Video Surveillance Market Size, Share & Trends Analysis Report By Component (Camera, Monitors), By Vertical (Commercial, Government), By System Type, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-122-7

- Number of Pages: 100

- 格式:电子(PDF)

- Historical Range: 2017 - 2021

- Industry:Technology

Report Overview

The global视频监控市场规模乐鱼体育手机网站入口was estimated atUSD 56.90 billion in 2022and is expected to grow at a compound annual growth rate (CAGR) of 12.4% from 2023 to 2030. This growth is driven by increasing security demands in private and public places such as schools, airports, businesses, and homes. The emergence of smart cities necessitates intelligent video surveillance for monitoring various activities. Cloud-based systems gain traction for their scalability and cost-efficiency. Advancements likeAIand deep learning enhance surveillance effectiveness, contributing to the industry's significant expansion in the years ahead.

For instance, in April 2023, Infinova, a global video surveillance systems manufacturer, secured a significant contract to provide video surveillance solutions for more than 60 airports in India. This deal supplies over 6,000 cameras, including versatile high-speed PTZ domes, durable vandal-resistant minidomes, and adaptable day/night fixed cameras. The deployment targets crucial airport zones, like check-in areas, baggage screening points, and boarding gates. Beyond enhancing security, these cameras are anticipated to optimize airport operations by monitoring passenger and baggage movement, thus mitigating congestion and delays.

Businesses are investing in AI-equipped and future-proof video surveillance systems. AI-driven video analytics automate tasks such as object and facial recognition, liberating human operators for more critical duties such as addressing security alerts. The capacity of AI to uncover imperceptible threats like unauthorized presence or leftover objects enhances security. Furthermore, AI enhances scalability by efficiently processing substantial video data, allowing deployment in expansive environments such as airports and stadiums. Embracing AI ensures adaptability to evolving technologies, enabling businesses to maintain security excellence and stay at the forefront of safety measures.

先进的分析转换视频监控ystems into valuable business solutions. AI-driven object detection and tracking enable security enhancements, from identifying intrusions to monitoring traffic flow. Behavioral analytics analyze actions of individuals or objects, pinpointing suspicious behavior or observing customer and employee conduct. Face recognition bolsters security by verifying access or tracking individuals, while heatmaps highlight active video areas, aiding in identifying high-traffic zones or potential crime spots. AI's scene analysis capability identifies objects, people, and activities, serving purposes from crime scene reconstruction to investigative evidence gathering.

The rise of 5G has given potential benefits for video surveillance. Its superior bandwidth and lower latency enable real-time transmission of high-definition video streams, which is vital for live monitoring and video analytics. With its capacity for extensive connectivity, 5G supports numerous devices, facilitating applications such as crowd monitoring and traffic management. Enhanced security through robust encryption safeguards video data, and improved mobility allows for flexible camera deployment, beneficial for public safety and event monitoring. Moreover, the cost-effectiveness of 5G drives the potential to deploy more cameras and sensors, reducing overall surveillance expenses.

System Type Insights

In terms of system type, the IP video surveillance systems segment led the market in 2022 with a revenue share of over 54%. This is attributed to rising demand for high-quality video surveillance solutions, cost reductions in IP cameras, and the surging trend of cloud-based video surveillance. IP video surveillance systems utilize digital technology for transmitting and receiving video signals over IP networks, offering enhanced scalability and flexibility compared to traditional analog video surveillance systems. IP cameras allow control and remote monitoring, making them well-suited for distributed and large environments.

Hybrid video surveillance systems segment is predicted to foresee significant growth in the forecast years in the market. This is due to the increasing popularity of hybrid video surveillance systems, which offer the flexibility of analog systems and the advanced features of IP systems. These hybrid solutions find application across diverse environments such as residences, educational institutions, and enterprises. Moreover, their user-friendly installation and maintenance contribute to their cost-effectiveness, making them a cost-effective option for businesses seeking efficient video surveillance solutions.

Vertical Insights

The commercial segment led the video surveillance market in 2022, accounting for over 35% share of the global revenue. The high share can be attributed to the growing demand for video surveillance systems across diverse commercial applications. These applications include retail environments for theft deterrence and customer behavior analysis, data centers and enterprises for safeguarding critical infrastructure, banking and finance buildings for crime prevention and fraud mitigation, and hospitality establishments and warehouses for guest safety, staff monitoring, and security enhancement. For instance, in August 2023, VIVOTEK, a prominent Taiwanese video surveillance products manufacturer, introduced a comprehensive solution for a leading logistics center in Japan by deploying 105 FE9380-HV 360-degree cameras and a 14 IB9368-HT bullet network camera within the warehouses. These cameras provide a panoramic view of the entire area, eliminating blind spots. Thus, the new surveillance system has helped the logistics company improve its warehouse efficiency and security.

The industrial segment is poised for substantial growth in the forecast years in the market. This growth is driven by the growing demand for security within industrial facilities to safeguard against theft, vandalism, and other criminal activities. In addition, the increasing adoption of smart manufacturing technologies is fueling the demand for video surveillance systems essential for monitoring and managing operations. The growing necessity to conform to safety regulations, particularly concerning occupational health and environmental protection, further contributes to this upsurge. Moreover, integrating technological advancements such as artificial intelligence anddeep learninginto video surveillance enhances its efficiency in the industrial sector.

Component Insights

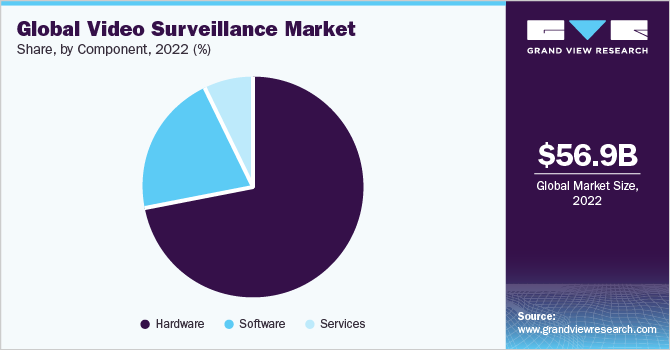

In terms of component, the hardware segment dominated the market in 2022 with a revenue share of over 71%. The segment's growth is primarily attributed to the robust demand for surveillance cameras, monitors, and storage devices. Surveillance cameras are pivotal in monitoring diverse environments, spanning businesses, residences, educational institutions, and public spaces. Their capabilities continue to advance, incorporating features such as night vision, motion sensing, and facial recognition. Monitors serve to observe real-time feeds from surveillance cameras, usually stationed in control rooms or dedicated monitoring areas. Moreover, storage devices are essential in archiving recorded footage captured by surveillance cameras, facilitating applications like crime investigation and suspect identification.

The services segment is anticipated to grow significantly in the coming years, driven by a surge in demand for video surveillance systems, necessitating specialized skills for installation and configuration. Moreover, the rising popularity of video surveillance as a service (VSaaS) contributes to this trend, offering a more economical and scalable alternative to traditional on-premises setups. The adoption ofvideo analytics需求也在上升,创建一个自称ional services to implement and manage these advanced features. Furthermore, the increasing requirement for security consulting and seamless system integration services further drives the anticipated expansion of the services segment in the market.

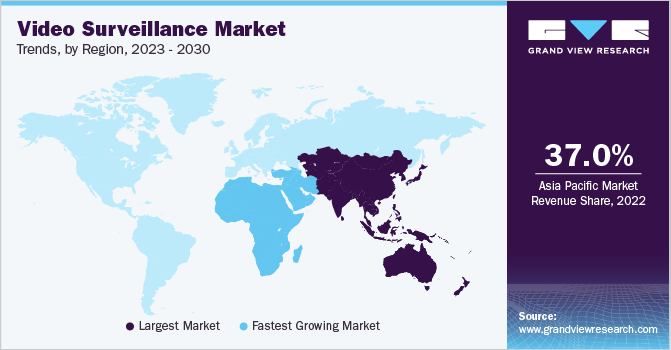

Regional Insights

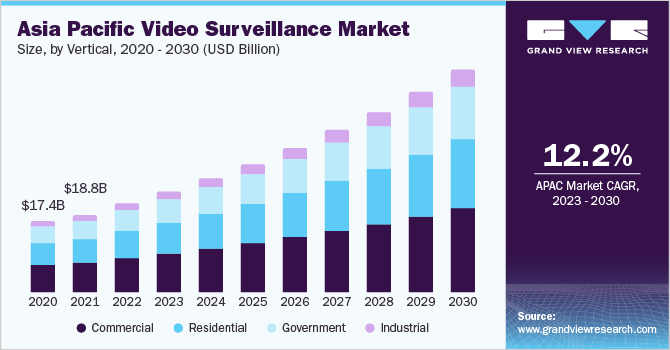

Asia Pacific dominated the market in 2022 with a revenue share of over 37%. China, Japan, and India are the major countries driving this regional dominance, fostering a substantial demand for video surveillance systems to enhance public safety and security. The region's focus on smart city projects has propelled the integration of video surveillance as a pivotal component for monitoring traffic, crime, and various activities within these initiatives. Moreover, the Asia Pacific region is witnessing growing retail chains and small businesses progressively adopting video surveillance solutions to safeguard assets and deter criminal activities. In addition, favorable government initiatives, such as China's policies promoting video surveillance adoption in public spaces such as schools and hospitals, further drive the market's growth in the region.

The Middle East & Africa are poised to offer lucrative market opportunities in the upcoming years as the region is expected to grow at the fastest CAGR of 16.1% over the forecast period. Key players in the MEA market are focused on expanding their investments, product portfolios, solutions, and strategic partnerships to create robust and user-friendly functionality, including mobile video surveillance. UAE and KSA are the two major countries contributing to the high generation of the market in this region. This can be due to enterprises in the MEA taking opportunities to go beyond safeguarding their conventions and compliances and applying technology to limit threats on enterprise devices. Furthermore, MEA has the maximum adoption of mobile and connected devices that are greatly susceptible to endpoint attacks.

Key Companies & Market Share Insights

The market is characterized by the presence of established as well as new players. Major players operating in this market are actively focusing on mergers & acquisitions to capitalize on their market positions. In addition, emerging and innovative companies are involved in upgrading existing video surveillance offerings, as well as establishing partnerships to increase their market share. For instance, in June 2023, Becklar, LLC, specializing in safety solutions, acquired Eyeforce Inc., a prominent provider of monitored remote guarding solutions. The acquisition aims to augment Becklar LLC's offerings for its dealers by providing a broader and more cutting-edge array of connected safety solutions in the North America region. Thus, Eyeforce Inc. combines video surveillance, AI analytics, and live audio response to enhance safety, prevent crime, and reduce theft and losses in commercial properties. This bolsters the potential of the newly established collaboration in the safety solutions market. Some prominent players in the global video surveillance market include:

Hangzhou Hikvision Digital Technology Co., Ltd.

Dahua Technology Co., Ltd

Robert Bosch GmbH

Axis Communications AB.

Motorola Solutions, Inc.

Zhejiang Uniview Technologies Co., Ltd.

Tiandy Technologies Co., Ltd.

TKH Group N.V.

Hanwha Vision Co., Ltd.

Infinova

Video Surveillance MarketReport Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 64.92 billion |

Revenue forecast in 2030 |

USD 147.00 billion |

Growth rate |

CAGR of 12.4% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2017 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Component,system type,vertical, region |

Regional scope |

北美;欧元pe; Asia Pacific; Latin America; MEA |

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Kingdom of Saudi Arabia; South Africa. |

Key companies profiled |

杭州Hikvision数码科技有限公司。Dahua Technology Co., Ltd; Robert Bosch GmbHAxis Communications AB.; Motorola Solutions, Inc.; Zhejiang Uniview Technologies Co., Ltd.; Tiandy Technologies Co., Ltd.; TKH Group N.V.; Hanwha Vision Co., Ltd.; Infinova |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Video Surveillance MarketReport Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global video surveillance market report based on component, system type, vertical, and region.

Component Outlook (Revenue, USD Billion, 2017 - 2030)

Hardware

Camera

Monitors

Storage Devices

Others

Software

Services

System Type Outlook (Revenue, USD Billion, 2017 - 2030)

Analog Video Surveillance Systems

IP Video Surveillance Systems

Hybrid Video Surveillance Systems

Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

Commercial

Retails Stores & Malls

Data Centers & Enterprises

Banking & Finance Building

Hospitality Centers

Warehouses

Others

Industrial

Residential

Government

Healthcare Buildings

Educational Buildings

Religious Buildings

Government Buildings

Others

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

North America

U.S.

Canada

欧元pe

Germany

UK

France

Asia Pacific

China

Japan

India

South Korea

Australia

Latin America

Brazil

Mexico

Middle East and Africa (MEA)

UAE

Kingdom of Saudi Arabia

South Africa

Frequently Asked Questions About This Report

b.The global video surveillance market size was estimated at USD 56.90 billion in 2022 and is expected to reach USD 64.92 billion in 2023.

b.The global video surveillance market is expected to grow at a compound annual growth rate of 12.4% from 2023 to 2030 to reach USD 147.00 billion by 2030.

b.Asia Pacific dominated the market in 2022, accounting for over 37% share of the global revenue. China, Japan, and India are the major countries driving this regional dominance, fostering a substantial demand for video surveillance systems to enhance public safety and security.

b.Some key players operating in the video surveillance market include Hangzhou Hikvision Digital Technology Co., Ltd.; Dahua Technology Co., Ltd; Robert Bosch GmbHAxis Communications AB.; Motorola Solutions, Inc.; Zhejiang Uniview Technologies Co., Ltd.; Tiandy Technologies Co., Ltd.; TKH Group N.V.; Hanwha Vision Co., Ltd.; Infinova.

b.Key factors driving the video surveillance market growth include the growing demand for security concerns and the emergence of AI in the video surveillance market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."