Digital Shipyard Market Size, Share & Trends Analysis Report By Solution, By Shipyard Type (Commercial, Military), By Capacity, By Technology, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-126-0

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry:Technology

Report Overview

The globaldigital shipyard market sizewas estimated atUSD 2.67 billion in 2022和预期的年复合增长growth rate (CAGR) of 19.1% from 2023 to 2030. The growth of the market is anticipated to be driven by the proliferation of the Industrial Internet of Things (IIoT) in the shipyard industry. The IIoT enables the integration of physical machinery and assets with digital systems, allowing shipyards to collect and analyze real-time data. This data-driven approach enhances operational efficiency, improves decision-making, and enables predictive maintenance, ultimately leading to cost savings and improved productivity.

The factors such as the rising interest in connected andautonomous shipsfuel the industry's growth. These solutions enable shipyards to integrate advanced technologies such as sensors, connectivity, automation, and artificial intelligence (AI) into vessels. Connected and autonomous ships offer improved safety, reduced fuel consumption, optimized navigation, and enhanced operational efficiency. Autonomous ships, also called crewless ships, are outfitted with software and hardware that allows them to operate without the intervention of humans. Sensors, automated navigation systems, propulsion and auxiliary systems, GPS trackers, and other components are used in these ships. These components allow the ship to make decisions based on its surroundings.

The significance of utilizing adigital twin造船行业是其潜在的反式form shipbuilding and maintenance procedures. A digital twin is a virtual replica of a ship or shipyard continuously updated with real-time data. Shipyards can develop advanced 3D models and simulations by employing digital twins, enabling more precise planning and design. This aids in identifying potential issues and streamlining ship construction processes, resulting in cost and time savings. In addition, digital twins comprehensively understand ship and equipment performance in real time. This facilitates continuous monitoring and optimization of operations, ensuring optimal efficiency and performance throughout the ship's lifespan.

The software companies continuously enhance their products to fortify them against potential hacking attempts. Within the maritime sector, shipyards and ship operators store vast repositories of sensitive data on their IT platforms, including information about ships and components. Consequently, these entities face elevated vulnerability to cyberattacks, which could result in substantial financial losses. The growing adoption of digitalization also raises the specter of cyber threats and cybercrimes aimed at stealing critical operational data from ships, posing a threat to national security.

Addressing these cyber risks necessitates deploying sophisticated cybersecurity solutions, which demands increased investments from software companies. As a result, the maritime industry has recognized the imperative of safeguarding against cyber threats and risks. For instance, in January 2021, the International Maritime Organization (IMO) issued Resolution MSC. 428(98) contains concise guidelines for managing cyber risks, which apply to a variety of maritime organizations.

COVID-19 Impact

The COVID-19 pandemic has had a significant impact on the market for digital shipyard. The outbreak forced firms to adapt to new challenges and implement changes in their operations. One of the notable impacts of COVID-19 on the market is the rising usage of digital technologies and processes. With the disruption caused by the pandemic, shipyards have accelerated their adoption of digital solutions to streamline operations and ensure business continuity. This includes the implementation ofrobotic process automationand other technology platforms to enhance efficiency and productivity.

The pandemic has also presented challenges to the digital shipyard industry. The global supply chain disruptions, travel restrictions, and workforce limitations have affected the shipbuilding and maintenance processes. This has resulted in delays in project timelines and increased costs due to the need for additional safety measures and remote working arrangements. However, the pandemic has positively and negatively impacted the market for digital shipyard. While there have been challenges due to disruptions in the supply chain and workforce limitations, the crisis has also accelerated the adoption of digital technologies and processes. With the growth of the market and the continuous advancements in solutions, the digital shipyard industry is expected to rebound and thrive in the post-pandemic era.

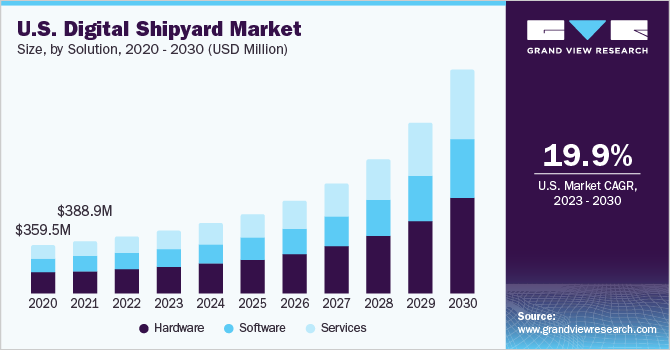

Solution Insights

Based on solution, the market is classified into hardware, software, and services. The hardware segment held a dominant revenue share of 46.2% in 2022. The ongoing advancements in hardware technologies, such as encompassing sensors, theIndustrial Internet of Things(IIoT), and edge computing devices, propel the integration of hardware components in the digital shipyard sector. These progressions empower real-time data collection and enable seamless network connectivity and integration with digital twin systems. Notably, these hardware components are pivotal in establishing connections between digital twin models and the tangible assets present within the digital shipyard industry.

The services segment is expected to emerge with a significant CAGR of 20.2% over the forecast period. As the global fleet of ships continues to grow, there is a constant need for ship maintenance and repair services. The services segment within the market caters to this demand by providing specialized services such as ship repair, retrofitting, and maintenance. The need to keep ships in optimal condition and comply with regulations drives the demand for these services.

Shipyard Type Insights

Based on shipyard type, the market is classified into commercial and military. The commercial segment led with a revenue share of 52.3% in 2022. The growth influences the commercial shipyard segment in maritime trade. As global trade continues to expand, there is a higher demand for new commercial ships and the maintenance and repair of existing ones. For instance, in April 2022, Wartsila introduced virtual and augmented simulation solutions that leverage the latest AR and VR technology. These solutions create immersive environments that simulate real-life shipboard operations, improving learning retention, job performance, and team collaboration. Such innovation drives the need for such services that can optimize shipbuilding and maintenance processes.

The military segment is expected to grow at a faster CAGR of 20.0% over the forecast period. The allocation of defense budgets plays a crucial role in driving the military shipyard segment. Governments invest in digital shipyard services to optimize defense spending, improve shipbuilding capabilities, and extend the lifespan of existing naval assets. The demand for digital shipyard services within the military segment is influenced by the availability of defense funding and the strategic priorities of nations.

For instance, in December 2022, the government of India intends to provide cash subsidies, tax reductions, and other incentives to support its shipbuilding sector. This move aims to alleviate the impact of elevated freight rates on the country's manufacturers. The proposed measures involve offering subsidies to facilitate the construction of a minimum of 50 new vessels and granting the shipbuilding industry "infrastructure status," which would assist in securing financing from banks.

Capacity Insights

Based on capacity, the market is classified into small, medium, and small and large. Among these, the large capacity segment dominated with a revenue share of 44.0% in 2022 and is anticipated to retain its dominance over the projected period. The need for larger vessels in various industries, such as shipping, oil and gas, and offshore exploration, drives the demand for digital shipyard services in the large-capacity segment. These services enable shipyards to efficiently design, construct, and maintain large-scale vessels, meeting the increasing demand for transportation and other maritime activities.

The medium capacity segment held a considerable revenue share in 2022. The medium capacity segment caters to the demand for customized vessels in industries such as offshore support, fishing, and coastal transportation. Digital shipyard solutions enable shipyards to efficiently design and construct vessels that meet the specific requirements of their clients. The ability to offer customized solutions drives the growth of the medium capacity segment within the digital shipyard industry.

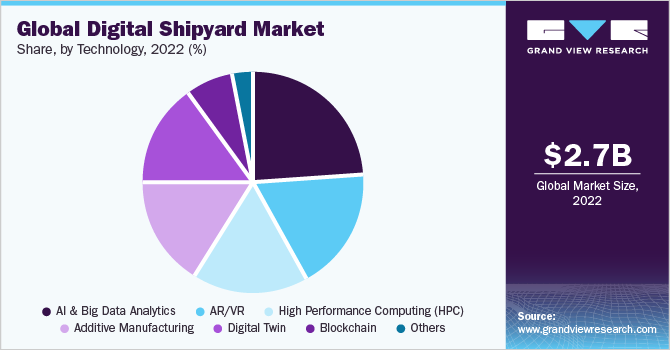

Technology Insights

Based on technology, the market is classified into AR/VR, digital twin, additive manufacturing,AIand big data analytics, High-Performance Computing (HPC), blockchain, and others. Among these, the AI/big data segment dominated with a revenue share of 24.1% in 2022. Adopting AI and big data analytics in the digital shipyard market allows shipyards to collect, analyze, and interpret vast amounts of data generated throughout the shipbuilding process. AI and big data technologies enable shipyards to implement predictive maintenance and condition monitoring systems. By analyzing data from various sensors and equipment onboard vessels, shipyards can detect potential issues in real time, predict maintenance needs, and proactively address them. This helps reduce downtime, increase vessel availability, and optimize maintenance schedules, leading to cost savings and improved operational performance.

The digital twin segment is expected to emerge as the fastest-growing segment, with a CAGR of 20.4% over the forecast period. Digital twins enable shipyards to create virtual replicas of vessels, allowing for enhanced ship design and planning. Shipyards can optimize vessel performance, identify potential issues, and make informed decisions before physical construction begins by simulating and analyzing different design scenarios. This leads to improved efficiency, reduced costs, and faster time-to-market. Key players such as Dassault Systèmes are undergoing partnerships to enhance the creation of digital shipyards. For instance, in November 2022, Dassault Systèmes and Samsung Heavy Industries (SHI) signed a memorandum of understanding (MoU) to collaborate on the development of a smart shipyard. This partnership aims to utilize digital twin technologies to facilitate the transformation of SHI's shipyard operations and support its business initiatives.

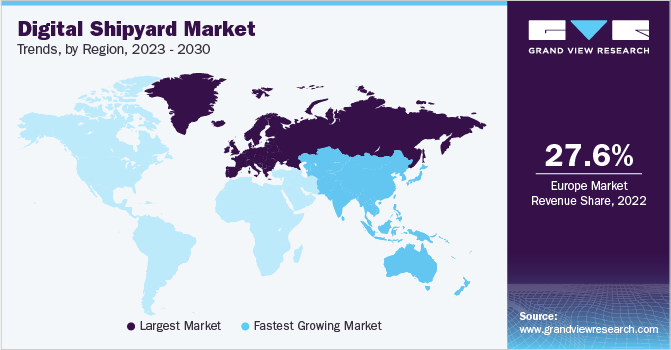

Regional Insights

Europe led the overall market in 2022, with a revenue share of 27.6% in 2022. The Europe region has stringent environmental regulations and strongly focuses on sustainable shipping practices. This drives the demand for digital solutions in shipbuilding that can help optimize vessel design, reduce emissions, and improve fuel efficiency. For instance, the International Maritime Organization (IMO) is leading a collective industry endeavor to expedite a significant shift in fuel and technology in response to the climate crisis. The objective is to achieve a minimum 50% reduction in annual CO2 emissions by the year 2050. Digital Shipyard technologies enable shipyards to implement eco-friendly practices and comply with these regulations, leading to increased adoption in the European market.

亚太地区预计将增长最快的CAGR of 20.7% throughout the forecast period. The demand for shipbuilding automation has surged in response to the labor shortage that arose during the pandemic. Digital shipyard solutions offer automation capabilities that help address this labor shortage and improve overall productivity in the Asia Pacific shipbuilding industry. The Asia Pacific region is a major hub for shipbuilding, with countries like China, South Korea, and Japan leading the market. The growth of the shipbuilding industry in the region drives the demand for digital shipyard solutions to streamline operations, optimize resources, and meet the increasing demand for ships.

Key Companies & Market Share Insights

The market is fragmented and is anticipated to witness fierce competition owing to players attaining to capture the market. Major players are spending heavily on partnerships and collaboration to integrate advanced technologies used in digital shipyards. For instance, in February 2021, Damen Shipyard Group formed a collaborative agreement with Sea Machines Robotics to explore and advance the implementation of collision avoidance technology on Damen ships. This partnership aligns with Damen's strategic goals of digitalization, enhanced sustainability, and operational excellence.

These industry participants actively engage in strategic endeavors, including mergers and acquisitions and introducing new products to fortify their market position. These initiatives aim to secure a substantial market share and enhance overall profitability. Some prominent players in the global digital shipyard market include:

SAP

Wartsila, BAE Systems

Dassault Systemes

AVEVA

Siemens Digital Industries Software

Accenture

Hexagon

Inmarsat Plc.,

Damen Shipyards Group

Digital Shipyard Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 2.91 billion |

Revenue forecast in 2030 |

USD 9.88 billion |

Growth rate |

CAGR of 19.1% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical year |

2017 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million/billion, and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Solution, shipyard type, capacity, technology, region |

Regional scope |

North America; Europe; Asia-Pacific; Latin America; Middle East & Africa |

Country scope |

U.S.; Canada; UK; Germany; France; China; India; Japan; Taiwan; Brazil; Mexico; United Arab Emirates (UAE); Kingdom of Saudi Arabia (KSA); South Africa |

Key companies profiled |

SAP; Wartsila; BAE Systems; Dassault Systemes; AVEVA; Siemens Digital Industries Software; Accenture; Hexagon; Inmarsat Plc.; Damen Shipyards Group |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Digital Shipyard Market Report Segmentation

This report forecasts market revenue growths at global, regional, as well as at country levels and offers an analysis of the qualitative and quantitative market trends in each of the sub-segments from 2017 to 2030. For this report, Grand View Research has segmented the global digital shipyard market report based on solution, shipyard type, capacity, technology, and region:

Solution Outlook (Revenue, USD Million, 2017 - 2030)

Hardware

Software

Services

Shipyard Type Outlook (Revenue, USD Million, 2017 - 2030)

Commercial

Military

Capacity Outlook (Revenue, USD Million, 2017 - 2030)

Small

Medium

Large

Technology Outlook (Revenue, USD Million, 2017 - 2030)

AR/VR

Digital Twin

Additive Manufacturing

AI & Big Data Analytics

高性能计算(HPC)

Blockchain

Others

Regional Outlook (Revenue, USD Million, 2017 - 2030)

North America

U.S.

Canada

Europe

Germany

UK

France

Asia-Pacific

China

India

Japan

Latin America

Brazil

Mexico

Middle East & Africa

United Arab Emirates (UAE)

Kingdom of Saudi Arabia (KSA)

South Africa

Frequently Asked Questions About This Report

b.The global Digital Shipyard market size was estimated at USD 2.67 billion in 2022 and is expected to reach USD 2.91 billion in 2023.

b.The global Digital Shipyard market is expected to grow at a compound annual growth rate of 19.1% from 2023 to 2030 to reach USD 9.88 billion by 2030.

b.Europe led the overall market in 2022 gaining a market share of 27.6%. The European region has stringent environmental regulations and strongly focuses on sustainable shipping practices. This drives the demand for digital solutions in shipbuilding that can help optimize vessel design, reduce emissions, and improve fuel efficiency.

b.Some of the key player include SAP, Wartsila, BAE Systems, Dassault Systemes, AVEVA, Siemens Digital Industries Software, Accenture, Hexagon, Inmarsat Plc., and Damen Shipyards Group.

b.Digital twin adoption has been fueled by the industry's rapid growth and the demand for cutting-edge technology. Furthermore, factors such as the rising interest in connected and autonomous ships fuel the industry's demand for digital shipyard solutions. These solutions enable shipyards to integrate advanced technologies such as sensors, connectivity, automation, and artificial intelligence (AI) into vessels.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."