Pharmaceutical Regulatory Affairs Market Size, Share & Trends Analysis Report By Services, By Category, By Service Provider, By Company Size, By Product Stage, By Indication, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-107-1

- Number of Pages: 255

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Healthcare

Report Overview

The globalpharmaceutical regulatory affairs market sizewas estimated atUSD 8.27 billion in 2022and is anticipated to grow at a compound annual growth rate (CAGR) of 7.7% from 2023 to 2030. Key factors driving market growth include increasing focus on patient safety andpharmacovigilance, accelerated drug development and approval processes, and increasing regulatory requirements. Furthermore, increasing harmonization and international collaboration and the rapidly evolving regulatory landscape for advanced therapies are some of the factors driving the market growth.

Several countries provided special & emergency approvals to respond to the COVID-19 pandemic. For instance, in December 2021, Pfizer received the FDA Emergency Use Authorization for PAXLOVID, a new COVID-19 oral antiviral treatment. According to EUA, based on clinical data from the EPIC-HR research, PAXLOVID significantly lowers the risk of hospitalization or death compared to placebo by 89%. Such special approvals were instrumental in heightened demand for specialized regulatory services and enabled companies to identify niche areas thereby expediting market entry.

Companies must have an in-house regulatory department or outsource their regulatory affairs owing to stringent regulatory requirements in developed economies and changing regulations in developing ones. Establishing an in-house regulatory affairs department in offshore countries is only sometimes feasible. Hence, companies tend to adopt different outsourcing models based on the size and priority of projects, thereby contributing to the globalregulatory affairs市场。此外,一些监管改革related to clinical trials, vaccine development, and product approvals initiated by global & local regulatory authorities to expedite patient access to COVID-19 treatments and vaccines are anticipated to impact the regulatory affairs market positively.

A significant increase has been witnessed in the number ofclinical trialsconducted in emerging economies. This can be attributed to the availability of skilled labor, advanced technologies, and infrastructure facilities at relatively lower costs than developed economies such as the U.S., which is expected to stimulate the demand for regulatory services such as clinical trial applications & product registrations in these regions.

Emerging economies contribute to more than 30.0% of total clinical trial applications submitted globally, and the share is expected to increase over the coming years, contributing to the growth of the regulatory affairs market in the region. The shifting from volume- to value-based care in the U.S. is expected to increase the pressure on life science companies to reduce costs, which may lead to an increase in noncore function outsourcing, thereby driving the regulatory affairs market.

Category Insights

In terms of category, the drug segmentheld the largest revenue share of over 57% in 2022. Regulatory affairs play a very important role in the entire drug development, manufacturing, and commercialization continuum. This can be attributed to various regulations and related regulatory submissions/documentation at each of the steps involved in the process. A clear understanding of these regulations enables timely and cost-effective product launches in the market and can also help pharmaceutical companies gain the first-mover advantage.

The biologics segment is anticipated to witness the fastest CAGR of 7.84% over the forecast period.Increasing healthcare needs, coupled with increasing investments in healthcare infrastructure and improving regulatory frameworks, are driving the demand for biologics. The increasing middle-class population in Africa and expanding access to healthcare services contribute to the growing demand for advanced and innovative therapies. Furthermore, the prevalence of diseases such as HIV/AIDS, malaria, and noncommunicable diseases, such as diabetes & cancer, highlights the urgent need for effective biologic treatments.

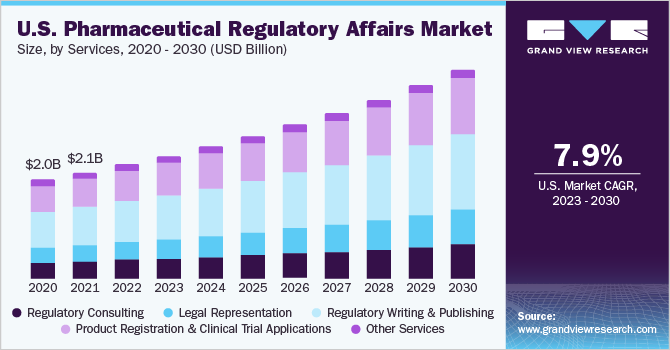

Services Insights

Based on services, the regulatory writing & publishing segment dominated the market in 2022 and held the largest revenue share of 36.58%.Rigid quality control procedures are used on regulatory papers to ensure consistency, accuracy, and compliance. These high-quality criteria are adhered to by the regulatory writing and publishing section, which is essential for obtaining regulatory clearances. For depth review procedures, adherence to formatting and submission standards, and adherence to guidelines in documentation are a few instances of these services.

Legal representation is anticipated to witness the fastest CAGR of 8.46% over the forecast period.Laws and regulations are growing increasingly complicated due to the changing legal landscape. For people as well as companies to successfully manage these complexities, expert legal advice is required. To maintain compliance, protect rights, and get favorable outcomes in legal disputes, there is an increasing need for legal guidance.

Indication Insights

The oncology segment dominated the market in 2022 with the largest revenue share of 33.08%. This can be attributed to the high prevalence of cancer, which is boosting the need for safe and effective treatment options. Africa is expected to experience the most significant increase in cancer cases and deaths compared to other regions. According to data published by GLOBOCAN, the number of cancer cases is estimated to increase from 1.1 million new cases in 2020 to 2.1 million cases in 2040.

The immunology segment is anticipated to witness the fastest CAGR of 9.24% over the forecast period. Immunological diseases including autoimmune diseases, allergy problems, and immune-mediated disorders are becoming increasingly prevalent. These disorders necessitate efficient therapeutic approaches, increasing the market for pharmaceuticals with an immunological focus.

Product Stage Insights

产品的阶段,2022年,临床tudies segment held the largest market share of 46.41%.This can be attributed to the rising number of clinical trial registrations over the last few years.The COVID-19 pandemic has increased the number of clinical trials in the region due to the urgency to identify and commercialize an effective cure and/or vaccine for the disease. Furthermore, supportive regulatory actions, such as shortening trial approval time, waiving the waiting period, releasing industry guidance documents, and funding clinical trials undertaken by regulatory authorities, are anticipated to boost this segment in the pharmaceutical regulatory affairs industry.

The preclinical segment is expected to show the fastest CAGR of 8.40% over the forecast period. This can be attributed to the increasing demand for novel disease treatments, such as Zika virus, & Ebola, COVID-19, and the rising prevalence of existing diseases such as cancer, CVDs, & neurological diseases.Preclinical entities are tested in vivo as well as in vitro. Pharmacokinetic (PK) and toxico-kinetic test studies undertaken in this stage are an integral part of Investigational New Drug (IND) applications, while in vivo bioanalytical & DMPK assays are essential for investigating new drugs & conducting clinical trial filings across various regions.

Service Provider Insights

The outsourced regulatory affairs segment held the largest revenue share in 2022 of 56.26% and is anticipated to witness the fastest CAGR of 9.31% over the forecast period. This can be attributed to the rising popularity of outsourcing services as outsourcing enables companies to reduce costs, reduce staff training time, prioritize strategic projects, and improve overall efficiency, as well as provide greater flexibility.Moreover, factors such as sociocultural factors, language, race, age, ethnicity, genetics, disease prevalence, and intellectual property rights vary according to the country. Outsourcing provides access to local expertise to address these variations and lends clarity on time & cost investments required for bringing the product to the respective market.

On the other hand, the in-house segment holds a significant share of the market. Large healthcare firms have strong in-house teams for regulatory affairs owing to their strong pipelines, varied product portfolios, and the ability to attract skilled & experienced professionals, which makes it a feasible and practical option.

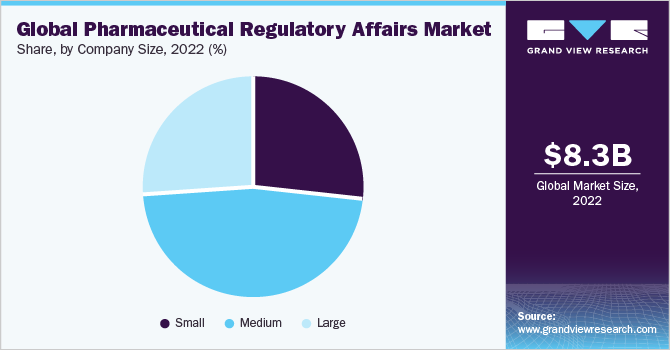

Company Size Insights

In terms of company size, the medium size companies segment dominated the global market in 2022 and held the maximum revenue share of more than 45%. Medium-sized companies have more resources and capabilities than small companies, enabling them to navigate the complex regulatory landscape more effectively. These companies have a broader product portfolio and a wider geographic presence, allowing them to serve a larger customer base across different countries. They can invest in R&D, clinical trials, and regulatory compliance, ensuring their products meet the necessary standards and regulations.

的大公司segment is expected to rise with the fastest CAGR of 8.04% over the forecast period.Large companies have extensive resources, a global presence, and expertise in navigating complex regulatory frameworks. These companies often have established relationships with regulatory authorities, enabling them to influence policy and shape regulatory standards. Large companies have the financial strength to invest in extensive clinical trials, advanced manufacturing facilities, and robust regulatory compliance systems.Moreover, their strong distribution networks and supply chain capabilities ensure the widespread availability of essential medicines and help address healthcare challenges across the region.

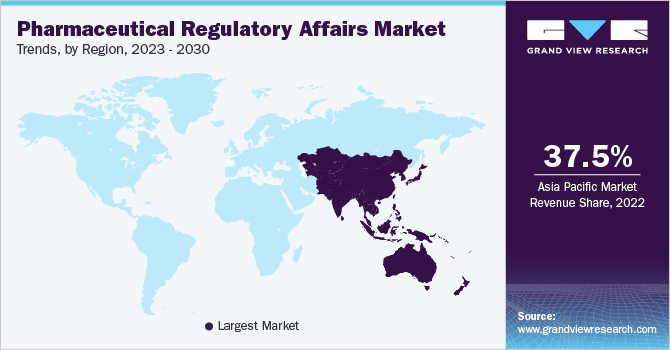

Regional Insights

Asia Pacific is expected to be the largest pharmaceutical regulatory affairs industry due to the cost savings, improved regulatory landscape, and growing number of clinical trials conducted in the region. Furthermore, the expansion of established biopharmaceutical companies may increase the demand for regulatory service providers. This is owing to the heterogeneous and complex regulatory environment, fueling the growth of the pharmaceutical regulatory affairs industry. Cost efficiency is a major factor for outsourcing regulatory affairs services, as biopharmaceutical companies face tremendous pressure to reduce the cost of R&D.

北美预计也将见证有积极ant growth during the forecast period. North America is known to have one of the most stringent regulatory systems globally. In 2021, there was a significant increase in the approval of biologics, accounting for 39.0% of the total new drug approvals. This trend indicates the growing pipeline of biotechnology products. The stringent regulatory environment and increasing R&D expenditure in region are expected to increase the demand for outsourcing regulatory affairs services among leading biopharmaceuticals.

Key Companies & Market Share Insights

Key companies in the market undertake several strategic initiatives such as partnerships, mergers, and acquisitions, to maintain their market position. For instance, in February 2022, Genomic Medicine Sweden (GMS) entered into a collaboration with the Centers for Personalized Medicine (ZPM) for personalized medicine. This collaboration is expected to strengthen the company’s position in the market. Moreover, in July 2021, ICON Plc completed the acquisition of PRA Health, which has transformed the scale and capabilities of the company. The combined company leverages the enhanced operations to accelerate biopharma customers’ commercial success and transform regulatory space & clinical trials by developing much-needed medical devices & medicines. Some prominent players in the global pharmaceutical regulatory affairs market include:

Freyr

IQVIA Inc

ICON plc

WuXi AppTec

Charles River Laboratories

Labcorp Drug Development

Parexel International Corporation

Pharmalex GmbH

Pharmexon

- Genpact

Pharmaceutical Regulatory Affairs Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 8.88 billion |

Revenue forecast in 2030 |

USD 14.90 billion |

Growth rate |

CAGR of 7.7% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Service, category, indication, product stage, service provider, company size, region |

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East; Africa |

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Russia; Turkey; Netherlands; Switzerland; Sweden; Japan; China; India; Australia; South Korea; Indonesia; Malaysia; Singapore; Thailand; Taiwan; Brazil; Mexico; Argentina; Colombia; Chile; Saudi Arabia; UAE; Egypt; Israel; Botswana; Namibia; Zimbabwe; Zambia; Tanzania; Rwanda; Ghana; Nigeria; Uganda; Mauritius; Kenya |

Key companies profiled |

Freyr; IQVIA Inc.; ICON plc; WuXi AppTec; Charles River Laboratories; Labcorp Drug Development; Parexel International Corporation; Pharmalex GmbH; Pharmexon; Genpact |

Customization scope |

Freereport customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, and segment scope. |

价格和购买该俱乐部ns |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Pharmaceutical Regulatory Affairs Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pharmaceutical regulatory affairs market report based on service, category, indication, product stage, service provider, company size, and region:

Services Outlook (Revenue, USD Billion, 2018 - 2030)

Regulatory Consulting

Legal Representation

Regulatory Writing & Publishing

Writing

Publishing

Product Registration & Clinical Trial Applications

Other Services

Category Outlook (Revenue, USD Billion, 2018 - 2030)

Drugs

Innovator

Preclinical

Clinical

Pre-Market Approval (PMA)

Generics

Preclinical

Clinical

Pre-Market Approval (PMA)

Biologics

Biotech

Preclinical

Clinical

Pre-Market Approval (PMA)

ATMP

Preclinical

Clinical

Pre-Market Approval (PMA)

Biosimilars

Preclinical

Clinical

Pre-Market Approval (PMA)

Indication Outlook (Revenue, USD Billion, 2018 - 2030)

Oncology

Neurology

Cardiology

Immunology

Others

Product Stage Outlook (Revenue, USD Billion, 2018 - 2030)

Preclinical

Clinical studies

PMA

Service Provider Outlook (Revenue, USD Billion, 2018 - 2030)

In-house

Outsourcing

Company Size Outlook (Revenue, USD Billion, 2018 - 2030)

Small

Medium

Large

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

North America

U.S.

Canada

Europe

U.K.

Germany

France

Italy

Spain

Russia

Turkey

Netherlands

Switzerland

Sweden

Asia Pacific

Japan

China

India

Australia

South Korea

Indonesia

马来西亚

Singapore

Thailand

Taiwan

Latin America

Brazil

Mexico

Argentina

Colombia

Chile

Middle East

Saudi Arabia

UAE

Egypt

Israel

Africa

Botswana

Namibia

Zimbabwe

Zambia

Tanzania

Rwanda

Ghana

Nigeria

Uganda

Mauritius

Kenya

Frequently Asked Questions About This Report

b.The global pharmaceutical regulatory affairs market size was estimated at USD 8.27 billion in 2022 and is expected to reach USD 8.88 billion in 2023

b.The global pharmaceutical regulatory affairs market is expected to grow at a compound annual growth rate of 7.67% from 2023 to 2030 to reach USD 14.89 billion by 2030.

b.Asia Pacific dominated the pharmaceutical regulatory affairs market with a share of 37.46% in 2022. This is attributable to cost savings, improved regulatory landscape, and a growing number of clinical trials conducted in the region. Furthermore, the expansion of established biopharmaceutical companies may increase the demand for regulatory service providers.

b.Some key players operating in the pharmaceutical regulatory affairs market include Freyr, IQVIA Inc., ICON plc, WuXi AppTec, Charles River Laboratories, Labcorp Drug Development, Parexel International Corporation, Pharmalex GmbH, Pharmexon, Genpact.

b.Key factors that are driving the market growth include increasing focus on patient safety and pharmacovigilance, accelerated drug development and approval processes, and increasing regulatory requirements.