Retail Cloud Market Size, Share & Trends Analysis Report By Component (Solution, Services), By Service Model Type (SaaS, IaaS, PaaS), By Deployment, By Organization Size, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-110-5

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry:Technology

Report Overview

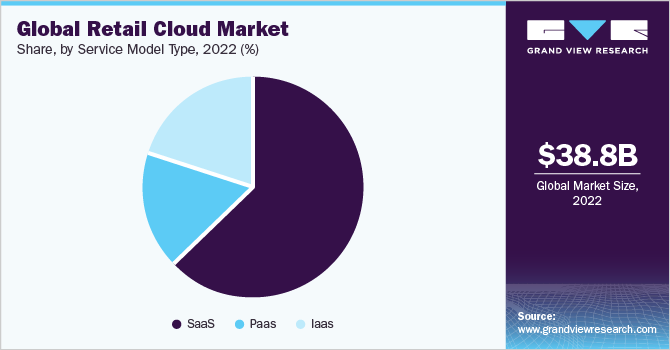

The globalretail cloud market sizewas estimated atUSD 38.83 billion in 2022,预计年复合增长的恶性肿瘤h rate (CAGR) of 15.8% from 2023 to 2030. This expansion is primarily driven by the increasing adoption of cloud computing among retailers, as it offers cost-effective and efficient solutions for their operations. There is a growing demand for scalability and flexibility in retail, which cloud technology can provide, allowing businesses to quickly adapt to changing market conditions. Additionally, retailers focus on improving customer experience and engagement, and cloud-based systems enable seamless interactions and personalized services. The rising importance of data analytics in the retail sector is propelling the adoption of cloud platforms, empowering retailers to gain valuable insights and make data-driven decisions for enhanced performance.

For instance, in May 2023, WHSmith North America (WHSNA) announced its adoption of cutting-edge retail cloud solutions from Oracle, including Oracle Retail Merchandise Financial Planning Cloud Service and Oracle Retail AI Foundation Cloud Service. This strategic move aims to enhance inventory planning and placement across WHSNA's stores in the U.S. and Canada. By embracing these advanced cloud services, WHSNA is actively pursuing its digital transformation strategy to leverage technology to elevate the customer experience and drive sales growth, further solidifying its position as a forward-looking and customer-centric business.

Cloud computingis revolutionizing the retail market in several ways. It enables retailers to effectively manage peak demand by providing scalability and elasticity to adjust resources. The technology facilitates predicting future demand through data analysis and optimizing inventory and staffing levels. Cloud-based self-service business intelligence empowers retailers to make informed decisions without IT support. Cloud computing also aids in financial management, tracking income, and expenses, and preparing financial reports. Moreover, it enhances security, compliance, and disaster recovery, ultimately boosting efficiency, profitability, and customer satisfaction in the retail industry. Thus, retail industry cloud adoption is growing rapidly, driven by cost savings, flexibility, scalability, security, and innovation benefits, and is being utilized in customer relationship management, inventory and pricing management, marketing automation, and fraud detection.

The shopping landscape is undergoing rapid transformation, with a significant shift toward online shopping, accelerated even further by the pandemic. Thus, retailers must prioritize enhancing their online experiences to meet customer expectations. Speed is crucial in this endeavor, as today's consumers demand fast and seamless interactions when browsing websites and using apps for shopping. Meeting these expectations is essential for retailers to stay competitive and maintain customer satisfaction in the digital era. For instance, in Jan 2022, Akamai Technologies, a content delivery network service provider, stated that online retail sales increased by 32% in 2020 and even faster in 2021, and a 100-millisecond delay in site loading time can decrease conversion rates by 7%.

The retail cloud market experienced significant growth during the COVID-19 pandemic due to several key factors. The shift to online operations compelled retailers to seek cloud-based solutions, driving demand for such services. Additionally, changing consumer behavior emphasized the need for seamless online shopping experiences, prompting retailers to invest in cloud technologies. Moreover, the pandemic accelerated the adoption of cloud computing, with businesses recognizing its cost efficiency and agility. Cloud-based solutions were favored in the retail sector for their scalability, flexibility, and security advantages.

有限公司mponent Insights

The solution segment led the market in 2022, accounting for over 64% share of the global revenue. The high share can be attributed to the rising demand for customer management,supply chain management, workforce management, and data security solutions. Customer management solutions enhance engagement, satisfaction, and retention through personalized experiences and data tracking. For improved efficiency, supply chain management solutions optimize inventory, orders, and supplier coordination. Workforce management solutions effectively track attendance, shifts, and benefits. Data security solutions safeguard against unauthorized access and threats through encryption and monitoring. As organizations become more complex, the demand for these solutions is expected to grow, becoming increasingly crucial for effective operations in the coming years.

The services segment is predicted to foresee significant growth in the forecast years. This growth is driven by several factors, including the increasing complexity of retail operations, leading to a higher demand for professional services. Additionally, the growing adoption of cloud-based retail solutions has created opportunities for service providers as retailers seek to outsource their IT operations. Moreover, the rising demand for omnichannel retail necessitates integrated services combining cloud-based solutions and professional services to deliver a seamless shopping experience across multiple channels.

Deployment Insights

The public cloud segment led the market in 2022, accounting for over 50% share of the global revenue. This is attributed to the numerous advantages it offers retailers, including scalability, flexibility, and cost-effectiveness. Public clouds grant access to services such as data storage, computing power, and analytics, making them highly appealing to the retail industry. Key players such as Amazon Web Services, Inc.; Microsoft; and Google Cloud Platform are prominent providers offering services that cater to various retail needs, ranging from data storage and analytics toe-commerceplatforms, CRM, supply chain management, inventory management, and fraud detection. The public cloud's dominance is expected to continue as retailers seek to leverage its benefits to enhance their operations and stay competitive.

The hybrid cloud segment is expected to showcase significant growth over the forecast period. The growth is attributed to the rising adoption of cloud-based retail solutions such as supply chain management systems, e-commerce platforms, andcustomer relationship management(CRM) systems, which have gained popularity among retailers. The hybrid cloud approach allows them to deploy these solutions more efficiently and cost-effectively. By leveraging the hybrid cloud model, retailers can seamlessly integrate their existing infrastructure with cloud services, optimizing performance and scalability while maintaining data security and control.

Organization Size Insights

The large enterprises segment led the market in 2022, accounting for over 67% of global revenue. The high share can be attributed to their ample resources and infrastructure, enabling them to effectively adopt and utilize retail cloud solutions. Large enterprises benefit from the scalability and flexibility of cloud computing, enhancing customer experiences and streamlining operations. Key factors driving their adoption of retail cloud solutions include cost savings, improved security, and increased agility. Cloud computing allows them to save on IT infrastructure costs, access robust security measures, and swiftly deploy new applications and services. As the retail cloud market continues to expand, more large enterprises are expected to embrace these solutions as the advantages of cloud computing become increasingly evident to businesses of all sizes.

The small & medium size enterprises segment will witness significant growth in the coming years. Cloud computing offers SMEs numerous advantages, such as rapid adaptability to changing business needs and potential cost savings. As SMEs recognize the benefits of cloud technology in reducing costs and enhancing operational efficiency, their uptake of retail cloud solutions is expected to surge in the coming years, further propelling their growth in the retail cloud market. For instance, in April 2021, IBM Corporation, a technology-based company, stated that 75% of SMEs plan to implement cloud computing projects and improve IT infrastructure.

Service Model Type Insights

The SaaS segment led the market in 2022, accounting for over 62% share of the global revenue. SaaS solutions provide cost-efficiency by offering subscription-based models and reducing hardware, software licenses, and IT infrastructure expenses. Retailers can easily scale their operations with SaaS, adding or removing features and users as needed without significant investments. The accessibility of SaaS allows retailers to access data and applications from anywhere globally, which is ideal for businesses with international reach. Moreover, the user-friendly nature of SaaS makes it simple for even technically limited retailers to adopt and benefit from these solutions quickly.

The IaaS segment is predicted to foresee significant growth in the forecast years. IaaS offers retailers the advantage of renting computing, storage, and networking resources on a flexible pay-as-you-go basis, eliminating the need for costly hardware investments. Retailers can swiftly deploy new applications and services with enhanced agility and flexibility. As the retail industry evolves, the rising demand for IaaS solutions is driven by its potential to reduce costs, enhance agility, and foster innovation.

Regional Insights

North America dominated the market in 2022, accounting for over 39% share of the global revenue. The U.S. and Canada have emerged as promising growth hubs in the region. The region's dominance can be attributed to the high penetration of cloud computing, the rising adoption of omnichannel retail practices, and the growing demand fordata analyticsand insights in the retail sector. Additionally, numerous leading retailers further bolster North America's market position. The U.S. and Canada stand out as key contributors to this growth due to their robust and mature retail industries and a strong emphasis on innovation and technology, which fuels the adoption of cloud computing solutions in the retail sector.

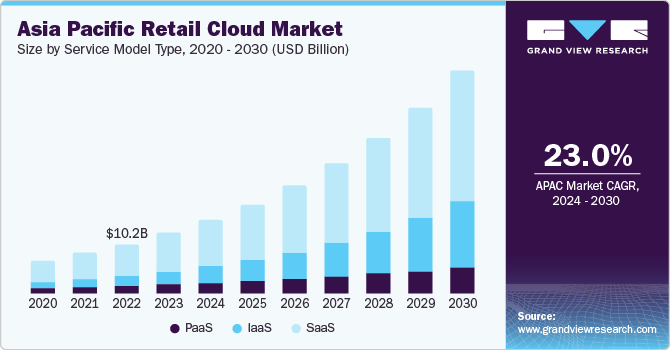

亚太地区预计将注册快t CAGR over the forecast period. This growth is driven by a growing demand for cloud-based services from small and medium-sized enterprises (SMEs) in Asia Pacific. Recognizing the advantages of cloud solutions, SMBs are fueling the market's expansion by embracing these technologies to enhance their operations and competitiveness. Countries like China, India, and Japan are experiencing robust economic growth and rapidly increasing internet penetration and smartphone adoption. This, in turn, drives the demand for efficient retail cloud solutions to support the thriving e-commerce industry. Additionally, the government's and businesses' significant investments in cloud infrastructure further fuel the demand for retail cloud solutions.

Key Companies &Market Share Insights

The rapidly growing retail cloud market is witnessing fierce competition between established players and startups, leading companies to adopt various strategies for gaining a competitive edge. These strategies include mergers and acquisitions to acquire new capabilities and expand into new markets, investing in new product offerings to cater to customer needs, embracing technological advancements like artificial intelligence and machine learning, innovating to enhance the customer experience, and expanding into new geographical markets.

有限公司mpanies also prioritize security and compliance to address the increasing risk of cyberattacks. Companies must remain agile, innovative, and customer-focused to succeed in this dynamic market while keeping up with the evolving technology landscape. For instance, in June 2023, Plotch., an AI-driven e-commerce ERP for small businesses, partnered with Google Cloud to introduce an ONDC-in-a-Box solution targeted at retail enterprises in India. Through this partnership, Plotch., and Google Cloud will offer enterprises the necessary tools and support to seamlessly integrate ONDC, including pre-built ONDC APIs and access to Google Cloud's infrastructure and expertise, streamlining the implementation process and empowering businesses to leverage the benefits of the open network efficiently. Some prominent players in the global retail cloud market include:

Accenture.

Amazon Web Services, Inc.

Cisco Systems, Inc.

有限公司gnizant

Fujitsu

Google LLC

IBM Corporation

Oracle

Salesforce, Inc.

SAP

Retail Cloud Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 45.31 billion |

Revenue forecast in 2030 |

USD 126.19 billion |

Growth rate |

CAGR of 15.8% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2017 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

有限公司mponent,service model type, deployment, organization size, region |

Regional scope |

北美;欧洲;亚太地区;拉丁美洲; MEA |

有限公司untry scope |

U.S.; Canada; Germany; U.K.; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia; UAE; South Africa |

Key companies profiled |

Accenture; Amazon Web Services, Inc.; Cisco Systems, Inc.; Cognizant; Fujitsu; Google LLC; IBM Corporation; Oracle; Salesforce, Inc.; SAP |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Retail Cloud Market Report Segmentation

这份报告预测收入增长在全球、再保险gional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global retail cloud market report based on component, service model type, deployment, organization size, and region:

有限公司mponent Outlook (Revenue, USD Billion, 2017 - 2030)

Solution

Customer Management

Supply Chain Management

Workforce Management

Data Security

Others

Services

Professional Services

Managed Services

Service Model Type Outlook (Revenue, USD Billion, 2017 - 2030)

SaaS

PaaS

IaaS

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

Public Cloud

Private Cloud

Hybrid Cloud

Organization Size Outlook (Revenue, USD Billion, 2017 - 2030)

Large Enterprises

Small & Medium Size Enterprises

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

North America

U.S.

Canada

Europe

U.K.

Germany

France

Asia Pacific

China

Japan

India

South Korea

Australia

拉丁美洲

Brazil

Mexico

MEA

Kingdom of Saudi Arabia

UAE

South Africa

Frequently Asked Questions About This Report

b.The global retail cloud market size was estimated at USD 38.83 billion in 2022 and is expected to reach USD 45.31 billion in 2023.

b.The global retail cloud market is expected to grow at a compound annual growth rate of 15.8% from 2023 to 2030 to reach USD 126.19 billion by 2030.

b.North America dominated the market in 2022, accounting for over 39% share of the global revenue. The region's dominance can be attributed to the high penetration of cloud computing, the rising adoption of omnichannel retail practices, and the growing demand for data analytics and insights in the retail sector.

b.Some key players operating in the retail cloud market include Accenture; Amazon Web Services, Inc.; Cisco Systems, Inc.; Cognizant; Fujitsu; Google LLC; IBM Corporation; Oracle; Salesforce, Inc.; SAP.

b.Key factors driving the retail cloud market growth include the growing adoption of multi-cloud architecture and the shift towards omnichannel retail.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."