Nutraceuticals CDMO Market Size, Share & Trends Analysis Report By Dosage Form (Tablets, Softgel), By Services (Product Formulation & Development, Research & Development), By Company Size, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-077-4

- Number of Pages: 175

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Healthcare

Report Overview

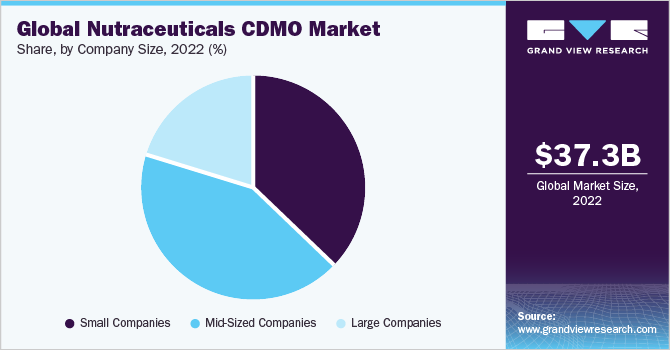

The globalnutraceuticals CDMO market sizewas valued atUSD 37.3 billion in 2022and is expected to grow at a compound annual growth rate (CAGR) of 7.7% from 2023 to 2030. The key factors driving the market are increasing R&D activities, demand for nutraceutical products, and the influx of small/medium-sized pharmaceutical manufacturers seeking outsourcing partners. Moreover, rising emphasis on stronger immunity and overall well-being is pushing demand fordietary supplements, vitamins, and other nutraceuticals thereby pushing demand for new products.

Nutraceuticals are gaining popularity due to the growing demand for organic and natural products that support health and wellness. The advancement in technology, such as the adoption of AI,Robotic Process Automation(RPA), 3-D printing trends,Virtual Reality, and Augmented Reality, increase efficiency during the manufacturing and product formulation process. 3D printing techniques in the nutraceutical industry have given rise to new ventures to make better drug delivery. The technology allows the utilization of customizable ingredients to produce products that are uniquely designed with specific ingredients.

The COVID-19 pandemic significantly impacted the market growth. The pandemic provided nutraceutical companies an opportunity to innovate and create products that address emerging health concerns. Moreover, consumers have shown a greater interest in products that support immune function and overall health. Nutraceuticals such as minerals, vitamins,herbal supplements, antioxidants, andfunctional foodswith immune-boosting properties have experienced increased demand.

Increasing mergers & acquisitions, and collaborations are major factors driving the growth of the nutraceuticals CDMO market. For instance, in March 2023, Akums Drugs & Pharmaceuticals India-based contract development and manufacturing organization (CDMO), entered the nutraceutical gummies market. The customized products are designed to deliver the pediatrics, geriatrics, and adults a convenient dosage form as compared to the traditional dosages. These range from immunity boosters and multivitamins boosters to products that support their urinary health, sleep, morning sickness, hair health, and urinary health.

Services Insights

Manufacturing and packaging services dominated the nutraceuticals CDMO market and accounted for the largest revenue share of over 32.00% in 2022.Manufacturing and packaging are essential components of the supply chain. Several companies lack the specialized equipment, infrastructure, or expertise required to effectively and efficiently handle the process internally. By outsourcing these services to CDMOs, companies can concentrate on their core competencies. In addition, there are several advantages such as regulatory compliance, cost-effectiveness, and scalability, which tend to increase the demand for these services.

On the other hand, the product formulation and development segment is anticipated to register a lucrative CAGR of 8.2% in the nutraceuticals contract development and manufacturing organization (CDMO) market during the forecast period of 2023 to 2030. The high growth of this segment is due to customized formulations, expertise in nutraceutical formulation, regulatory compliance, and cost efficiency and scalability. These services assist companies create high-quality and compliant nutraceutical products.

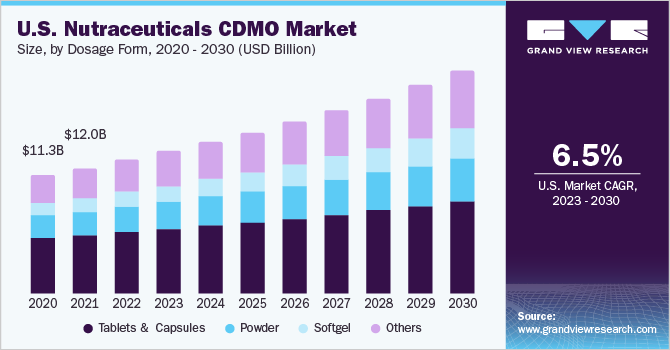

Dosage Form Insights

The tablets & capsule segment dominated the nutraceuticals CDMO market and accounted for the largest revenue share in 2022. High shares of the segment are primarily due to the rise in demand for easy and convenient dietary supplements. The advantage of capsules is that they can encapsulate different types of active ingredients with minimal use of excipients. Moreover, capsules also offer additional benefits over alternative dosage forms. They can be produced in attractive colour combinations, allowing for product differentiation and branding. They are easy to handle, which makes them convenient for both manufacturers during the production process and for the consumers while consuming the supplements.

软胶囊的类别将见证一个substantial CAGR from 2023 to 2030. It is a highly popular method for delivering a wide range of nutraceutical formulations and supplements. The Softgel segment has gained momentum post-COVID-19 pandemic. Consumer preferences have shifted towards soft gel capsule technology for nutraceutical products due to its patient-centric form. The key factors contributing to the increasing demand for soft gels are the growing awareness of health supplements and their benefits among consumers and there has been a significant expansion in the number of softgel and nutraceutical manufacturers in the market.

Company Size Insights

The mid-size companies held the largest market share and are expected to register the fastest CAGR over the forecast period. Mid-size companies specializing in nutraceuticals can deliver greater customization and flexibility compared to larger companies. These companies can adapt their processes to meet specific ingredient sourcing preferences, formulation requirements, and packaging needs of their clients. This adaptability enables them to meet the particular requirements of the nutraceutical market, which frequently needs a wide range of products and formulations.

On the other hand, large size companies also hold a significant market share in the market. This is attributed to large-size companies having substantial infrastructure, including advanced technologies, state-of-the-art manufacturing facilities, and strong quality control systems. Moreover, they have the resources to invest in automation, cutting-edge equipment, and analytical capabilities.

Regional Insights

North America dominated the nutraceuticals CDMO industry and accounted for the largest revenue share of 37.1% in 2022. The key factors driving the growth of the market in the region are increasing R&D activities and rising demand for nutraceuticals among consumers owing to their medical benefits. Presence of a large number of CDMOs such as Innovations in Nutrition + Wellness, Catalent Inc, Nutrivo LLC, SDC Nutrition Inc, and Pharmatech Labs.

The increasing strategy initiatives such as merger acquisition, geographic expansion, research and development activities, and manufacturing activities are also contributing to the growth of the nutraceuticals CDMO industry in the region. For instance, in June 2021, Innovations in Nutrition + Wellness (INW) acquired Capstone Nutrition, a global manufacturer of high-quality nutrition and wellness product. This acquisition combined two complementary businesses and strengthen INW as a global provider of products such as minerals, vitamins, and supplement categories.

亚太地区预计将注册快t CAGR of 9.3% during the forecast period in the Nutraceuticals CDMO industry. The region’s significant growth is observed due to the rising awareness of consumers about the benefits of functional food. Additionally, the growing trend of outsourcing manufacturing and drug development, and advancement in research and development in ingredients are also major key factors contributing to the growth of the market in the region. Furthermore, India is well poised to become a multi-billion market in the nutraceutical industry. This is due to the largest & fastest-growing consumer base, and rising awareness of health and fitness among people, especially among youngsters. The adoption of products like gummies, dissolving strips, and chewable, and powdered drink mixes are fueling innovation in the nutraceutical CDMO industry in the region.

Key Companies & Market Share Insights

The major players operating across the nutraceuticals CDMO industry are focused on the adoption of strategic initiatives such as mergers, partnerships, acquisitions, etc. For instance, in October 2020, Lonza, a Swiss developer of capsules and other health and biotech ingredients declared that it has invested USD 93.0 million into its capsule and health Ingredient division, to significantly increase its softgel manufacturing capacity across 8 global facilities. In addition, the company, in February 2023, announced the expansion of the bioconjugation facility in Visp (CH) Switzerland. Some prominent players in the global nutraceuticals CDMO market include:

Catalent Inc.

Lonza

NUTRASCIENCE LABS

Robinson Pharma, Inc.

Health Wright Products, Inc.

Innovations in Nutrition + Wellness

INPHARMA S.p.A.

Aenova Group

NutraPakUSA

SFI Health

Nutraceuticals CDMOMarket Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 40.12 billion |

Revenue Forecast in 2030 |

USD 67.83 billion |

Growth rate |

CAGR of 7.7% from 2023 to 2030 |

Base year for estimation |

2022 |

Actual estimates/Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2030 |

Report Coverage |

Revenue forecast, company share, competitive landscape, growth factors, trends |

Segments Covered |

Dosage form, services, company size, region |

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa, Saudi Arabia; UAE; Kuwait |

Key companies profiled |

Catalent Inc.; Lonza; NUTRASCIENCE LABS; Robinson Pharma, Inc.; Health Wright Products, Inc.; Innovations in Nutrition + Wellness; INPHARMA S.p.A.; Aenova Group; NutraPakUSA; SFI Health |

Customization scope |

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Nutraceuticals CDMO Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global nutraceuticals CDMO market based on dosage form, services, company size, and region.

Dosage Form Outlook (Revenue, USD Million, 2018 - 2030)

Tablets & Capsules

Powder

Softgel

Others

Services Outlook (Revenue, USD Million, 2018 - 2030)

Product Formulation and Development

Manufacturing and Packaging

Research & Development (R&D)

Regulatory Compliance

Others

Company Size Outlook (Revenue, USD Million, 2018 - 2030)

Small Companies

Mid-Sized Companies

Large Companies

Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

Europe

UK

Germany

France

Italy

Spain

Denmark

Sweden

Norway

Asia Pacific

Japan

China

India

Australia

South Korea

Thailand

Latin America

Brazil

Mexico

Argentina

Middle East & Africa

South Africa

Saudi Arabia

UAE

Kuwait

Frequently Asked Questions About This Report

b.The global nutraceuticals CDMO market size was estimated at USD 37.3 billion in 2022 and is expected to reach USD 40.12 billion in 2023.

b.The global nutraceuticals CDMO market is expected to grow at a compound annual growth rate of 7.7% from 2023 to 2030 to reach USD 67.83 billion by 2030.

b.North America dominated the nutraceuticals CDMO market with a share of 37.10% in 2022. This is attributable to increasing R&D activities, and rising demand for nutraceuticals among consumers owing to their medical benefits.

b.Some key players operating in the nutraceuticals CDMO market include Catalent Inc., Lonza, NUTRASCIENCE LABS, Robinson Pharma, Inc., Health Wright Products, Inc., Innovations in Nutrition + Wellness, INPHARMA S.p.A., Aenova Group, NutraPakUSA, SFI Health and others.

b.Key factors that are driving the nutraceuticals CDMO market growth include increasing R&D activities and increased demand for nutraceutical products. People have become more conscious of their immune health and overall well-being, resulting in increased consumption of dietary supplements, vitamins, and other nutraceuticals.