Veterinary Diagnostics Market Size, Share & Trends Analysis Report By Species (Canine, Feline), By End-use (POC/In-House, Labs), By Testing Type (Immunoassays, Pathology), By Product, By Disease Type, And Segment Forecasts, 2022 - 2030

- Published Date: Jan 2022

- Report ID: GVR-3-68038-130-6

- Number of Pages: 165

- Format: Electronic (PDF)

- Historical Data: 2017 - 2020

Report Overview

The global veterinary diagnostics market size was valued at USD 6.63 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 11.2% from 2022 to 2030. The growth in this market is attributed to factors, such as increased expenditure on animal health, rising incidence of zoonotic diseases & number of veterinary practitioners, technological advancement in point of care diagnostics, and increasing disposable income levels in developing regions. The growing incidence of infectious animal ailments is further poised to augment the demand for veterinary diagnostics. Moreover, advancements in diagnostics together with the growing acceptance of innovative techniques in most of the laboratories are driving the market growth.

For instance, in August 2021, FORCE Technology established a new subsidiary called AeroCollect A/S. AeroCollect technology with simple air samples offers a picture of the diseases in a herd. This is a revolution in animal diagnostics developed in Denmark by the GTS institute FORCE Technology. AeroCollect technology is presently used in the swine, poultry, and mink industries. The global COVID-19 pandemic has impacted all industries. OIE has confirmed that no animals can spread this virus. However, human-to-animal transmission has been reported in a few countries. During the COVID-19 pandemic, limited operation of veterinary clinics due to stringent lockdown norms consequently resulted in a decline in veterinary visits, thus impacting the market.

However, the market has shown a V-shaped recovery during the 3rd quarter of 2020 due to the resumption of pet clinic visits and ease of norms. According to IDEXX, U.S. clinic visits increased by 6% in Q4 2020 from the last quarter, which is expected to drive the market growth over the forecast period. An increase in pet adoption will also support the market growth. For instance, shelters, nonprofit rescues, and private breeders all reported high consumer demand post-COVID-19 in the U.S. Strong product pipeline By IDEXX, Zoetis, and Heska Corp. is expected to propel the growth over the forecast period. For instance, Zoetis acquired Scandinavian Micro Biodevices in August 2020 to expand its revenue in veterinary diagnostics.

Moreover, veterinarians have been gradually increasing the frequency of diagnostic testing. This trend was highlighted during the COVID-19 pandemic when hospitals had to focus on essential pet services. Continued growth in the population of pets and the increased penetration of veterinary diagnostic products at veterinary clinics further promote market growth. For instance, IDEXX showed improved utilization of diagnostics supported a 21% surge in same-store diagnostic revenue per practice, and a 15% surge in same-store veterinary clinic revenue in its Q1 2021 earning call.

Veterinary Diagnostics Market: A steadily growing market, not hugely impacted by pandemic

Pandemic Impact |

Post COVID Outlook |

The market experienced steady growth of 10.3% from 2019 to 2020 to reach USD 6.2 billion |

Strong product pipeline By IDEXX, Zoetis, and Heska Corporation is expected to propel the growth over the forecast period. For instance, Zoetis acquired Scandinavian Micro Biodevices in August |

There was an increase in pet adoption reported post-COVID 19 due to social isolation. For instance, shelters, nonprofit rescues, private breeders all reported high consumer demand post-COVID 19 in the U.S. |

Greater emphasis on vet point of care diagnostics as a preventive measure to avoid any future pandemic or zoonotic outbreak, thus propelling the growth |

IDEXX's CAG diagnostics revenue increased by 23% in Q3 2020 as compared to last year |

Market opportunity for new entrants. (for eg Advanced Animal Diagnostics received USD 50,000 grant from NCBiotech in 2020) which is expected to propel market growth |

Increasing demand for point-of-care diagnostics is expected to further propel market growth. It provides fast results for clinical tests and can be directly assessed to save time. According to AVMA, there were around 26,000 veterinary hospitals & clinics in the U.S. in 2019 and more than 80% of them provided point-of-care testing. In June 2021, DCN Dx acquired PortaScience, Inc., a point-of-care diagnostics development corporation. With this acquisition, DCN Dx expanded its capabilities for veterinary, healthcare, and consumer markets. The aforementioned factors are expected to propel the market growth over the forecast period.

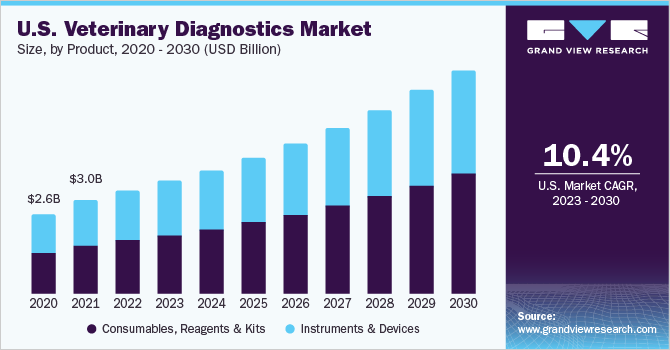

Product Insights

On the basis of product, the global market has been bifurcated into test consumables, reagents & kits, and instruments & devices. The consumables, reagents & kits product segment held the largest share of more than 52% in 2021. The segment is projected to expand further at the fastest CAGR retaining the dominant position throughout the forecast period. The overall market is determined by deeply understanding the demand for these products from veterinary clinics, hospitals, labs, etc. In addition, there is an increasing demand for point-of-care diagnostics by pet owners.

伴随矩阵的常用现场即时诊断ion animals are blood glucose monitors, pregnancy kits, urinalysis strips, etc. Whereas, for the livestock, the tests majorly remain confined to the labs owing to high sensitivity and efficacy requirements in their disease testing. The rate of consumption and usage of consumables & reagents in diagnosis is growing owing to veterinary diagnostics. This can be attributed to increasing awareness about zoonotic diseases and the growing number of pet adoptions & concern for their health.

Species Insights

The canine species segment accounted for the largest share of more than 34% of the global revenue in 2021. The dominant share captured by dog species is a result of increasing animal healthcare spending, specifically in developed regions. The increasing incidence of obesity, diabetes, cancer, and other major diseases is one of the major drivers for the market. According to an APOP report in 2019, in the U.S., around 57% of dogs were recorded as obese. Obesity further increases the risk of joint diseases, diabetes mellitus, cancer, and other chronic conditions.

The increasing concern of pet owners resulted in a regular diagnosis of glucose levels, thus increasing the market for glucose monitors. The porcine segment also held a substantial share of the market in 2021 owing to the growing consumption of pork and demand for better diagnostic procedures. In March 2021, MatMaCorp launched MYRTA, a hand-held real-time polymerase chain reaction device for over-the-counter and point-of-care molecular diagnostics solutions for human andanimal health. The MYRTA system could also be used in veterinary health, as displayed by its capability to detect porcine reproductive and respiratory syndrome virus.

Disease Type Insights

The non-infectious diseases segment held the maximum share of more than 27% of the global revenue in 2021. The market has demonstrated an increase in the number of diagnostics entering with innovative technologies to detect diseases in animals. For instance, the Lab on a Chip technology can analyze electrolytic imbalance in the body fluids, such as urine, blood, and milk. The hereditary, congenital, and acquired diseases segment is expected to register the fastest growth rate over the forecast period. These diseases are quite prevalent nowadays.

The genetic disease is not visible in the beginning and thus not easily diagnosed. Molecular screening is recommended for such cases. Infectious diseases in animals are a noteworthy danger to the worldwide human and animal population and their wellbeing. These diseases should be successfully controlled to prevent epidemics and the spread of infections from animal to animal or animal to humans. A few examples of prevalent animal diseases are brucellosis, influenza, respiratory and reproductive diseases, herpes, and tuberculosis.

Testing Type Insights

The pathology testing type segment dominated the market in 2021 with a share of more than 13% owing to its wide variety of service offerings, such as various lab tests, imaging, and specialized tests. It comprises histopathology and immune histochemistry diagnostics that are used to detect changes in the tissues of animals due to a disease or medical condition. The cells can be taken from biopsy samples obtained from animals, which are processed and handed over to pathologists for further evaluation through special staining—Hematoxylin and Eosin (H&Es)—with advanced equipment. Immunohistochemistry offers markers for neoplastic & infectious diseases in small animals, such as the distemper virus, adenovirus, etc., and large animals, such as BVD virus, IBR virus, and others.

Moreover, nanotechnology is the next big shot for veterinary diagnostics as it promises to screen multiple pathogens in a single assay. These advanced technologies can highly improve animal disease diagnostic capabilities while reducing the time and cost associated with conventional technologies. Themolecular diagnosticssegment is also expected to grow at a significant rate owing to its increased use in research purposes.Polymerase Chain Reaction(PCR) is widely used for molecular diagnosis in animals for the identification and detection of various pathogens. The traditional PCR techniques are rapidly being replaced by real-time PCR. It enables the rapid identification of pathogens and provides great accuracy.

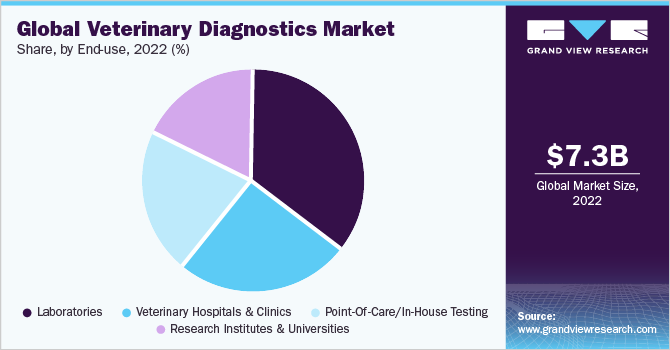

End-use Insights

On the basis of end uses, the global market has been segmented into laboratories, hospitals, clinics, in-house testing, and research institutes & universities. The laboratories segment held the largest revenue share of more than 37% in 2021. Veterinary hospitals & clinics was the second-largest end-use segment owing to the availability of a wide range of diagnostic options in these facilities. Moreover, the use of advanced analyzers for diagnostics purposes inveterinary hospitals增加了,这是推动市场。point of care segment is expected to exhibit the fastest CAGR over the forecast period.

The end consumers, such as pet owners, are gaining valuable benefits out of the technologically advanced diagnostics, such as in-house analyzers and point of care for their convenience and quick results. With advancements in veterinary diagnostics, there is a growing trend of POC testing in livestock and other animals, paving a way for market players to expand their POC portfolio and tests segment. The research institutes are also a big force behind the development and usage of these diagnostics. The functions, which are governed by the research institutes in relation to the animal diagnosis are deployment, identification, and development of new diagnostic methods or procedures for research, and monitoring purposes of newly emerging or existing diseases in animals.

Regional Insights

North America accounted for the largest revenue share of more than 50% in 2021. There has been a significant rise in veterinary healthcare expenditure in the region, which is expected to accelerate the market growth. Furthermore, the presence of healthcare programs and the rise in the number of initiatives to promote animal health are factors anticipated to increase the growth potential in this region. For instance, the North American Pet Health Insurance Association is focused on increasing the awareness levels about health insurance coverage for pets.

Efficient measures undertaken by the animal welfare organizations in case of an emergency or sudden disease outbreak are also expected to contribute to market growth across North America. The Asia Pacific regional market is projected at the fastest growth rate during the forecast period. The rise in middle-class households, increased disposable income, acceptance of pet animals, and high demand for animal proteins are some of the key factors expected to boost the growth of the regional market.

Key Companies & Market Share Insights

The market is fragmented with the presence of many big and small industry players. Key players are adopting business strategies including diverse product offerings, regional expansion, business expansion, joint ventures, and new product launches to gain a higher market share. For instance, in November 2021, FUJIFILM Europe aims to expand its veterinary diagnostic customer portfolio with products and services with the purchase of DMV Imaging. DMV Imaging, headquartered in Lyon, France, has specialized in offering veterinary POC laboratory diagnostics.

In January 2021, Heska entered into an agreement to acquire Lacuna Diagnostics, Inc. This enabled the company to enter the clinical specialty services space. In March 2021, Zomedica Corp., a veterinary health corporation producing point-of-care diagnostics products for cats and dogs, recorded the first veterinarian sale of TRUFORMA and officially entered commercialization. Some of the prominent players in the global veterinary diagnostics market include:

Zoetis

Heska Corp.

IDEXX Laboratories Inc.

Agrolabo S.p.A.

IDvet

Virbac

Thermo Fisher Scientific Inc.

Neogen Corp.

Covetrus

iM3Vet Pty Ltd.

Veterinary Diagnostics MarketReport Scope

Report Attribute |

Details |

Market size value in 2022 |

USD 7.30 billion |

Revenue forecast in 2030 |

USD 16.9 billion |

Growth rate |

CAGR of 11.2% from 2022 to 2030 |

Base year for estimation |

2021 |

Historical data |

2017 - 2020 |

Forecast period |

2022 - 2030 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product, species, testing type, disease type, end-use, region |

Regional scope |

North America; Europe; Asia Pacific; Latin America; MiddleEast and Africa |

Country scope |

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Japan; India; China; Brazil; Mexico; Argentina; South Africa; Saudi Arabia |

Key companies profiled |

Zoetis; Heska Corp.; IDEXX Laboratories Inc.; Agrolabo S.p.A.; IDvet; Virbac; Thermo Fisher Scientific Inc.; Neogen Corp.; Covetrus; iM3Vet Pty Ltd. |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global veterinary diagnostics market report on the basis of product, species, disease type, testing type, end-use, and region:

Product Outlook (Revenue, USD Million, 2017 - 2030)

Consumables, Reagents & Kits

Instruments & Devices

Species Outlook (Revenue, USD Million, 2017 - 2030)

Cattle

Canine

Feline

Caprine

Equine

Ovine

Porcine

Avian

Others

Testing Type Outlook (Revenue, USD Million, 2017 - 2030)

Analytical Services

Diagnostic Imaging

Bacteriology

Pathology

Molecular Diagnostics

Immunoassays

Parasitology

Serology

Virology

Disease Type Outlook (Revenue, USD Million, 2017 - 2030)

Infectious Diseases

Non-Infectious Diseases

Hereditary, Congenital and Acquired Diseases

General Ailments

Structural and Functional Diseases

End-use Outlook (Revenue, USD Million, 2017 - 2030)

laboratories

Veterinary Hospitals and Clinics

Point-Of-Care/In-House Testing

Research Institutes and Universities

Regional Outlook (Revenue, USD Million, 2017 - 2030)

North America

U.S.

Canada

Europe

Germany

U.K.

France

Italy

Spain

Asia Pacific

China

Japan

India

latin America

Brazil

Mexico

Argentina

Middle East & Africa

South Africa

Saudi Arabia

Frequently Asked Questions About This Report

b.The global veterinary diagnostics market is expected to grow at a compound annual growth rate of 11.5% from 2021 to 2028 to reach USD 14.6 billion by 2028.

b.North America dominated the veterinary diagnostics market with a share of 32.09% in 2020. This is attributable to the favorable healthcare structure in this region, with high healthcare spending for animals.

b.Some key players operating in the veterinary diagnostics market include Abaxis, Inc.; Idexx Laboratories, Inc.; Heska Corporation; Neogen Corp; Merck; Thermo Fisher Scientific, Inc.; Qiagen N.V.; Virbac Corp; Zoetis, Inc.; IDVet; Agrolabo SPA; Im3 Inc.; VCA Antech; and Henry Schein, Inc.

b.Key factors that are driving the veterinary diagnostics market growth include increased animal healthcare expenditure, rising incidence of zoonotic diseases, and a growing number of veterinary practitioners.

b.The global veterinary diagnostics market size was estimated at USD 6.2 billion in 2020 and is expected to reach USD 6.8 billion in 2021.