Online Advertising Market Size, Share & Trends Analysis Report By Type (Native Advertising, Video Advertising), By Product, By Pricing Model, By End-user, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-088-9

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry:Technology

Report Overview

The globalonline advertising market sizewas valued atUSD 236.90 billion in 2022and is expected to grow at a compound annual growth rate (CAGR) of 15.7% from 2023 to 2030. The market has experienced tremendous growth and transformation in recent years. As the internet has become an integral part of people's daily lives, businesses have recognized the potential to reach their target audiences through online platforms. This has led to a significant shift in ad strategies, with more emphasis placed on digital channels. One of the key advantages of online ads is their ability to reach a global audience. Unlike traditional forms of ads such as print or television, online ads can be targeted to specific demographics and geographic locations. This level of precision allows businesses to tailor their messages and offers to the right people at the right time, growing the chances of conversions and sales.

在线广告市场提供了一个范围广泛of ad formats and channels. Display ads, search engine marketing, social media ads, video ads, and native ads are just a few examples of the options available to businesses. This diversity allows advertisers to experiment with different formats and find the most effective ones for their target audience and campaign objectives. Another significant factor driving the growth of this market is the availability of data and advanced analytics.

Digital platforms collect vast amounts of user data, including demographics, browsing behavior, and preferences. Advertisers can leverage this data to create highly personalized and targeted campaigns, maximizing their return on investment. Moreover, advanced analytics tools enable businesses to track the performance of their ads in real-time, providing valuable insights and the opportunity to optimize campaigns for better results.

智能手机等移动设备的兴起,一个d tablets, has had a significant impact on the expansion of this market. Mobile devices have become increasingly popular and ubiquitous, and people are now spending more time accessing the internet through these devices rather than traditional desktop computers. One of the key factors driving the growth of online ads through mobile devices is the convenience and portability they offer. Mobile devices provide users with the flexibility to access the internet anytime and anywhere, allowing advertisers to reach consumers in various contexts and locations.

Whether users are commuting, waiting in line, or relaxing at home, they can easily connect to the internet and engage with content. Mobile apps and mobile browsers have become an integral part of people's daily lives, offering a wide range of services and entertainment options. As a result, users are spending a significant amount of time on these mobile platforms. This increased mobile usage presents a valuable opportunity for advertisers to capture users’ attention and deliver targeted messages.

COVID-19影响

The COVID-19 pandemic had a significant impact on the online advertising market. In the early stages of the pandemic, many businesses faced uncertainty and budget constraints, leading to a reduction in advertising spending. Industries like travel, hospitality, and retail, which were severely impacted by lockdowns and restrictions, significantly reduced their advertising budgets. However, as people spent more time online due to lockdowns and remote work, there was an increased demand for digital content and online services. This shift in consumer behavior led to a reallocation of advertising budgets from traditional channels to digital channels. Social media, search engine marketing, and online video platforms became more popular among advertisers.

程序化的广告,包括自动化buying and selling of ad inventory, gained further prominence during the pandemic. Advertisers increasingly turned to programmatic platforms to optimize their campaigns, reach targeted audiences, and make real-time adjustments based on changing consumer behavior. The e-commerce sector experienced a significant boom as physical stores faced closures and limitations. Online retailers and marketplaces increased their advertising efforts to capitalize on this trend, driving up competition and ad spending in the e-commerce sector.

With people spending more time at home, video streaming and gaming consumption also saw a surge. Advertisers recognized this opportunity and increased their investments in platforms like YouTube, Twitch, and mobile gaming apps to reach captive audiences. Advertisers had to adapt their messaging and creative content to align with the changing consumer sentiment during the pandemic. Empathy, health, and safety became important themes in advertising, with brands focusing on conveying messages of support and solidarity.

Type Insights

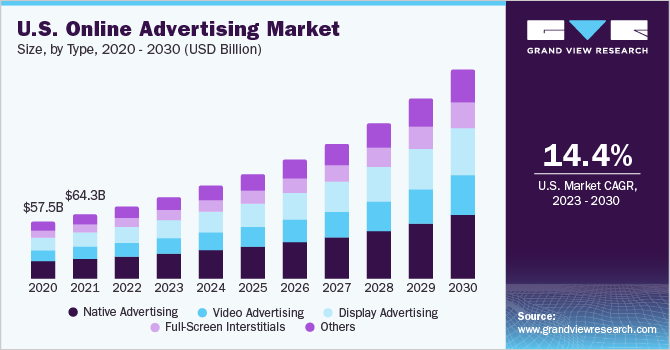

In terms of type, the market is classified into native advertising, video advertising, display advertising, full-screen interstitials, and others. The native advertising segment dominated the overall market, gaining a market share of 25.1% in 2022 and witnessing a CAGR of 15.1% during the forecast period. Native ads have witnessed remarkable growth over the past decade, emerging as an effective and popular advertising strategy. This approach involves seamlessly integrating promotional content into the surrounding editorial or user-generated content, making it appear as a natural part of the platform or medium.

By matching the form and function of the platform, native ads provide a non-disruptive and cohesive user experience, resulting in increased engagement. One of the key factors contributing to the growth of native advertising is its ability to engage users effectively. By blending in with the surrounding content, native ads are less intrusive and more likely to capture users’ attention. This integration with the platform’s format and style allows native ads to generate higher levels of engagement compared to traditional display ads.

The full-screen interstitials segment is anticipated to observe the fastest growth, growing at a CAGR of 16.8% throughout the forecast period. Full-screen interstitials have experienced remarkable growth in the digital advertising industry. These ad formats have become increasingly popular due to their immersive and attention-grabbing nature. By occupying the entire screen of a user’s device, full-screen interstitials provide a seamless and impactful advertising experience.

The rise of mobile advertising has pl’yed a significant role in the growth of full-screen interstitials. With the widespread use of smartphones and the increasing amount of time people spend on their mobile devices, advertisers have been searching for more engaging and visually appealing ad formats. Full-screen interstitials emerged as a solution to deliver highly immersive ad experiences on mobile devices, capturing users’ attention effectively.

Platform Insights

In terms of platform, the market is classified into mobile; laptops, desktops & tablets; and others. Among these, the mobile segment is expected to dominate in 2022, gaining a market share of 59.1% and witnessing the fastest CAGR of 16.5% during the forecast period. The growth of the mobile platform in this market has been significant over the years and continues to expand rapidly. One of the primary drivers of this growth is the rising adoption of smartphones worldwide.

与智能手机越来越便宜and accessible, more and more people are using mobile devices to access the internet. This shift in consumer behavior has created a massive opportunity for advertisers to reach a large and engaged audience through mobile advertising. Mobile applications, or apps, have also played a crucial role in the growth of the mobile platform in online advertising. Users spend a significant amount of their digital time within apps, making them an attractive space for advertisers to engage with consumers. Advertisers can place targeted ads within mobile apps, leveraging the app’s user base and context to deliver relevant advertising messages. This strategy has proven effective in capturing the attention of users and driving conversions.

The consumption of video content on mobile devices has experienced tremendous growth. Platforms such as YouTube, Instagram, and TikTok have become prominent channels for mobile video advertising. Advertisers recognize the power of video in capturing attention and delivering their brand message effectively. As a result, they have invested heavily in mobile video advertising, creating engaging and visually appealing video ad campaigns specifically designed for mobile platforms.

The mobile platform's location-based targeting capabilities have also contributed to its growth in the online advertising industry. Mobile devices provide precise location data, allowing advertisers to deliver highly targeted and personalized ads based on a user’s real-time location. This capability has opened up new opportunities for businesses with physical stores or those aiming to reach a specific local audience. Advertisers can tailor their messaging and promotions based on the user’s proximity to their store or specific geographic areas.

Pricing Model Insights

In terms of pricing model, the market is classified into flat rate pricing model, cost per mile pricing model, and cost per click pricing model. The Cost Per Mille pricing model segment dominated with a revenue share of 44.8% in 2022 and is expected to witness a CAGR of 15.5% during the forecast period. The Cost Per Mille (CPM) pricing model has been a prominent pricing structure in the online advertising industry for quite some time. CPM refers to the cost per one thousand ad impressions, where advertisers pay for the number of times their ad is displayed to users.

While the advertising industry has seen the emergence of other pricing models, such as Cost Per Click (CPC) and Cost Per Action (CPA), CPM continues to play a significant role. The growth of the CPM pricing model in the market for online advertising has been influenced by several factors. CPM is often favored by advertisers seeking to build brand awareness and reach a large audience. Advertisers can achieve widespread exposure through CPM campaigns, as they pay for impressions rather than specific user actions. This pricing model allows them to target a broad audience and maximize their ad visibility.

The cost per click pricing model segment is anticipated to witness the fastest CAGR of 17.5% throughout the forecast period. The Cost Per Click (CPC) pricing model has experienced significant growth and popularity in the online advertising industry over the years. This model is widely used in various forms of digital advertising, including search engine ads, display ads, and social media ads.

While my information is based on data up until September 2021, I can provide you with a comprehensive overview of the factors that have contributed to the growth of the CPC pricing model. One of the key factors driving the growth of CPC is its performance-based nature. Advertisers only pay when a user clicks on their ads, which aligns with their goal of driving traffic to their websites or landing pages. This pay-per-click structure makes CPC an attractive option for businesses as they can measure the effectiveness of their campaigns based on the number of clicks received.

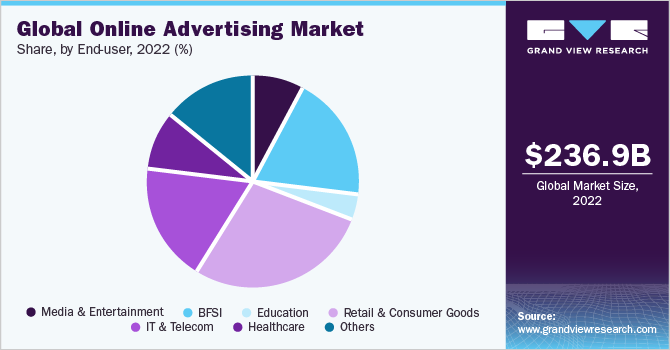

End-user Insights

In terms of end-user, the market is classified into media & entertainment, BFSI, education, retail & consumer goods, IT & telecom, healthcare, and others. The retail & consumer goods segment dominated the overall market, gaining a revenue share of 28.5% in 2022 and witnessing a CAGR of 14.6% during the forecast period. The growth of the retail & consumer goods end-user segment has been significant in recent years.

The rise of e-commerce and digital transformation has led to increased online advertising spending by companies in the retail and consumer goods sector. One of the primary drivers of this growth is the expansion of e-commerce. As more consumers turn to online platforms to make their purchases, companies in the retail and consumer goods sector are allocating larger portions of their advertising budgets to online channels. This shift allows them to effectively reach their target audience and promote their products and services.

The media & entertainment segment is anticipated to witness the fastest growth, growing at a CAGR of 18.0% throughout the forecast period. The growth of the media & entertainment end-user segment has been significant in recent years. With the increasing digitalization of content consumption and the rise of online platforms, media & entertainment companies have recognized the need to allocate a significant portion of their advertising budgets to online channels.

The online advertising industry has witnessed substantial growth as advertisers shift their focus from traditional mediums such as television, radio, and print to digital platforms. This trend is driven by several factors, including the increasing internet penetration, the widespread use of smartphones and other connected devices, and the availability of targeted advertising options.

Regional Insights

North America led the overall market in 2022, with a market share of 37. 6%. The North America online advertising market has experienced significant growth over the years, driven by various factors. One of the key contributors to this growth is the increasing internet penetration in the region. With a large portion of the population having access to the internet, advertisers have a broad audience to target and engage with through online advertising channels.

Another factor that has fueled the growth of the North America market is the rise of mobile advertising. The widespread use of smartphones and mobile devices has resulted in a shift in consumer behavior, with people spending more time on mobile apps and websites. Advertisers have recognized this trend and have focused their efforts on mobile advertising to reach consumers where they spend a significant amount of their time.

Asia Pacific is anticipated to witness the fastest growth, growing at a CAGR of 16.8% throughout the forecast period. The Asia Pacific online advertising industry has witnessed significant growth in recent years. One of the primary drivers of this growth is the increasing internet penetration in the region. As millions of new users come online every year, the audience for online advertising expands, attracting advertisers to invest more in the market.

Another crucial factor contributing to the growth of the Asia Pacific market for online advertising is the rising adoption of smartphones. With smartphones becoming more affordable and accessible, a larger portion of the population has gained access to the internet. This has created new opportunities for advertisers to reach their target audience through mobile ads, driving the overall growth of the market.

Key Companies & Market Share Insights

The market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. Some prominent players in the market include Google LLC (Alphabet), Facebook Inc. (Meta Platforms), Microsoft Corporation, and Amazon.com Inc.; among others. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

In May 2023, Google unveiled innovative generative artificial intelligence (AI) advertising solutions. This development signifies Google's commitment to advancing its advertising capabilities by leveraging the power of AI technology. With these newly unveiled generative AI advertising tools, Google aims to provide businesses with innovative solutions for creating compelling advertisements. Some prominent players in the global online advertising market include:

Google LLC (Alphabet)

Facebook Inc .a Platforms)

Microsoft Corporation

Amazon.com, Inc.

Twitter, Inc.

Baidu

Tencent

ByteDance

Adobe Systems, Inc.

v2 Ventures (Adknowledge)

AOL

Verizon Media

Online Advertising Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 269.50 billion |

Revenue forecast in 2030 |

USD 747.38 billion |

Growth Rate |

CAGR of 15.7% from 2023 to 2030 |

Base year for estimation |

2022 |

Historic year |

2017 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Type, platform, pricing model, end-user, region |

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

Country scope |

U.S.; Canada; Germany; UK; France; China; India; Japan; South Korea; Australia; Mexico; Brazil; KSA; UAE; South Africa |

Key companies profiled |

谷歌,LLC(字母);Facebook Inc .a Platforms); Microsoft Corporation; Amazon.com, Inc.; Twitter, Inc.; Baidu; Tencent; ByteDance; Adobe Systems, Inc.; v2 Ventures (Adknowledge); AOL; Verizon Media |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Online Advertising Market Report Segmentation

This report forecasts revenue growths at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global online advertising market report based on type, platform, pricing model, end-user, and region:

Type Outlook (Revenue, USD Billion, 2017 - 2030)

Native Advertising

Video Advertising

Display Advertising

Full-Screen Interstitials

Others

Platform Outlook (Revenue, USD Billion, 2017 - 2030)

Mobiles

Laptops, Desktops & Tablets

Others

Pricing Model Outlook (Revenue, USD Billion, 2017 - 2030)

Flat Rate Pricing Model

Cost Per Mille Pricing Model

Cost Per Click Pricing Model

End-user Outlook (Revenue, USD Billion, 2017 - 2030)

Media & Entertainment

BFSI

Education

Retail & Consumer Goods

IT & Telecom

Healthcare

Others

Regional Outlook (Revenue, USD Billion; 2017 - 2030)

North America

U.S.

Canada

Europe

Germany

UK

France

Asia pacific

China

India

Japan

South Korea

Australia

Latin America

Brazil

Mexico

Middle East & Africa

K.S.A.

U.A.E.

South Africa

Frequently Asked Questions About This Report

b.The global online advertising market size was estimated at USD 236.90 billion in 2022 and is expected to reach USD 269.50 billion in 2023.

b.The global online advertising market is expected to grow at a compound annual growth rate of 15.7% from 2023 to 2030 to reach USD 747.38 billion by 2030.

b.The native advertising segment dominated the overall online advertising type market, gaining a market share of 25.1% in 2022 and witnessing a CAGR of 15.1% during the forecast period. Native ads have witnessed remarkable growth over the past decade, emerging as an effective and popular advertising strategy.

b.Some key players operating in the online advertising market include Google LLC (Alphabet), Facebook Inc. (Meta Platforms), Microsoft Corporation, Amazon.com Inc., Twitter Inc., Baidu, Tencent, ByteDance, Adobe Systems, Inc., v2 Ventures (Adknowledge), AOL, and Verizon Media.

b.The growth of online advertising market is anticipated to grow rapidly in recent years owing to factors including high internet penetration, growth in e-commerce, the emergence of high-speed internet, rise in advertising spends on digital media across various industries, increase in popularity of streaming platforms, and increasing awareness about digital marketing.