Wireless Cardiac Monitoring Systems Market Size, Share & Trends Analysis Report, By Type (Implantable Cardiac Monitors, Patch-Type Monitor, Mobile Cardiac Telemetry System), By End-User, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-120-7

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Healthcare

Report Overview

The globalwireless cardiac monitoring systems market sizewas valued atUSD 2.98 billion in 2022and is expected to grow at a CAGR of 11.4% from 2023 to 2030. Wireless cardiac monitoring systems are remote healthcare devices that track heart activities for medical analysis. The market is expected to grow due to several factors, such as a growing geriatric population susceptible to cardiovascular diseases (CVDs), technological advancements in remote monitoring technologies, and increasing product approvals in developed economies. According to British Heart Foundation, the prevalence of heart & circulatory disease globally was 620 million in 2021, of which atrial fibrillation had a share of approximately 10%.

市场上流行有积极的影响。According to an article by the European Society of Cardiology, mobile-based home electrocardiogram (ECG) monitoring systems enabled healthcare professionals to identify disease-related cardiac complications & ECG alterations in non-hospitalized COVID-19 patients. Moreover, patch-based monitoring systems gained FDA approval for inpatient monitoring of COVID-19 patients owing to a high prevalence of cardiovascular complications such as arrhythmias in hospitalized patients. In addition, the pandemic accelerated the demand fortelehealth& virtual healthcare solutions, as patients had limited access to care facilities, which further boosted the market growth.

The advancements in remote patient monitoring technology are expected to boost the market. A growing number of industry players are entering into strategic alliances such as funding and collaboration to develop vendor-neutral cardiac data management platforms, which allows the company to monitor medical information from implantable cardiac monitors (ICM), wearable devices, consumer ECG devices, and others.

In addition, the introduction ofartificial intelligence平台集成了电子健康(AI)records and identifies urgent patient reports and heart rhythm criticality. For instance, in July 2023, PaceMate, a remote cardiac monitoring service provider, received investment from Lead Edge Capital to alleviate the former company’s cardiac solutions and demographic reach. Such developments are expected to drive the market during the forecast period.

The growing prevalence of cardiovascular diseases and the increasing geriatric population susceptible to such diseases is expected to boost the market. According to American Heart Association, the age-adjusted prevalence of cardiovascular disease (CVD) was 7,354.1 per 100,000 population across the globe in 2020. Moreover, a similar source stated that more than two-thirds of the geriatric population is suspected of developing cardiovascular disease. According to Frontiers Media S.A. article, the prevalence ofatrial fibrillation(AFib) increases with aging. As per a similar source, the prevalence of AFib in people aged 49 or below is 0.12% to 0.16%; however, in those aged 60 or above, the prevalence of AFib is estimated at 3.7% to 4.2%.

Type Insights

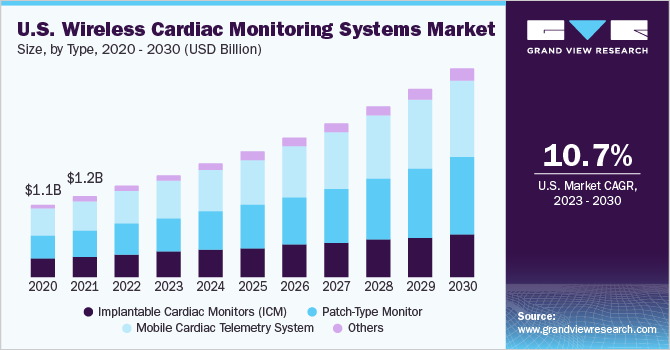

基于类型,市场划分为implantable cardiac monitors (ICM), patch-type monitors, mobile cardiac telemetry system, and others. Mobile cardiac telemetry systems dominated the market with a revenue share of 35.78% in 2022. These systems continuously monitor cardiac activities, improving diagnosis and patient compliance. In addition, medical professionals are actively integratingtelemedicineinto general practices, which allows them to analyze long-term patient heart rhythm activities and deliver patient-centric solutions via mobile cardiac telemetry.

The patch-type monitor segment is estimated to be the fastest-growing, with a CAGR of 13.2% during the forecast period. Patch-type monitors are non-invasive and are attached to the patient’s skin using adhesives. In addition, these devices are more discreet and convenient than traditional holter devices. A growing player participation in this category is expected to drive the growth of wireless cardiac monitoring systems growth. For instance, in October 2022, Turtle Shell Technologies Pvt Ltd announced to launch an ECG patch, which will allow healthcare professionals to identify early signs of cardiac disease or conditions to improve patient safety.

End-Use Insights

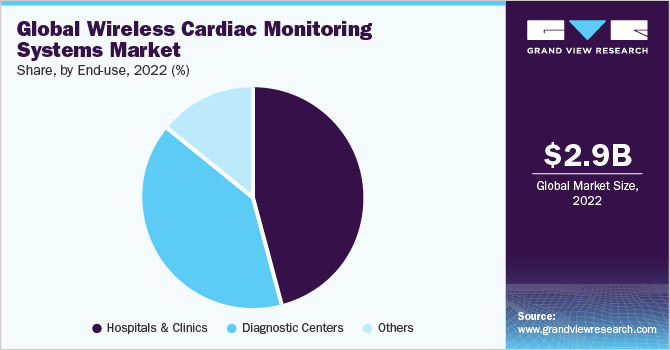

Based on end-use, the market is segmented into hospitals & clinics, diagnostic centers, and others. Hospitals & clinics dominated the market with a revenue share of 45.8% in 2022. The share is due to the hospital and clinic’s ability to manage patients who often require continuous cardiac monitoring due to their critical conditions. Moreover, these healthcare providers are equipped with nuanced medical equipment and specialized staff that facilitates the usage and diagnosis of wireless cardiac monitoring systems.

However, the diagnostic centers segment is estimated to be the fastest-growing, with a CAGR of 13.0% during the forecast period. The growing focus on outsourcing monitoring activities to independent facilities aids segment growth. For example, independent diagnostic testing facilities (IDTF) are specialized facilities with expertise in diagnostic testing, including cardiac monitoring. In addition, these facilities are increasing their collaboration with healthcare providers, further strengthening their growth. For instance, in December 2021, AliveCor, Inc. launched AliveCor Labs, an IDTF, to facilitate U.S. healthcare providers to access improved cardiac monitoring services.

Regional Insights

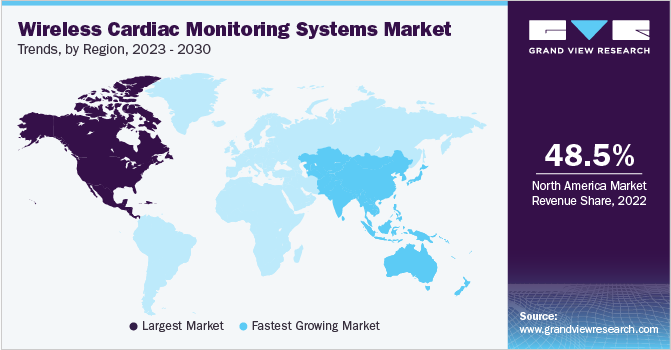

North America dominated the global wireless cardiac monitoring systems market and accounted for 48.53% of the total market share in 2022. The share is attributed to the advanced healthcare infrastructure, high prevalence of cardiovascular diseases, rapid technological advancements, high healthcare expenditure, and a growing geriatric population. According to Rural Health Information Hub, the geriatric population in the U.S. is expected to increase by 18 million between 2020-2030. Moreover, a similar source stated that 90% of adults over 65 develop one or more chronic conditions.

Asia-Pacific is expected to witness the fastest CAGR of 13.5% over the forecast period. The growth can be attributed to the increasing product approvals in countries such as China and Japan. For instance, in January 2020, Biotronik SE & Co. KG launched its implantable cardiac monitor (ICM), BioMonitor III, in Japan to help healthcare professionals identify underlying arrhythmia. Similarly, in October 2021, Shanghai Chest Hospital launched ICM to improve ECG monitoring & symptom correlation for Chinese patients. Such developments are expected to drive the growth of the market during the forecast period.

Key Companies & Market Share Insights

The market is highly competitive, with a large number of manufacturers, the market players are focusing on various strategic initiatives such as new product launches, geographical expansion, mergers and acquisitions, collaboration, product upgradation, and partnerships. For instance, in May 2023, VivaLNK, Inc. launched an updated multi-parameter wearable ECG patch. The product is expected to provide continuous 14-day live stream capabilities, which improve patient comfort and reduces the clinic’s administrative tasks. The following are some of the key manufacturers in the global wireless cardiac monitoring systems market:

Koninklijke Philips N.V.

Abbott

Medtronic

Biotronik SE & Co. KG

Boston Scientific Corporation

Asahi Kasei Corporation.

iRhythm Technologies, Inc.

Avertix Medical, Inc.

Baxter International Inc.

OSI Systems, Inc. (Spacelabs Healthcare)

Wireless Cardiac Monitoring Systems MarketReport Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 3.34 billion |

Revenue forecast in 2030 |

USD 7.12 billion |

Growth rate |

CAGR of 11.4% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Type, end-use, region |

Regional scope |

北美;欧洲;亚太地区;拉丁美洲; MEA |

Country scope |

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

Key companies profiled |

Koninklijke Philips N.V., Abbott, Medtronic, Biotronik SE & Co. KG, Boston Scientific Corporation, Asahi Kasei Corporation., iRhythm Technologies, Inc., Avertix Medical, Inc., OSI Systems, Inc. (Spacelabs Healthcare), Baxter International Inc. |

Customization scope |

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Wireless Cardiac Monitoring Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global wireless cardiac monitoring systems market on the basis of type, end-use and region:

Type (Revenue in USD Billion, 2018 - 2030)

Implantable Cardiac Monitors (ICM)

Patch-Type Monitor

Mobile Cardiac Telemetry System

Others

End-use (Revenue in USD Billion, 2018 - 2030)

Hospitals & Clinics

Diagnostic Centers

Others

Regional Outlook (Revenue in USD Billion 2018 - 2030)

North America

U.S.

Canada

Europe

U.K.

Germany

France

Italy

Spain

Sweden

Norway

Denmark

Asia Pacific

China

Japan

India

Australia

Thailand

South Korea

拉丁美洲

Brazil

Mexico

Argentina

Middle East and Africa

Saudi Arabia

South Africa

UAE

Kuwait

Frequently Asked Questions About This Report

b.The global Wireless Cardiac Monitoring Systems market size was estimated at USD 2.98 billion in 2022 and is expected to reach USD 3.34 billion in 2023

b.The global Wireless Cardiac Monitoring Systems market is expected to grow at a compound annual growth rate of 11.4% from 2023 to 2030 to reach USD 7.12 billion by 2030

b.North America dominated the global wireless cardiac monitoring systems market and accounted for 48.53% of the total market share in 2022. The share is attributed to the advanced healthcare infrastructure, high prevalence of cardiovascular diseases, rapid technological advancements, high healthcare expenditure, and a growing geriatric population

b.Some prominent players in the Wireless Cardiac Monitoring Systems market are- Koninklijke Philips N.V., Abbott, Medtronic, Biotronik SE & Co. KG, Boston Scientific Corporation, Asahi Kasei Corporation., iRhythm Technologies, Inc., Avertix Medical, Inc., OSI Systems, Inc. (Spacelabs Healthcare), and Baxter International Inc.

b.The Wireless Cardiac Monitoring Systems market is expected to grow due to several factors, such as a growing geriatric population susceptible to cardiovascular diseases (CVDs), technological advancements in remote monitoring technologies, and increasing product approvals in developed economies.