Voice Over New Radio Market Size, Share, & Trends Analysis Report By Component (Hardware, Solution, Services), By Deployment, By End-use Devices, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-118-2

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2023 - 2030

- Industry:Technology

Report Overview

The globalvoice over new radio market sizewas valued atUSD 3.49 billion in 2022and is expected to grow at a compound annual growth rate (CAGR) of 50.5% from 2023 to 2030. Voice over new radio (VoNR), or voice over 5G, is the next most prominent feature in the evolution of the 5G standalone network. VoNR or Vo5G carries out voice calls using the 5G network. The growing demand for high-quality and seamless voice calling and the increasing need for network efficiency and easy integration are anticipated to propel the market’s growth over the forecast period.

根据数据发布的GSMA聪明ce, as of 2021, over 200 mobile operators provided commercial voice-over LTE services to their customers across 100 countries. The existing VoLTE network providers are focusing on optimizing their networks to capture benefits in terms of operation, spectrum, and communication efficiency to provide their customers with a better calling experience. As communication service providers (CSPs) upgrade to 5G networks, they are anticipated to shift to offer VoNR to their customers for a better experience. The growing demand for higher-quality calling is thus contributing to the VoNR market’s growth.

5 g的不断推出,消费者expectations are shifting to high data rates. As the consumer demand for 5G increases, there is a growing interest in phasing out legacy networks such as 2G/3G from telecom operators. This is because phasing out 2G/3G networks will free up spectrum and resources for next-generation 4G/5G networks, thus enabling telecom operators to provide better service. Additionally, facilitating 2G/3G network decommissioning can lead to cost savings and improved cost efficiency and can provide the ability to allocate more resources to support 5G and other future technologies. The growing focus on deploying a 5G network is anticipated to contribute to the growth of Vo5G or VoNR calling services.

Voice over new radio (VoNR) is a prominent new feature of the 5G standalone network. Telecom operators with an existing 5G standalone core are ahead in launching VoNR services for their customers. For instance, in June 2022, T-Mobile, which has its 5G standalone core, announced the commercial offering of its VoNR service for its customers with Samsung Galaxy S21 5G in limited areas of Portland, Oregon, and Utah, U.S. The launch was in collaboration with various infrastructure and handset/chipset partners, including Nokia Corporation, Telefonaktiebolaget LM Ericsson, Qualcomm Technologies, Inc., and Samsung Electronics Ltd. The collaboration between equipment providers, end-use device providers, and telecom operators is the key to the VoNR market’s growth over the forecast period.

Since voice-over new radio relies on a 5G standalone network, it faces some operational difficulties that are expected to hinder the market’s growth. Factors such as high infrastructure costs, higher frequency spectrum costs, higher energy consumption costs, and security & management costs pose a challenge in the market. Additionally, since both 4G LTE and 5G were first launched as data-only services, facilitating voice over these networks is a complex process that is delaying the commercial deployment of VoNR. However, the evolution of 5G technology and more widespread adoption of 5G networks is anticipated to decrease the market’s challenges over the forecast period.

COVID-19 Impact Analysis

The telecom industry and 5G deployments were negatively impacted by the COVID-19 pandemic. Global lockdowns and business shutdowns caused supply chain disruptions and halted 5G component manufacturing, resulting in delayed 5G deployments. This delay in 5G deployments impacted the 5G standalone network deployment, which further halted/delayed the commercialization of voice over new radio (VoNR). Additionally, the financial crisis followed by the pandemic hampered the investments made in testing and deploying VoNR technology, thus further delaying its commercialization. With the world recovering from pandemic adversities, there is global encouragement for 5G deployments, which bodes well for the growth of the market.

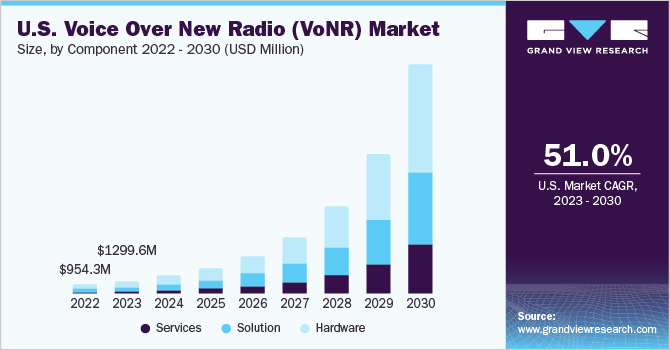

Component Insights

The hardware segment dominated the market in 2022 and accounted for a revenue share of more than 45.0%. The hardware segment is further bifurcated into 5G RAN, 5G Core, and others. 5G RAN and 5G Core are crucial elements in facilitating VoNR over a standalone 5G network. Telecom operators and VoNR service providers are investing heavily to upgrade their infrastructure to standalone 5G to provide Vo5G/VoNR to their customers. 5G RAN and 5G Core are crucial in providing higher capacity and clarity in voice calling, lowering latency, and increasing network efficiency. Hence, telecom operators are implementing VoNR hardware to facilitate voice calling over 5G networks to their customers, which is anticipated to fuel the segment’s growth over the forecast period.

The services segment is anticipated to be the fastest-growing segment over the forecast period. The growth of the services segment can be attributed to the growing adoption of 5G networks and voice-over 5G. Since VoNR is integrated into the 5G ecosystem, allowing customers to access voice and data services without switching to a different technology requires seamless integration with data services. Integration & deployment, maintenance, and upgradation are some of the services necessary for deploying VoNR. These services are anticipated to prove crucial as the VoNR market gains momentum, thus driving the market’s growth.

Deployment Insights

The public cloud segment dominated the market in 2022 and accounted for a revenue share of more than 37.0%. Voice over new radio (VoNR) provides voice services using cloud-native 5G standalone networks. VoNR uses Multimedia Subsystem (IMS), which unifies packet-based calls into a network infrastructure using a mobile network as its source. The public cloud deployment enables voice service providers to deploy an easy-to-maintain and highly scalable IP multimedia communication network through an IMS system. High scalability, low maintenance, cost-effectiveness, and multitenant shared servers are some of the public cloud’s features contributing to the segment’s growth.

The hybrid cloud segment is anticipated to grow significantly over the forecast period. The transition to 5G allows CSPs to upgrade voice delivery via cloud-native software network and establish a platform for developing new voice services. The growth of the hybrid cloud segment can be attributed to the features offered by the hybrid cloud, such as higher control over the network, high security, scalability, low maintenance, and the mixture of both the features of public and private cloud deployments.

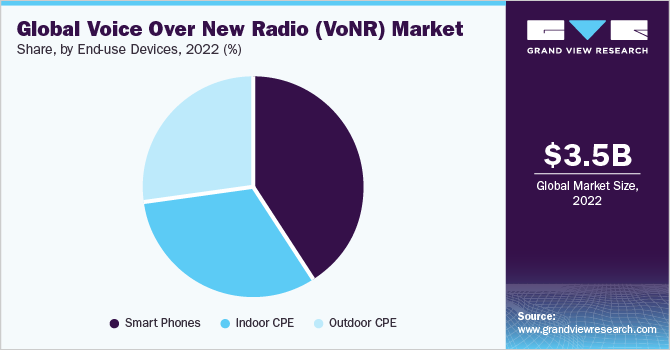

End-use Devices Insights

Thesmartphonesegment dominated the market in 2022 and accounted for a revenue share of more than 41.0%. The provision of voice services has evolved since the launch of smartphones. The introduction of 5G non-standalone networks enables voice services by continuing the use of LTE and 2G/3G infrastructure. However, standalone 5G networks require a new approach, and VoNR is designed to meet the challenge. Additionally, using VoNR service provided over standalone 5G requires dedicated devices. Smartphones are among the most popular devices used for voice communication over the 5G network. The popularity of smartphones and the growing use of 5G technology contribute to the segment’s growth.

The indoor CPE segment is anticipated to grow significantly over the forecast period. Indoor CPE refers to the Customer Premises Equipment (CPE) installed on the customer's location to access a service provider's network. Customers use indoor CPE for VoNR for enhanced indoor coverage, improved call quality at indoor premises, and residential and enterprise deployments. The growing demand from residential or enterprise customers for high-quality indoor calling can be facilitated through indoor CPE. In addition, the gradual shift to 5G, even indoors, is driving the segment's growth further.

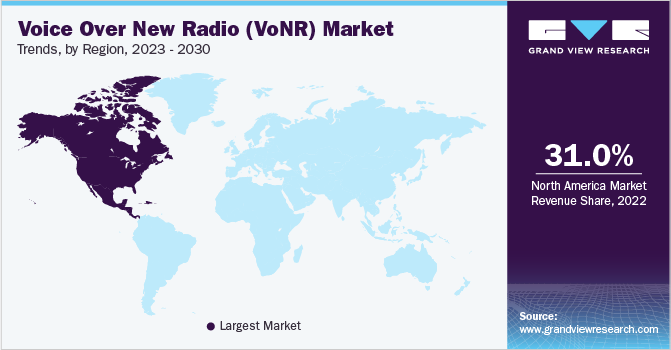

Regional Insights

North America dominated the voice over new radio (VoNR) market in 2022 and accounted for a more than 31.0% revenue share. North American countries have been at the forefront of new technological advances regarding 5G. The presence of key market players such as T-Mobile, USA, Inc., and Qualcomm Technologies, Inc. is fostering innovation in the region. In February 2020, Qualcomm Technologies, Inc. announced the launch of its Snapdragon X60 5G Modem-RF System, its third-generation 5G modem-to-antenna solution. The Snapdragon X60 is designed to propel network transition to 5G standalone mode through support for any key mode, spectrum band, or combination, along with 5G Voice-over-NR (VoNR) capabilities. Such initiatives are a key driver for the regional market’s growth.

Asia Pacific is anticipated to register significant growth over the forecast period. The rising demand for high-quality calling services is driving the use of voice over-technologies in Asian countries. According to data published by the GSMA, in 2025, China will have around 1.7 billion VoLTE + Vo5G mobile connections, being the largest market, which is anticipated to drive the regional market’s growth. In February 2023, at the China-Japan-Korea Tripartite Strategic Cooperation Framework Agreement (SCFA) Summit, KT Corporation and China Mobile demonstrated 5G voice over new radio (VoNR) international roaming with ‘VoNR+’ call services. Such initiatives are anticipated to grow the regional market over the forecast period.

Key Companies & Market Share Insights

The voice over new radio market can be considered a consolidated market with a presence of few large players. The VoNR market is fairly new, and VoNR services have been recently commercialized. With the advent of 5G technology, key market players are engaging in partnerships and developments to offer VoNR service to their customers. The growing demand for high-clarity voice calls is driving the demand for VoNR calling and thus is pushing telecom operators to launch innovative VoNR solutions.

The VoNR market is still in the development phase, and vendors across the globe are partnering with key telecom equipment providers to demonstrate VoNR capabilities. For instance, in May 2023, the Emirates Integrated Telecommunications Company DU successfully demonstrated 5G Voice over New Radio (VoNR) capabilities in partnership with Nokia Corporation and Huawei Technologies Co., Ltd. With VoNR, Du can offer enhanced call setup times by providing seamless 5G connections with uninterrupted high-speed data transmission. Such initiatives are harnessing the market’s growth. Some of the prominent players in the global voice over new radio market include:

T‑Mobile USA, Inc.

Telefónica Deutschland

STC

Zain

Jio Platforms Limited

ADVANCED INFO SERVICE PLC.

Nokia Corporation

Telefonaktiebolaget LM Ericsson

Qualcomm Technologies, Inc.

Huawei Technologies Co., Ltd.

Voice Over New Radio Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 4.74 billion |

Revenue forecast in 2030 |

USD 83.09 billion |

Growth rate |

CAGR of 50.5% from 2023 to 2030 |

Base year of estimation |

2022 |

Historical data |

2022 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

Segments covered |

Component, deployment, end-use devices, region |

Regional scope |

北美;欧洲;亚太地区;拉丁美洲; MEA |

Country scope |

U.S.; Canada; U.K.; Germany; Switzerland; China; India; Japan; South Korea; Australia; Thailand; Brazil; Kingdom of Saudi Arabia (KSA); UAE; Kuwait |

Key companies profiled |

T‑Mobile USA, Inc.; Telefónica Deutschland; STC; Zain; Jio Platforms Limited; ADVANCED INFO SERVICE PLC.; Nokia Corporation; Telefonaktiebolaget LM Ericsson; Qualcomm Technologies, Inc.; Huawei Technologies Co., Ltd. |

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

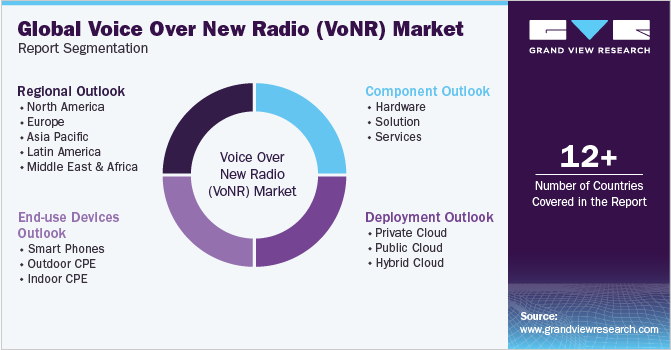

Global Voice Over New Radio Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2022 to 2030. For this study, Grand View Research has segmented the global voice over new radio market report based on component, deployment, end-use devices, and region:

Component Outlook (Revenue, USD Million, 2022 - 2030)

Hardware

5G RAN

5G Core

Others

Solution

- Services

Deployment Outlook (Revenue, USD Million, 2022 - 2030)

Private Cloud

Public Cloud

Hybrid Cloud

End-use Devices Outlook (Revenue, USD Million, 2022 - 2030)

Smart Phones

Outdoor CPE

Indoor CPE

Regional Outlook (Revenue, USD Million, 2022 - 2030)

North America

U.S.

Canada

Europe

U.K.

Germany

Switzerland

Asia Pacific

China

India

Japan

South Korea

Australia

Thailand

拉丁美洲

Brazil

Middle East & Africa

Kingdom of Saudi Arabia (KSA)

UAE

Kuwait

Frequently Asked Questions About This Report

b.The global voice over new radio market size was estimated at USD 3.49 billion in 2022 and is expected to reach USD 4.74 billion in 2023.

b.The global voice over new radio market is expected to grow at a compound annual growth rate of 50.5% from 2023 to 2030 to reach USD 83.09 billion by 2030.

b.North America dominated the market in 2022. North American countries have been the forefront of new technological advances regarding 5G. The presence of key market players such as T-Mobile, USA, Inc., and Qualcomm Technologies, Inc. is fostering innovation in the region.

b.Some key players operating in the voice over new radio (VoNR) include T‑Mobile USA, Inc., Telefónica Deutschland, STC, Zain, Jio Platforms Limited, ADVANCED INFO SERVICE PLC., Nokia Corporation, Telefonaktiebolaget LM Ericsson, Qualcomm Technologies, Inc., Huawei Technologies Co., Ltd.

b.The growing demand for high-quality and seamless voice calling and the increasing need for network efficiency and easy integration are anticipated to propel the voice over new radio (VoNR) market’s growth over the forecast period.