Wood Pallets Market Size, Share & Trends Analysis Report By Product Type (Stringer Wooden Pallet, Block Wooden Pallet), By Wood Type (Softwood, Hardwood), By End-use (Chemicals, F&B), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-137-6

- Number of Pages: 160

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Bulk Chemicals

Wood Pallets Market Size & Trends

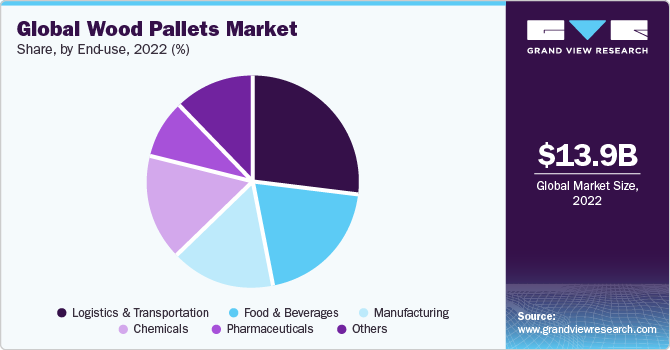

Theglobal wood pallets market size was estimated at USD 13.90 billion in 2022and is expected to grow at a compound annual growth rate(CAGR) of 4.5% from 2023 to 2030. The expansion of global trade drives the need for efficient and standardized logistics processes and equipment. Wooden pallets are used in the supply chain sector to facilitate the movement and storage of goods across borders. The growth of global trade is expected to contribute to the growth of the market. Wooden pallets are known for their strength and durability. They are used to support heavy loads and withstand rough handling and transportation conditions. This durability can result in a longer lifespan for wooden pallets. Furthermore, their easy reparability and the growing demand for reusable packaging components are expected to contribute to global market growth.

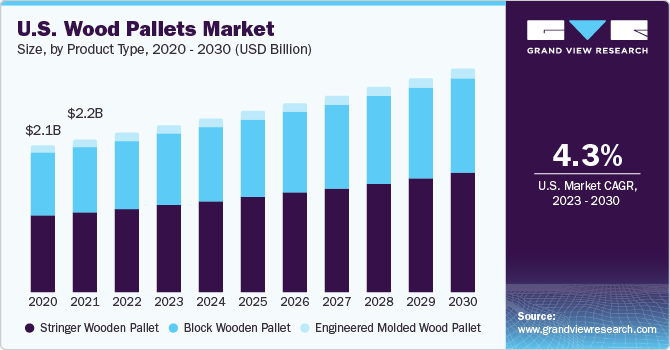

在美国市场的增长预计to be fueled by the rising demand in warehousing, logistics, food & beverage, and manufacturing industries. The growinge-commercesector in the U.S. is fueling the construction of warehouses in the country. In addition, warehouse usage is not limited to the e-commerce sector and is also being influenced by the growth of other end-use industries. For instance, in August 2023, a leading U.S. renewable energy company, Orion Energy, announced to invest USD 750.0 million to construct a new warehouse facility. Wooden pallets fall under the essential equipment required in warehouses. The growing warehouse construction can positively influence the market in the country.

According to The World Bank Group, the gross domestic product (GDP) in the U.S. is witnessing an upward trend from 2013 to 2022. Although the GDP contracted in 2020 due to the COVID-19 pandemic, the rebound in GDP recovery in 2021 showed strong growth. Also, the U.S. economy remained resilient in the first half of 2023 despite economic risks and uncertainties, including further interest rate hikes and a series of bank failures. The resilient economy predicts good consumer spending power, which can drive the production of end-use industries and fuel their logistics & inventory rollout. This, in turn, can positively drive the product demand for shipping the goods.

Wood Type Insights

The softwood segment dominated the market in 2022 and accounted for the largest share of over 60.0% of the overall revenue. Softwood comes from needle-bearing tree coniferous tree species. Mostly pine wood is used as softwood for the manufacturing of wood pallets. Softwood is easily available compared to hardwood and economical compared to hardwood pallet types, which drives its demand. Furthermore, softwood material-based pallets are lightweight, which helps reduce their weight during transportation. Softwood boards can mimic higher-density hardwood with thicker dimensions, which positions their durability slightly below that of hardwood types.

The hardwood-based pallets are used for higher load-bearing capacities and are valued at higher prices. Hardwood comes from walnut trees, hickory trees, beech trees, maple trees, and oak trees. The hardwood material is used in other industries, such as furniture, and its penetration in pallets manufacturing is less than that of softwood. Sometimes combination of hardwood and softwood is also preferred to develop wood pallets.

Product Type Insights

Block wooden pallets are traditionally manufactured from softwood. Block wooden pallets dominated the product type segment and accounted for over 54.0% share of the overall revenue in 2022. The high market share is attributed to the features exhibited by the block wood pallets, which include offering uniform support for loads, easy cleaning, etc. compared to stringer wood pallets.

Stringer wood pallets use stringers to support the unit load. Stringers are sandwiched between the bottom and top deck boards. Stringer pallets are made from hardwood, which makes the sourcing of raw materials expensive compared to block wood pallets. The stringer wood pallets are also known as two-way pallets, meaning that a pallet jack can access them on two sides.

End-use Insights

The transportation and logistics end-use segment dominated the market with a share of over 26.0% in 2022. Wood pallets form a critical part of the supply chain of any business. Wood pallets are vital equipment in the logistics & transportation industry. Wood pallets act as a cushion to forces during transportation and protect items against breakage. In the food & beverage industry, the wood pallets that are used for transporting food & beverage products are kiln-dried. This process is done to dry the wood completely and prevent mold. Furthermore, the wood pallets are also sanitized through this heat treatment process to restrain the growth of microbes and bacteria.

The food & beverage industry demands stringent compliance to prevent contamination of food products. Hence, kiln-dried wood pallets are used during the transportation of fruits and vegetable crates in large quantities. The growth of wood pallets in the pharmaceutical industry is significantly less compared to other sectors. The refurbished wood pallets have to undergo chemical treatment to prevent cross-contamination. The wood pallets are subjected to the ISPM-15 process, wherein the wood is heated to temperatures at which potential pest infestation is eliminated. Theplastic palletsare resistant to chemicals, moisture, and mold growth, which significantly affects the wood pallet penetration in the pharmaceutical industry.

Regional Insights

North America dominated the market and accounted for a revenue share of over 31.0% in 2022. The high market share is attributed to the presence of tree species, such as western hemlock, southern yellow pine, eastern white pine, and Douglas fir among others. This makes the sourcing of raw materials convenient for the wood pallet manufacturers. Furthermore, the growing emphasis on sustainable packaging solutions in North America is also contributing to the market growth since they are viewed as a more sustainable option compared to plastic pallets due to their biodegradability and recyclability. The U.S. has a strong trade partnership with Canada.

The geographical proximity, language, similar lifestyle pursuits, and common culture have significantly driven the agricultural and other food & beverage exports from the U.S. to Canada. According to the International Trade Administration, agricultural exports from the U.S. to Canada totaled USD 25.0 billion in 2021. Also, the agricultural imports in the U.S. from Canada were around USD 31.0 billion in 2021. Under the United States-Mexico-Canada Agreement (USMCA) agricultural products are exempted from customs duty, which supports the growing trade between the countries. The growing import exports thus can drive the demand for wood pallets used for shipping these products.

The market in Asia Pacific is in the development and growth stage. Increasing industrialization in the Asia Pacific and the growth of the manufacturing sector in the region are expected to contribute to the growth of wood pallets in the region. Wood pallets enable the organized movement of goods within warehouses and factories. The growth of the manufacturing sector presents a positive market outlook for the wood pallets demand in the Asia Pacific region. China holds a dominant position in the Asia Pacific region in terms of manufacturing capacity. Most of the major companies from various end-use industries in Europe import products from China and have outsourced their production.

This drives the export and import trade and can positively influence the market in China. The Middle East & Africa region has a strong oil & gas sector. The lubricants and other chemicals derived from oil & gas are used in automotive and other end-use industries. The region has become a major producer of Group III base oil and API Group II base oil and exports these to Western Europe, North America, and India. The chemicals are usually shipped in barrels and these barrels are placed on wood pallets to provide a uniform base and ease material handling operations. The growing demand for lubricants and greases can propel the market growth.

Key Companies & Market Share Insights

The market exhibits the presence of a large number of players, most of which operate through North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa. In an attempt to augment their revenue and increase their market share companies engage in product customization in terms of material composition of wood pallets. Most of the players engage in mergers and acquisitions to expand their market reach. For instance, in July 2023, South Carolina-based EP Group acquired Morgan Wood Products, an Ohio-based wood pallet manufacturer. Some of the prominent players in the global wood pallets market include:

Kronus Ltd.

Kamps Inc.

UFP Industries, Inc.

Treyer Paletten GmbH

CHEP

Mid-Cork Pallets & Packaging

Hazelhill Timber Products

SAS GROUP

The Nelson Company

PECO Pallet

Hi-Tech Innovations

M/s Jay Wood Industry

NEFAB Group

LEAP

Palette Deutschland

Hangzhou Penno Packtech Co., Ltd.

Renqiu Hongfei Wood Industry Co., Ltd

SATO Holdings Corp.

PalettenWerk

Archimbaud Group

Wood Pallets MarketReport Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 14.62 billion |

Revenue forecast in 2030 |

USD 19.89 billion |

Growth rate |

4.5% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD billion and CAGR of 4.5% from 2023 to 2030 |

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

Segments covered |

Wood type, product type, end-use, region |

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Australia; Southeast Asia; Brazil; Saudi Arabia; United Arab Emirates; South Africa |

Key companies profiled |

Kronus Ltd.; Kamps Inc.; UFP Industries, Inc.; Treyer Paletten GmbH; CHEP; Mid Cork Pallets & Packaging; Hazelhill Timber Products; SAS Group; The Nelson Company; Peco Pallet; Hi-Tech Innovations; M/s Jay Wood Industry; NEFAB Group; LEAP; Palette Deutschland; Hangzhou Penno Packtech Co., Ltd.; Renqiu Hongfei Wood Industry Co., Ltd; SATO Company; PalettenWerk; Archimbaud Group |

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

GlobalWood Pallets MarketReport Segmentation

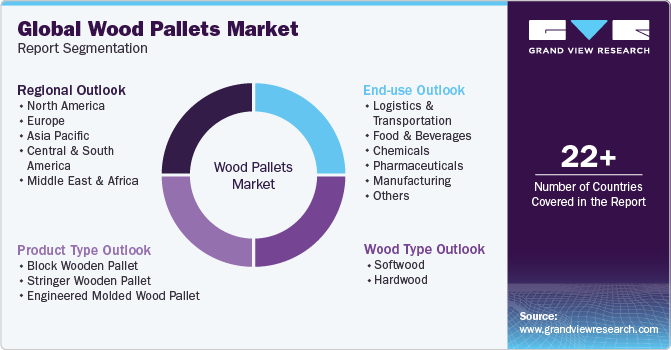

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the wood pallets market report on the basis of wood type, product type, end-use, and region:

Wood Type Outlook (Revenue, USD Billion, 2018 - 2030)

Softwood

Hardwood

Product Type Outlook (Revenue, USD Billion, 2018 - 2030)

块木Pallet

Stringer Wooden Pallet

Engineered Molded Wood Pallet

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

Logistics & Transportation

Food & Beverages

Chemicals

Pharmaceuticals

Manufacturing

Others

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

North America

U.S.

Canada

Mexico

Europe

Germany

France

UK

Italy

Spain

Asia Pacific

China

India

Japan

Australia

Southeast Asia

Central & South America

Brazil

Middle East & Africa

Saudi Arabia

United Arab Emirates

South Africa

Frequently Asked Questions About This Report

b.The global wood pallets market was valued at USD 13.90 billion in the year 2022 and is expected to reach USD 14.62 billion in 2023

b.The global wood pallets market is expected to grow at a compound annual growth rate of 4.5% from 2023 to 2030 to reach USD 19.89 billion by 2030.

b.产品类型segmen块木托盘t accounted for the largest market share of over 54.0% of the wood pallets market for the base year 2022. This is attributed to the features exhibited by the block wood pallets which include offering uniform support for loads, easy to clean, and easy to pick up compared to stringer wood pallets.

b.Some of the key players operating in the wooded pallets market include Kronus LTD, Kamps Inc., UFP Industries, Inc., TREYER PALETTEN GMBH, CHEP, Mid Cork Pallets & Packaging, Hazelhill Timber Products, and SAS GROUP

b.The growth of global trade and the rise in consumerism of food & beverage products are expected to drive the wood pallets market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."