决方案部分占最大的3月ket share of 69.50% in 2022. The solution segment consists of software and licenses offered by organizations to help customers detect and identify vulnerabilities using advanced technologies such as ML, statistical algorithms, behavioral analytics, andAI. The UEBA solutions minimize the requirements of IT analysts with their inbuilt capabilities of identifying the slightest variations in user behavior. These are the key factors expected to drive the segment's growth in the market.

The services segment is anticipated to grow at a CAGR of 34.7% during the forecast period. User and entity behavior analytics services include deployment, maintenance, customer support, consultation, and training services. The growing demand for user and entity behavior analytics solutions and software in various end-use industries, such as IT and telecommunications, BFSI, and healthcare organizations, to strengthen their cybersecurity capabilities is expected to support the segment growth over the forecast period.

Deployment Insights

The cloud-based segment accounted for a market share of 52.34% in 2022. Cloud-based user and entity behavior analytics can be termed a license model. It allows organizations to utilize product offerings based on their usage requirements, budget, time, and business goals. It is a cost-effective and flexible way of identifying, tracking, and unmasking vulnerabilities and potential threats across endpoint devices, servers, and networks. The defined factors are aimed at supporting the growth of the cloud-based segment growth in the market over the forecast period.

The on-premise segment is expected to grow at a CAGR of 32.4% during the forecast period. On-premise user and entity behavior analytics provides in-house software and solution offerings that enable organizations to have better control and security assurance across their networks, applications, and devices. Further, it offers organizations the utmost flexibility based on their focus areas, requirements, and dynamic security environment. Thus, the following factors are expected to support the growth of the on-premise segment in the market.

Enterprise Size Insights

The large enterprise segment accounted for the largest market share of 57.61% in 2022. The growing threats of cyberattacks, security breaches, and vulnerability of devices to be compromised due to the heightened use of connected devices remain major concerns. Furthermore, the use of unsecured networks, remote working trends, and lack of security solutions in traditional organizations are the key factors attracting attackers toward large organizations. Additionally, the large organization contains more critical information and data. Thus, ensuring the implementation of safety measures on organizational and personal devices, networks, and systems is becoming of utmost importance among large organizations.

The SMEs segment is expected to grow at the highest CAGR of 34.1% during the forecast period. Due to the lack of awareness, security infrastructures, and technological knowledge, small and medium organizations are the most valuable and easiest target segment for cyber attackers. The rising technological capabilities in the user and entity behavioral analytics offering serve highly reliable and cost-effective offerings to determine the potential threats. The following capabilities help SMEs save costs and resources and enhance security awareness across organizational servers and devices.

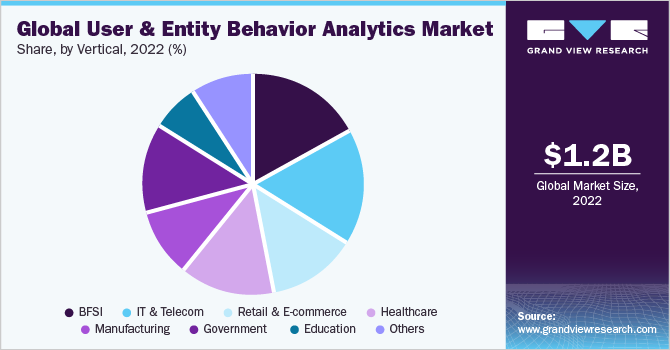

垂直的见解乐鱼APP二维码

IT和电信领域the largest market share of 17.16% in 2022. The IT and Telecommunication sector is facing a rapid increase in security breaches, data loss, and highly vulnerable cyberattacks due to the availability of valuable customer information, large and complex networks, and higher use of connected technologies. The highly connected devices and complex networks make it difficult for IT experts and support teams to identify and control threats within the controllable time limit. The UEBA solutions help organizations identify and track potential threats and share the alert notifications with the IT and support staff to counter these sophisticated threats in minimum time. These are the primary factors driving the demand for the IT and Telecommunication segment.

The retail and e-commerce segment is anticipated to grow at a CAGR of 37.8% during the forecast period. The BFSI is among the major sector that is susceptible to higher risks of cyber threats. The banking and finance industries are rapidly adopting advanced technologies and expanding their IT spending at an unprecedented pace to keep up with the ongoing technology trends, and customer demand and beat the rigorous competition. This makes them highly accessible and vulnerable to security breaches by attackers. Thus, the demand for endpoint threat detection and vulnerability identification solutions, such as user and entity behavior analytics, is expected to grow significantly in the BFSI industry.

Regional Insights

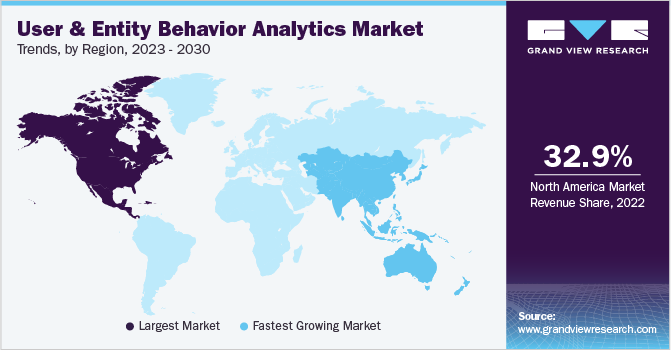

North America held the major share of 32.86% of the target market in 2022. The user and entity behavior analytics industry is expected to witness positive growth opportunities in North America due to the presence of key UEBA solutions and service providers such as IBM; Microsoft; McAfee; Palo Alto Networks; Varonis; etc. Further, the rising demand for network, servers, and application security solutions among various end-use industries such as healthcare, BFSI, government, and IT and Telecom in the region to gain access to critical organizational servers, networks, and endpoint devices carrying excessive amounts of personal and organizational data. Thus, demand for user and entity behavior analytics is expected to witness lucrative growth opportunities in the North American region.

Asia Pacific is predicted to grow as the fastest-developing regional market at a CAGR of 36.3%. The fast adoption of superior technologies such as connected IoT devices, web applications, and interface technologies in various end-use industries such as BFSI, IT, Telecom, healthcare, and others is increasing the demand for robust security solutions in the Asia Pacific region. Further, the region's growing regulatory policies and security compliance to protect customer data in sectors such as BFSI are expected to drive the demand for user and entity behavior analytics solutions and services in the Asia Pacific region.

Key Companies & Market Share Insights

The key players operating in the user and entity behavior analytics market include Microsoft Corporation; CheckPoint; Varonis; Palo Alto; IBM Corporation; Fortinet; Rapid7; Cisco; Sophos; McAfee NAC; Exabeam; LogRhytm; Splunk; Lookout, Inc.; Cynet; and VMWare to broaden their software offering companies are adopting key strategic initiatives such as new launches, mergers, partnerships, and acquisitions. For instance, in March 2023, Palo Alto Networks announced the availability of new identity and threat detection and response. It identifies and analyses behavior data and deploys state-of-the-art technologies such as AI and ML to detect, identify, and prevent attacks within seconds. Some prominent players in the global user and entity behavior market include:

Microsoft Corporation

Check Point Software Technologies Ltd.

Varonis

帕洛阿尔托网络

IBM Corporation

Fortinet

Rapid7

Cisco

Sophos Group Plc

McAfee NAC

Exabeam, Inc

LogRhytm

Splunk, Inc

Lookout, Inc.

Cynet

VMWare

User And Entity Behavior AnalyticsMarket Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 1.61 billion |

Revenue forecast in 2030 |

USD 12.11 billion |

Growth rate |

CAGR of 33.4% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million/billion, and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, trends |

Segments covered |

Component, enterprise size, deployment, vertical, region |

Key companies profiled |

Microsoft Corporation; CheckPointSoftware Technologies Ltd; Varonis; Palo Alto Networks; IBM Corporation; Fortinet; Rapid7; Cisco; Sophos Group Plc; McAfee NAC; Exabeam; LogRhytm; Splunk; Lookout, Inc.; Cynet; VMWare |

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global User And Entity Behavior Analytics Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global user and entity behavior analytics market report based on component, deployment, enterprise size, vertical, and region:

Component Outlook (Revenue, USD Million, 2018 - 2030)

Solution

Services

DeploymentOutlook (Revenue, USD Million,2018 - 2030)

On-premise

Cloud

Enterprise SizeOutlook (Revenue, USD Million,2018 - 2030)

Large Enterprise

Small & Medium Enterprises

垂直Outlook (Revenue, USD Million,2018 - 2030)

BFSI

IT And Telecom

Retail & E-commerce

Healthcare

Manufacturing

Government

Education

Others

Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

Europe

Germany

UK

France

Italy

Spain

Asia Pacific

China

India

Japan

South Korea

Australia

Latin America

Brazil

Mexico

Argentina

Middle East & Africa

U.A.E

Saudi Arabia

South Africa

Frequently Asked Questions About This Report

b.The global user and entity behavior analytics market size was estimated at USD 1.21 billion in 2022 and is expected to reach USD 1.61 billion by 2023.

b.The global user and entity behavior analytics market is expected to grow at a compound annual growth rate of 33.4% from 2023 to 2030 to reach USD 12.11 billion in 2030.

b.解决方案部分占最大的3月ket share of 69.50% in 2022. The solution segment consists of software and licenses offered by organizations to help customers detect and identify vulnerabilities using advanced technologies such as ML, statistical algorithms, behavioral analytics, and AI. The UEBA solutions minimize the requirements of IT analysts with their inbuilt capabilities of identifying the slightest variations in the users' behavior. These are the key factors expected to drive the segment's growth in the user and entity behavior analytics market.

b.Some key players operating in the user and entity behavior analytics market include Microsoft Corporation, CheckPoint Software Technologies Ltd, Varonis, Palo Alto Networks, IBM Corporation, Fortinet, Rapid7, Cisco, Sophos Group Plc, McAfee NAC, Exabeam, LogRhytm, Splunk, Lookout, Inc., Cynet, and VMWare.

b.The rising use of advanced technologies such as IoT, web applications, and connected devices in industries such as BFSI, healthcare, government, retail, and manufacturing is increasing the demand for highly efficient security solutions. These industries generate and store highly confidential data and information in their systems, often facing higher security breaches across servers, networks, and endpoint devices. Therefore, the demand for modern and advanced security solutions such as behavioral analytics and threat identification system is constantly growing among the various end-use industries