Customer Self-service Software Market Size, Share & Trends Analysis Report By Solution (Web Self-service, Social Media & Community Self-service), By Service, By Deployment, By End-use, By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68039-225-9

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry:Technology

Report Overview

The global customer self-service software market size was valued at USD 7.12 billion in 2019 and is expected to expand at a compound annual growth rate (CAGR) of 22.1% from 2020 to 2027. The strong emphasis organizations are putting on delivering instant information as part of the efforts to increase productivity and operating efficiency is anticipated to drive the growth of the market. The eminent need to develop better relationships with customers and enhance the level of customer experience to retain the existing customers and attract new ones is also expected to contribute to the growth. The growing demand from customers for efficient services through multiple touchpoints, such as smartphones and the internet, is particularly expected to prompt enterprises to adopt self-service portals.

Organizations are aggressively deploying customer self-services software to strengthen their reach to the customers and offer them support on a 24x7 basis. Customer self-service software solutions allow enterprises to cater to the changing requirements of their customers efficiently, thereby raising the level of customer satisfaction and contributing to customer retention. Apart from managing customer relationships, customer self-service software can also help organizations in managing employee relationships, which means enterprises can potentially save on the costs incurred on procuring separate software forcustomer relationship management和员工关系管理。这些都是如此me of the major factors that are expected to drive the growth of the market over the forecast period.

Several other factors are driving the demand for customer self-service software. Organizations are increasingly outsourcing their client services to multiple contact centers. The growing reliance on a human interface and the subsequent high costs are adding to the organizations’ expenses while also adversely affecting the client service quality. Hence, organizations are looking for effective solutions, such as customer self-service software, which can potentially help simultaneously in reducing the customer churn rate and avoiding any excessive costs. The rising demand from individuals for relevant and up-to-date information is equally prompting organizations to integrate customer self-service software into their employee relationship management and Customer Relationship Management (CRM) platforms.

The software is designed to allow customers to obtain responses to their queries through an automated interview. Such an approach helps in enhancing the level of user experience and ensuring an efficient service as compared to the conventional search-based approach. Self-service solutions are typically developed with a user-centric platform approach so that users can access data from anywhere and anytime is anticipated to boost the market growth. On the other hand, most of the small and medium-sized organizations are trying hard to cut down the contact center expenses. Customer self-service software can potentially help these organizations in curbing these expenses while focusing on increasing the profit margins.

However, a looming lack of awareness among customers and hesitation among employees toward the adoption of self-service software is anticipated to restrain the growth of the market to a certain extent. Vendors of self-service solutions often rely on various third parties to provide data hosting services to their clients, which means any interruptions in these services could affect the operations of the organizations using the self-service solutions. Enterprises also deliberate before investing in self-service solutions as any potential security breaches in the information systems and servers of their third-party service providers, which can put the confidential data of their customers at risk. The economic downturn stemming from the outbreak of the COVID-19 pandemic is expected to induce a strategic change in enterprises’ buying criteria, as companies have started prioritizing business stability while making new investments rather than investing in new solutions and services. This is also expected to restrain the growth of the market over the forecast period.

Solution Insights

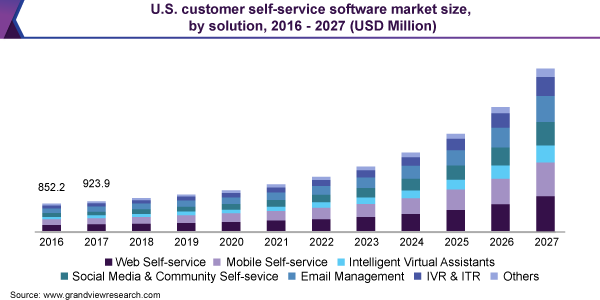

The web self-service segment dominated the market in 2019 with a market share of over 20%. Based on solutions, the market has been further segmented into mobile self-service, web self-service, social media and community self-service, email management,intelligent virtual assistants, IVR & ITR, and others. The growing demand for digital support mechanisms that can allow employees and consumers to self-assist themselves by providing relevant inputs and performing routine tasks over the internet is anticipated to drive the demand for web self-service solutions over the forecast period. Web self-service solutions ensure a seamless service experience for customers across various channels of information.

The social media and community self-service segment is anticipated to register significant growth over the forecast period. The rising smartphone penetration and the continued rollout of high-speed internet networks coupled with the rising preference of individuals to approach social media channels for obtaining information are expected to drive the growth of the social media and community self-service segment. Organizations across the globe are undergoing a digital transformation and are hence widening the scope of their client service interactions to include digital channels, such as social media, virtual assistants, and chat. The worksite restrictions and remote working arrangements being imposed to arrest the outbreak of the COVID-19 pandemic is also driving the adoption of social media and community self-service solutions as they allow both employees and customers of organizations to connect via social media channels and conveniently access the information they require.

Service Insights

The professional services segment dominated the market in 2019 with a market share of over 60%. Growing adoption of analytics andArtificial Intelligence(AI)自动化提高效率的e workforce is anticipated to drive the demand for professional services. Professional services can ease the deployment and configuration of self-service solutions for both cloud and on-premise deployment. The growing demand from clienteles for capabilities, such as project and program management and process excellence, to help the end-users in maximizing their return on investment is anticipated to drive the demand for professional services over the forecast period. Based on service, the market has been further segmented into managed services and professionals.

专业服务可以帮助clienteles in ensuring that their project stays on track and focusing on the business outcomes, and subsequently in enhancing operational efficiency. Market players are particularly putting a strong emphasis on offering professional services and helping their clientele in addressing their pre- and post-purchase queries regarding self-service solutions. For instance, Verint Systems, Inc. offers the AdviceLine service to its clientele. The service is designed to provide customers with quick guidance on the implementation of the solution and back-office operations.

Deployment Insights

The cloud segment dominated the market in 2019 with a market share of over 54%. Organizations are focus on modernizing their customer engagement operations by adopting cloud-based architectures that can facilitate the sharing of data across various functions. Organizations are particularly under pressure to accommodate the sudden rise in call volumes amid the outbreak of the COVID-19 pandemic and are hence deploying AI-based virtual agents to assist their clients. Cloud-based virtual agents can potentially handle the same intents as human agents, deliver a conversational experience, offer instant and on-demand services, and provide automated support.

The on-premise deployment segment is anticipated to register considerable growth over the forecast period. On-premise deployment offers various benefits, such as easy customization of software according to the clients’ business processes. The on-premise deployment also offers the ability to custom code the in-house operations and guarantee complete control and ownership to the customer. However, delays in making a purchase decision for self-service software, mainly due to the time required to make on-premise arrangements, coupled with the curbs enterprises are putting on their spending in response to the economic downturn stemming from the outbreak of the COVID-19 pandemic are expected to restrain the growth of the on-premise segment to a certain extent.

End-use Insights

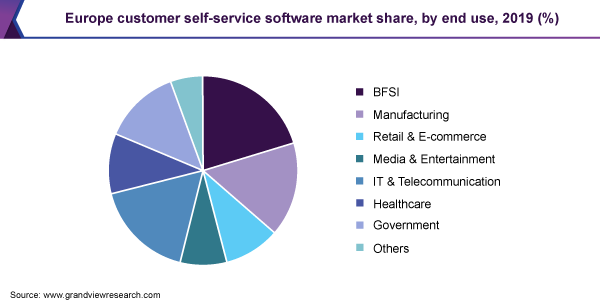

The BFSI segment dominated the market in 2019 with a market share of over 20%. While the number of fintech startups shown no signs of abating, customers are also gradually developing a digital mindset, which is contributing significantly to the digitalization of banking systems worldwide. The adoption of self-service solutions as part of the digital banking strategies for managing finances is anticipated to drive the growth of the BFSI segment. Based on end-use, the market has been further segmented into manufacturing, BFSI, retail & e-commerce, media & entertainment, IT and telecommunication, healthcare, government, and others.

等自助服务平台,不断上升的需求as ATMs, vending machines, and kiosks from financial institutions is driving the demand for self-service software and is subsequently opening opportunities for both established and new entrants. Financial institutions are confronting a rapid change in the industry landscape in line with the continued introduction of the latest consumer technologies designed to help people in saving and investing money. The growing preference for digital financial transactions and smart and high-touch customer services coupled with the companies’ focus on developing self-service solutions that can cater to all such requirements are anticipated to drive the growth of the BFSI segment. For instance, in May 2019, Salesforce.Com, Inc., announced Einstein Analytics, a customizable analytics solution that offers AI-enabled business intelligence for retail bankers and wealth advisors.

Regional Insights

North America dominated the customer self-service software market in 2019 with a revenue share of over 32%. The region is home to major software vendors, such as Verint Systems, Inc.; Microsoft Corporation; Avaya Inc.; Salesforce.Com, Inc.; and Nuance Communications, Inc. The growing popularity of social media channels and the rising demand for cloud-based deployment of self-service solutions is particularly driving the growth of the regional market. Various benefits, such as real-time access to the information, associated with software solutions, are expected to open opportunities in the regional market.

The strong emphasis enterprises in North America are putting on making timely and informed business decisions by accessing information in real-time is expected to drive the demand for self-service solutions in the region. As a result of the outbreak of the COVID-19 pandemic, the overall call volumes at the contact centers have been rising significantly. Contact centers in the region are responding to the situation by deploying AI-based and machine learning-based self-service software to ensure automated support for their customers. This is expected to open significant opportunities for the market players in the region.

Key Companies & Market Share Insights

Market players are pursuing various growth strategies, including mergers & acquisitions, strategic agreements and collaborations, and new product development, to stay competitive in the market. For instance, in August 2019, Salesforce.Com, Inc. acquired Tableau Software, Inc., a provider of self-service analytics platforms. The acquisition would allow Salesforce.Com, Inc. to expand its offerings in the self-service market. Before that, in January 2019, SAP SE completed the acquisition of Qualtrics International Inc., a provider of experience management software. SAP SE envisages leveraging the acquisition to deliver employee, customer, and brand experiences to businesses.

Market vendors are investing aggressively in research and development activities to develop new technologies and to upgrade the existing offerings. For instance, Avaya Inc. invested USD 204 million in research and development activities in 2019 to design flexible and secure, cloud- and mobile-enabled solutions. Some prominent players in the global customer self-service software market include:

Avaya Inc.

BMC Software, Inc.

HappyFox Inc.

Microsoft Corporation

Nuance Communications, Inc.

Oracle Corporation

Salesforce.Com, Inc.

SAP SE

Verint Systems, Inc.

Zendesk, Inc.

Customer Self-service Software Market Report Scope

Report Attribute |

Details |

Market size value in 2020 |

USD 7.96 billion |

Revenue forecast in 2027 |

USD 32.19 billion |

Growth rate |

CAGR of 22.1% from 2020 to 2027 |

Base year for estimation |

2019 |

Historical data |

2016 - 2018 |

Forecast period |

2020 - 2027 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2020 to 2027 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Solution, service, deployment, end-use, region |

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Country scope |

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil |

Key companies profiled |

Avaya Inc.; BMC Software, Inc.; HappyFox Inc.; Microsoft Corporation; Nuance Communications, Inc.; Oracle Corporation; Salesforce.Com, Inc.; SAP SE; Verint Systems, Inc.; Zendesk, Inc. |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail of customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For this study, Grand View Research has segmented the global customer self-service software market report based on solution, service, deployment, end-use, and region:

Solution Outlook (Revenue, USD Million, 2016 - 2027)

Web Self-service

Mobile Self-service

Intelligent Virtual Assistants

Social Media & Community Self-service

Email Management

IVR & ITR

Others

Service Outlook (Revenue, USD Million, 2016 - 2027)

Managed Services

Professional

Deployment Outlook (Revenue, USD Million, 2016 - 2027)

Cloud

On-premise

End-use Outlook (Revenue, USD Million, 2016 - 2027)

BFSI

Manufacturing

Retail & E-commerce

Media & Entertainment

IT & Telecommunication

Healthcare

Government

Others

Regional Outlook (Revenue, USD Million, 2016 - 2027)

North America

U.S.

Canada

Europe

U.K.

Germany

Asia Pacific

China

India

Japan

Latin America

Brazil

Middle East & Africa (MEA)

Frequently Asked Questions About This Report

b.Key factors driving the customer self-service software market growth include the growing integration of AI, business intelligence, and big data with CSS technologies to understand consumer behavior.

b.The global customer self-service software market size was estimated at USD 7.12 billion in 2019 and is expected to reach USD 7.96 billion in 2020.

b.The global customer self-service software market is expected to witness a compound annual growth rate of 22.1% from 2020 to 2027 to reach USD 32.19 billion by 2027.

b.North America led the customer self-service software market and accounted for around 30% share of global revenue in 2019. This is attributable to the rising adoption of automated CSS software across small & medium enterprises.

b.Some key players operating in the customer self-service software market include Oracle Corporation; Salesforce.Com Inc.; SAP SE; Nuance Communications Inc.; BMC Software Inc.; Microsoft Corporation; and Verint Systems Inc.; among others.