Wound Contact Layer Dressing Market Size, Share, & Trends Analysis Report By Product (Antimicrobial, Non-antimicrobial), By End-use (Hospital, Outpatient, Home healthcare), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-121-9

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Healthcare

Report Overview

The globalwound contact layer dressing market sizewas valued atUSD 376.39 million in 2022and is projected to grow at a CAGR of 12.8% during the forecast period. The market is primarily driven by factors such as the rising number of chronic diseases and conditions impacting wound healing capabilities and the rising number of accidents requiring effective healing methods. Growing focus on the development of composite dressings, increasing investments in emerging economies, and rapid technological development of wound dressings offer significant growth opportunities for the market.

Wound contact layer dressings incorporate advanced materials such assilicone和水凝胶。这些材料是旨在achieve better adhesion to the wound while not adhering to the wound bed. In addition, some dressings included technologies such as perforations or microstructures that improved moisture management and wound healing. The COVID-19 pandemic led to an increased focus on infection control in healthcare settings. This has led to a greater demand for products that reduce the risk of infection, such as antimicrobial dressings and topical agents. Some wound care companies have pivoted to meet this demand by developing new products that address infection control. The outbreak of COVID-19 has created large-scale opportunities for local manufacturers. Furthermore, as a result of limitations on international border crossings affecting the movement of major market players, disruptions occurred within their supply chains. Consequently, this situation provided a window of opportunity for local entrants to enter the market and fulfill the previously unaddressed demands of end users.

One of the key drivers propelling the demand for wound contact layer dressings is the increasing prevalence of chronic diseases and conditions that hinder the body's ability to heal wounds effectively. Both chronic wounds and surgical wounds exert a harmful influence on the process of wound recovery. Factors such as the expanding elderly demographic, the growing incidence of traumatic wounds, the rising number of surgical procedures, and the increasing occurrence of illnesses like obesity and diabetes collectively contribute to the growing frequency of chronic wounds. For instance, as per the International Diabetes Federation (IDF) Spain exhibits a diabetes prevalence rate of 14.80%, which translates to a significant count of 5,141,300 individuals solely within the nation.

Furthermore, the increasing incidence of obesity stands as another pivotal catalyst for potential market expansion, owing to its correlation with chronic wounds and the need for lower extremity amputations. Individuals affected by obesity face an elevated susceptibility to pressure ulcers due to diminished vascular activity within adipose tissue. The inability of these patients to reposition themselves effectively while lying down sets the stage for pressure-related injuries. Additionally, the presence of skin folds on their bodies creates an ideal environment for the proliferation of microorganisms. Consequently, ulcers emerge as a result of the breakdown of skin triggered by these microorganisms. As a result, this factor is expected to stimulate demand for such products, consequently driving market growth.

Furthermore, countries such as the U.S. and Canada have seen an increase in hospital admissions in recent years due to the high prevalence of chronic medical diseases & fatal injuries. According to the CDC, chronic diseases are the leading cause of disability and mortality. In the U.S., 4 out of 10 adults have two or more chronic diseases, and 6 out of 10 adults have a chronic disease.

Product Insights

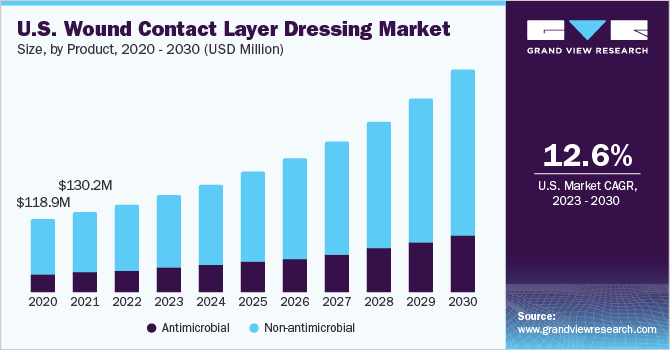

The non-antimicrobial wound contact layer dressing segment accounted for the largest market share, with 75.28% in 2022. These dressings provide protection, promote wound healing, and maintain moisture balance while avoiding using substances that directly target microbial growth. By reducing pain during dressing changes and maintaining an optimal healing environment, these dressings can improve the overall experience for patients.

The antimicrobial segment is projected to grow at the highest CAGR of 13.73% during the forecast period. These types of dressing covers are employed to modify the level of microorganisms present in the wound bed. Antimicrobial wound dressings find significant application in managing both partial and full-thickness wounds, including surgical incisions and percutaneous line sites. These particular products are accessible in various forms, such as nylon fabric, island dressings, film dressings, sponges, impregnated woven gauzes, or combinations of diverse materials.

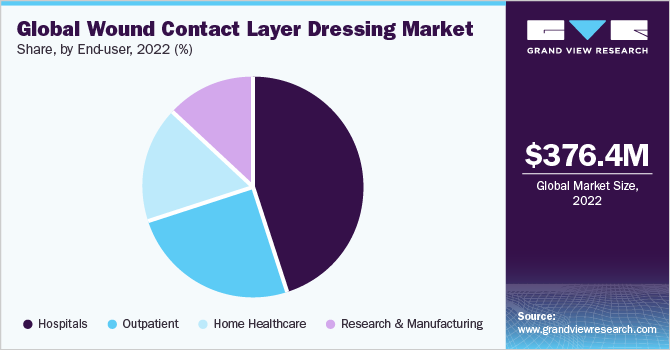

End-use Insights

The hospital segment dominated the market with a 45.21% market share in 2022. This dominance can be attributed to the rising demand for advanced medical facilities, considerable technological advancements in emerging economies, and rising healthcare expenditure in developing economies. Hospitals use wound dressings to treat a variety of wounds, including surgical wounds, burns, pressure ulcers, and diabetic foot ulcers. The demand for wound dressings in hospitals is driven by factors such as the growing incidence of chronic wounds, an increase in the number of surgeries, and a rise in the aging population. For instance, according to the Australian Institute of Health and Welfare, the number of hospitalizations in Australia has increased. For instance, in 2019 - 2020, 11.1 million people were hospitalized in Australia, of which 6.7 million were hospitalized in public hospitals, whereas 4.4 million were in private hospitals.

The home healthcare segment is projected to grow at the fastest CAGR of 13.5% during the forecast period. As the population ages, there is an increasing demand for home healthcare services, including wound care. Older adults are more prone to chronic wounds, such as pressure ulcers, diabetic foot ulcers, and venous leg ulcers, which require ongoing care and attention. With the rising cost of healthcare, there is a growing emphasis on cost-effectiveness in wound care. Home healthcare services are often more cost-effective than inpatient care, making them an attractive option for patients, insurers, and healthcare providers.

Regional Insights

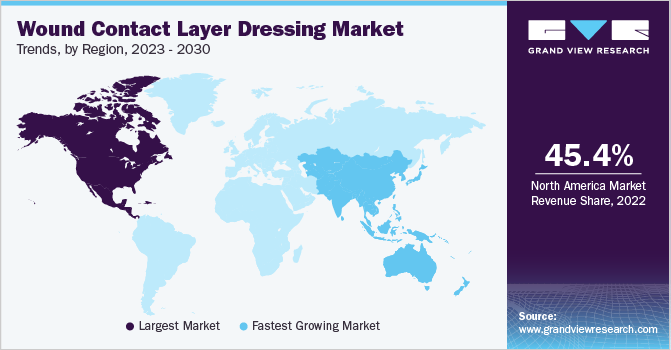

在2022年北美主导市场revenue share of 45.44%. The market is expected to demonstrate a moderate growth rate, which can be attributed to the presence of reimbursement policies and various awareness campaigns led by several organizations. The well-developed healthcare system and public awareness are major advantages for the healthcare system in North America.

Asia Pacific is projected to impel at the fastest growth rate of 13.45% over the forecast period. This can be attributed to various factors, such as the growing geriatric population, increasing medical tourism, and the rising number of populations suffering from various chronic & acute wounds. Moreover, with the presence of rapidly developing countries such as China & India, the wound contact layer dressing market is expected to grow in the coming years.

Key Companies & Market Share Insights

Some of the major players contributing to the market are Hollister Incorporated, 3M, Cardinal Health, Advanced Medical Solutions Limited, Avery Dennison Corporation, Elkem ASA, Paul Hartmann Limited, BSN Medical, Medline Industries, Inc., Smith + Nephew, and Molnlycke Health Care AB. New product launches, acquisitions, geographical expansions, product approvals and product innovation are the major strategies the market players adopt to retain their market share. For instance, in April 2021, Mölnlycke expanded in Malaysia with the construction of a new factory. This would help the company establish itself in the Malaysian market. Some of the prominent players in the wound contact layer dressing market include:

Hollister Incorporated

3M

Cardinal Health

Advanced Medical Solutions Limited

Avery Dennison Corporation

Elkem ASA

Paul Hartmann Limited

BSN Medical

Medline Industries, Inc.

Smith + Nephew

Molnlycke Health Care AB.

Wound Contact Layer Dressing MarketReport Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 415.98 million |

Revenue forecast in 2030 |

USD 964.19 million |

Growth rate |

CAGR of 12.8% from 2023 to 2030 |

Base year for estimation |

2022 |

Actual estimates/Historic data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD & CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, competitive landscape, growth factors & trends |

Segments covered |

Product, end-use, region |

Regional scope |

北美;欧洲;亚太地区;拉丁美洲; MEA |

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait. |

Key companies profiled |

Hollister Incorporated; 3M; Cardinal Health; Advanced Medical Solutions Limited; Avery Dennison Corporation; Elkem ASA; Paul Hartmann Limited; BSN Medical; Medline Industries, Inc.; Smith + Nephew; Molnlycke Health Care AB. |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Wound Contact Layer Dressing MarketReport Segmentation

This report forecasts revenue growth at global, regional, & country levels as well as provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global wound contact layer dressing market report on the basis of product, application, end use and region.

ProductOutlook (Revenue, USD Million, 2018 - 2030)

Antimicrobial

Non-antimicrobial

End-use Outlook (Revenue, USD Million, 2018 - 2030)

Hospitals

Outpatients

Home Healthcare

Research & Manufacturing

Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

Europe

UK

Germany

France

Italy

Spain

Denmark

Sweden

Norway

Asia Pacific

China

Japan

India

Australia

South Korea

Thailand

拉丁美洲

Brazil

Mexico

Argentina

Middle East & Africa

South Africa

Saudi Arabia

UAE

Kuwait

Frequently Asked Questions About This Report

b.The wound contact layer dressing market size was estimated at USD 376.39 Million in 2022 and is expected to reach USD 415.98 Million in 2023.

b.The wound contact layer dressing market is expected to grow at a compound annual growth rate of 12.8% from 2023 to 2030 to reach USD 964.19 Million by 2030.

b.The non-antimicrobial wound contact layer dressing segment dominated the wound contact layer dressing market with a share of 75.28% in 2022. This is attributable to benefits of this dressing such as protection, promote wound healing, and maintain moisture balance while avoiding using substances that directly target microbial growth

b.一些关键球员在伤口接触yer dressing market include Hollister Incorporated, 3M, Cardinal Health, Advanced Medical Solutions Limited, Avery Dennison Corporation, Elkem ASA, Paul Hartmann Limited, BSN Medical, Medline Industries, Inc., Smith + Nephew, and Molnlycke Health Care AB

b.Key factors driving the wound contact layer dressing market growth include a rising number of chronic diseases and conditions impacting wound healing capabilities and the rising number of accidents requiring effective healing methods