Wheat & Rice Flour Substitute-Resistant Starch Market Size, Share & Trends Analysis Report By Source (Fruits & Nuts, Grains, Vegetables, Cereal Food, Beans & Legumes), By Product, By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-141-1

- Number of Pages: 126

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry:Consumer Goods

Market Size & Trends

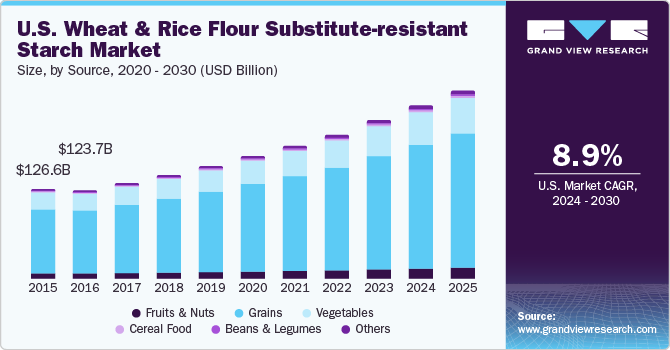

The globalwheat & rice flour substitute-resistant starch market size was valued at USD 802.42 billion in 2022and is expected to grow at a compound annual growth rate (CAGR) of 8.9% from 2023 to 2030. The primary factors driving the market growth include the growing demand for packaged and processed food products and increasing product launches in the industry.The growth of the food sector drives the demand for wheat & rice flour substitute-resistant starch.

The outbreak of COVID-19 affected the production capacity and raw material supplies required for manufacturing resistant starch from wheat & rice flour substitutes.The production capacity of corn starch in India was down by around 50% during the COVID-19 lockdown. According to a key statesman of the All India Starch Manufacturers Association, the corn starch industry witnessed a decline of 40%-50% in May 2020 due to subdued market demand. Furthermore, the trade barriers resulted in fluctuation in raw material pricing and uncertainty in production, which further impacted resistant starch production during COVID-19.

The increasing spending power of consumers, in addition to growing urbanization and changing lifestyles, is expected to drive the demand for processed food. The packaged food market is driven by consumer awareness regarding the availability of healthier versions and ongoing innovation by various key participants to reduce sugar, salt, trans-fat, and fat content in packaged foods. This factor drives the need for wheat & rice flour substitute resistant starches.

The growth in the processed food industry is one of the most important factors driving the demand for resistant starches. With growing health consciousness, consumers are shifting towards clean-label ingredients, which has led to manufacturers launching resistant starches from sources like peas, potatoes, and corn. Key market participants are focused on product innovation to strengthen their resistant starch product lines and to cater to the demand for novel ingredients, especially in North America and Europe.

耶鲁大学管理学院e of the recent new product launches include resistant starch sources such as peas and potatoes. There is an increased demand for pea starch in extruded snacks owing to its high amylose content; amylose results in characteristics such as high gelatinization temperature, resistance to thinning, and suitable gelling properties.

Major raw materials in the wheat & rice flour substitute resistant starch market include barley, oats, potato, corn, and peas. The yield of these crops is largely influenced by weather conditions, which ultimately influence raw material prices. The price trends of grains are highly volatile, especially corn. The increasing variations in corn prices have led to trade barriers for major corn exporters, such as the U.S. and Ukraine.

Application Insights

The bakery application segment is expected to reach USD 175,118.0 million by 2030, progressing at a CAGR of 8.6% over the forecast period. The rising number of artisan bakeries around the world is boosting the demand for resistant starch from varied sources. Rising consumer awareness regarding gluten-free products is driving the usage of these resistant starches in baked goods.

Several companies operating in the food ingredient sector are experimenting to produce wheat and rice substitute starches. For example, in November 2022, a U.S.-based provider of food ingredients, American Key Food Products, announced the launch of native tapioca starch for baked goods, snacks, gravies, and other applications. Further, a rise in the number of gluten-free products on supermarket shelves is also supporting segmental growth. In November 2021, Hy-Vee Inc., a U.S.-based supermarket chain, launched the Good Graces brand to offer a wide range of gluten-free products.

The penetration of wheat and rice flour substitute starches is projected to be high in soups, dressings, and condiments. The increasing types of resistant starch sources and their application in specific foods will benefit market growth. The corn starch segment held a major share of the market and is one of the main thickening agents in soups and dressings. Starch slurries are largely used in soups and sauces to achieve the appropriate texture.

Product Insights

In terms of revenue, RS2-resistant starches dominated the global market followed by the RS1 product type in 2022. RS2 product segment accounted for 38.86%% of the global market by value in 2022. The segment is projected to grow at a CAGR of 5.7% by volume during the forecast period.

RS2 is a type of dietary fiber that resists digestion by enzymes in the small intestine. The increasing usage of high amylose-resistant starch as a functional ingredient in food and beverage products, as well as in dietary supplements is driving the demand for RS2-resistant starch. The starches derived from grains such as corn have a high amylose content preferably used by consumers with concerns regarding the gastrointestinal tract.

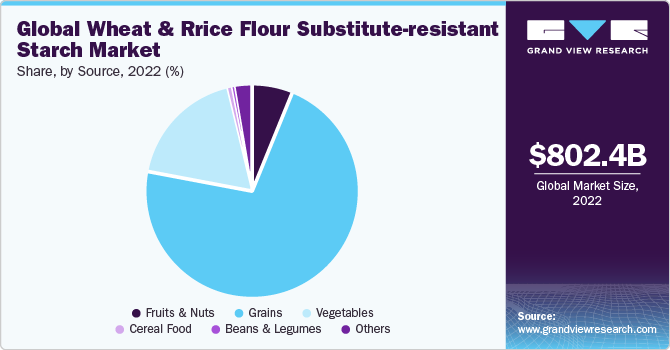

Source Insights

Grains led the global market with nearly 71.83% market share in terms of revenue in 2022.Increasing consumer interest in maintaining a healthy lifestyle and the rising incidence of diabetes and cardiovascular diseases are driving the grains segment growth. The rising demand for resistant starch and the easy availability of grains such as barley and corn is also benefiting segment growth.

The launch of grain flours from new sources such as quinoa is projected to positively impact the market. In October 2020, Ingredion Inc. announced the launch of Homecraft quinoa 112 flour, a rich source of resistant starch, in the U.S. and Canadian markets which can be used in gluten-free foods such as pasta, baked goods, and snack products.

玉米谷物来源主导市场的术语s of revenue in 2022. Corn source accounted for nearly 37.98% of grain sources in 2022. Corn is a widely used resistant starch source owing to the high content of amylose corn starch. Key companies such as Cargill are expanding their production of corn starch in Asian countries to cater to the growing consumer demand.

In terms of volume, the cereal food source segment is projected to record a growth rate of 8.8%. Rye and oats are rich sources of resistant starch. Rye-based kernel bread is preferred by consumers to enhance their glucose tolerance and appetite regulation.

Beans & legumes are emerging sources for resistant starch extraction. In May 2022, Croatia-based Nutris Group opened a factory for the production of plant-based products sourced from fava beans and potatoes. This manufacturing plant is aimed at the production of starch, fiber, and protein isolates from fava beans.

Regional Insights

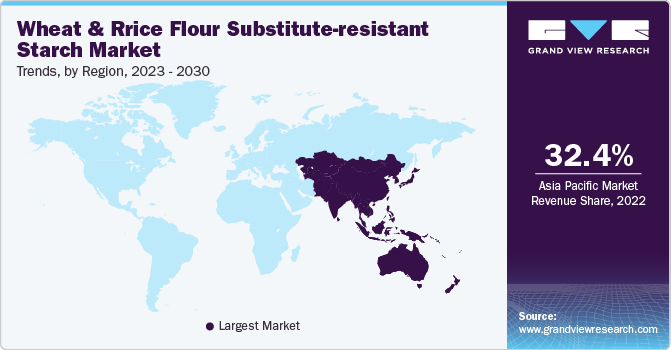

Asia Pacific dominated the global wheat & rice flour substitute resistant starch market and is expected to reach USD 514,369.2 million by 2030, progressing at a CAGR of 8.9% over the forecast period. This is owing to the high availability of cost-effective raw materials and labor coupled with growing the demand for processed snacks, especially in countries like China and Japan.

North America accounted for 24% of the global wheat & rice flour substitute resistant starch market in 2022. Some of the key sources of wheat & rice substitute resistant starches in North America are potatoes, corn, and pea. North America leads the market in terms of global corn starch production and this can be attributed to the growing demand for convenience foods in the region.

档次成分目前形式之一fastest-growing consumer trends in North America. This is mainly due to rising health consciousness in the U.S. and Canada, as well as the increasing number of vegans and flexitarians in the region. Pea starch is a popular clean-label ingredient in this market owing to its health benefits. Numerous pea starch manufacturers in the region are sourcing raw materials from local farmers.

Growing domestic consumption of snacks such as potato chips, sausages, and bread in the emerging markets of China, India, and the Middle East, coupled with the expansion of food retail outlets and new product launches, has had a positive impact on the wheat & rice flour substitute resistant starch market.

Key Companies & Market Share Insights

The key players operating in the wheat & rice flour substitute resistant starch market include Tate & Lyle; Ingredion; MSP Starch Products; ADM; Roquette Frères; PURIS; and Cargill, Incorporated. The market is highly competitive, with the presence of many major players and innovators. Rising demand for meat substitutes and healthy snacks among millennials is projected to further boost market growth over the forecast period.

New product launches and manufacturing capacity expansions are some of the key strategies adopted by the key market participants. For instance, in September 2020, MSP Starch Products entered the B2B prebiotic ingredient market by launching Solnul, a potato-derived resistant starch. The product is offered to food and dietary supplement companies.

此外,在2022年10月罗克等球员tte Frères launched a new line of organic pea starch produced at the company’s plant in Canada. This product launch was aimed at addressing the growing consumer demand for organic and healthier ingredients.

Key Wheat & Rice Flour Substitute-Resistant Starch Companies:

- Tate & Lyle

- Ingredion

- Emsland Group

- ADM

- Cargill, Incorporated

- Roquette Frères

- The Scoular Company

- Lodaat Pharmaceuticals

- MSP Starch Products

- PURIS

Wheat & Rice Flour Substitute-Resistant Starch MarketReport Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 868.74 billion |

Revenue forecast in 2030 |

USD 1,591.98 billion |

Growth Rate (Revenue) |

CAGR of 8.9% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2017 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Volume in metric ton, revenue in USD million, CAGR from 2023 to 2030 |

Report coverage |

Volume & revenue forecast, company ranking, competitive landscape, growth factors, trends |

Segments covered |

Source, product, application, region |

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand, South Korea, Brazil; Argentina, UAE, South Africa |

Key companies profiled |

Tate & Lyle; Ingredion; Emsland Group; ADM; Cargill, Incorporated; Roquette Frères; The Scoular Company; Lodaat Pharmaceuticals; MSP Starch Products; PURIS |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Wheat & Rice Flour Substitute-Resistant Starch MarketReport Segmentation

This report forecasts volume and revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global wheat & rice flour substitute-resistant starch market report based on source, product, application, source-application, product-application, source-prouduct, and region.

SourceOutlook (Volume, Metric Ton; Revenue, USD Million, 2017 - 2030)

Fruits & Nuts

Banana

Cashew nut

Others

Grains

Corn

Others

Vegetables

Potato

Cassava

Others

Cereal Food

Beans & Legumes

Peas

Others

- Others

ProductOutlook (Volume, Metric Ton; Revenue, USD Million, 2017 - 2030)

RS1

RS2

RS3

RS4

ApplicationOutlook (Volume, Metric Ton; Revenue, USD Million, 2017 - 2030)

Bakery Products

Bread

Biscuits & Cookies

Crackers

Other bakery products

Confectionery

Beverages

Breakfast Cereals

Pasta & Noodles

Dairy Products

Nutrition Bars

Meat & Processed Food

Meat Substitutes

Soups, Dressings, & Condiments

Others

Source-ApplicationOutlook (Volume, Metric Ton; Revenue, USD Million, 2017 - 2030)

Fruits & Nuts

Bakery Products

Bread

Biscuits & Cookies

Crackers

Other bakery products

Confectionery

Beverages

Breakfast Cereals

Pasta & Noodles

Dairy Products

Nutrition Bars

Meat & Processed Food

Meat Substitutes

Soups, Dressings, & Condiments

Others

Grains

Bakery Products

Bread

Biscuits & Cookies

Crackers

Other bakery products

Confectionery

Beverages

Breakfast Cereals

Pasta & Noodles

Dairy Products

Nutrition Bars

Meat & Processed Food

Meat Substitutes

Soups, Dressings, & Condiments

Others

Vegetables

Bakery Products

Bread

Biscuits & Cookies

Crackers

Other bakery products

Confectionery

Beverages

Breakfast Cereals

Pasta & Noodles

Dairy Products

Nutrition Bars

Meat & Processed Food

Meat Substitutes

Soups, Dressings, & Condiments

Others

Cereal Food

Bakery Products

Bread

Biscuits & Cookies

Crackers

Other bakery products

Confectionery

Beverages

Breakfast Cereals

Pasta & Noodles

Dairy Products

Nutrition Bars

Meat & Processed Food

Meat Substitutes

Soups, Dressings, & Condiments

Others

Beans & Legumes

Bakery Products

Bread

Biscuits & Cookies

Crackers

Other bakery products

Confectionery

Beverages

Breakfast Cereals

Pasta & Noodles

Dairy Products

Nutrition Bars

Meat & Processed Food

Meat Substitutes

Soups, Dressings, & Condiments

Others

Others

Bakery Products

Bread

Biscuits & Cookies

Crackers

Other bakery products

Confectionery

Beverages

Breakfast Cereals

Pasta & Noodles

Dairy Products

Nutrition Bars

Meat & Processed Food

Meat Substitutes

Soups, Dressings, & Condiments

Others

Product-ApplicationOutlook (Volume, Metric Ton; Revenue, USD Million, 2017 - 2030)

RS1

Bakery Products

Bread

Biscuits & Cookies

Crackers

Other bakery products

Confectionery

Beverages

Breakfast Cereals

Pasta & Noodles

Dairy Products

Nutrition Bars

Meat & Processed Food

Meat Substitutes

Soups, Dressings, & Condiments

Others

RS2

Bakery Products

Bread

Biscuits & Cookies

Crackers

Other bakery products

Confectionery

Beverages

Breakfast Cereals

Pasta & Noodles

Dairy Products

Nutrition Bars

Meat & Processed Food

Meat Substitutes

Soups, Dressings, & Condiments

Others

RS3

Bakery Products

Bread

Biscuits & Cookies

Crackers

Other bakery products

Confectionery

Beverages

Breakfast Cereals

Pasta & Noodles

Dairy Products

Nutrition Bars

Meat & Processed Food

Meat Substitutes

Soups, Dressings, & Condiments

Others

RS4

Bakery Products

Bread

Biscuits & Cookies

Crackers

Other bakery products

Confectionery

Beverages

Breakfast Cereals

Pasta & Noodles

Dairy Products

Nutrition Bars

Meat & Processed Food

Meat Substitutes

Soups, Dressings, & Condiments

Others

Source-ProductOutlook (Volume, Metric Ton; Revenue, USD Million, 2017 - 2030)

Fruits & Nuts

RS1

RS2

RS3

RS4

Grains

RS1

RS2

RS3

RS4

Vegetables

RS1

RS2

RS3

RS4

Cereal Food

RS1

RS2

RS3

RS4

Beans & Legumes

RS1

RS2

RS3

RS4

Others

RS1

RS2

RS3

RS4

Regional Outlook (Volume, Metric Ton; Revenue, USD Million, 2017 - 2030)

North America

U.S.

Canada

Mexico

Europe

U.K.

Germany

France

Spain

Italy

Asia Pacific

China

India

Japan

Australia & New Zealand

South Korea

Central & South America

Brazil

Argentina

Middle East & Africa

UAE

South Africa

Frequently Asked Questions About This Report

b.Key factors that are driving the market growth include the growing demand for packaged and processed food products and increasing product launches in the industry. The continued growth and expansion of the processed and convenience food sector have driven the demand for wheat & rice flour substitute resistant starch in recent years.

b.The global wheat & rice substitute resistant starch market size was estimated at USD 802.42 billion in 2022 and is expected to reach USD 868.74 billion in 2023.

b.The global wheat & rice substitute resistant starch market is expected to grow at a compound annual growth rate of 8.9% from 2023 to 2030 to reach USD 1,591.98 billion by 2030.

b.Asia Pacific dominated the wheat & rice substitute resistant starch market with a share of 32.4% in 2022. This is attributable to the high availability of cost-effective raw materials and labor coupled with growing demand for processed snacks especially in countries like China and Japan.

b.耶鲁大学管理学院e key players operating in the wheat & rice substitute resistant starch market include Tate & Lyle, Ingredion, MSP Starch Products, ADM, Roquette Frères, PURIS, and Cargill, Inc.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."