Glutamic Acid Market Size, Share & Trends Analysis Report By Application (Food & Beverages, Pharmaceuticals, Animal Feed), By Region (North America, Europe, APAC, CSA, MEA), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-561-1

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2017 - 2019

- Industry:Specialty & Chemicals

Report Overview

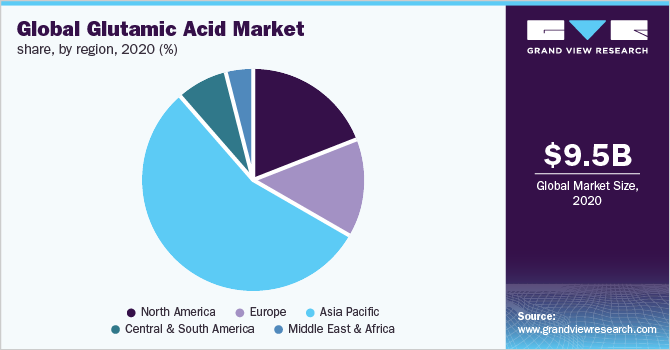

The global glutamic acid market size was valued at USD 9.54 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 7.6% from 2021 to 2028. Increasing demand for animal feed, coupled with the growing utilization offood additivesand food enhancers in the food and beverages industry, is estimated to trigger the product demand in the near future. The spread of the COVID-19 virus has crippled several economies and severely impacted the supply chains across industries. The production and consumption of glutamic acid are highly influenced by its demand from the end-use industries. Thus, any fluctuations in the demand from the end-use industries are anticipated to directly impact the demand for glutamic acid. The increasing awareness among individuals regarding consuming healthy products has positively impacted the demand for glutamic acid in the food and beverages and pharmaceuticals sectors.

The key raw materials used to produce glutamic acid include Coryneform bacteria, glucose, and sugarcane molasses. The product is manufactured using required raw materials through the fermentation process, which involves various steps such as fermentation, centrifugation, carbon adsorption, evaporation, crystallization, and ion exchange. The fermentation process has gained popularity among manufacturers owing to the high quality and purity of products obtained through this process. However, the process is capital-intensive and has high energy and water requirements.

The key suppliers of raw materials include Ambuja Group, Roquette Frères, Cargill, Incorporated, Eurosweet GmbH, Mahajan Molasses Company, and United States Biological. These suppliers are well-established players operating for a long time in the industry and have a strong distribution network.

Application Insights

The food and beverages application segment dominated the market with a revenue share of over 80.0% in 2020. This is attributed to the growing utilization of glutamic acid in the food and beverages industry as a flavor enhancer. Monosodium glutamate (MSG), a compound of glutamic acid, is generally used as a flavor enhancer in canned vegetables, salad dressings,soups, processed meat, carbohydrate-based snacks, anddairy productssuch asice cream, bread, and cheese. The globally increasing popularity of convenience food and ready-to-drink beverages is expected to drive the demand for glutamic acid in the food and beverages application.

The pharmaceuticals segment is anticipated to expand at the highest revenue-based CAGR of 8.0% over the forecast period. In pharmaceutical applications, glutamic acid plays a vital role in the prevention of nerve damage during chemotherapy and treatment of various diseases, such as epilepsy, muscular dystrophy, neurotransmission imbalances, and cognitive and behavioral problems, among individuals. Favorable government policies to support the pharmaceutical sector, coupled with the growing investment by private companies, are expected to drive the pharmaceutical industry, which, in turn, is projected to boost the consumption of glutamic acid in the coming years.

In the personal care and cosmetic industry, glutamic acid is used to adjust pH concentrations in cosmetics and personal products. It is used inbaby products, eye makeup, hair care products,skin care products, bath products, and anti-aging creams, among others. It is used in acne and anti-aging creams as it helps to reduce wrinkles, improves skin health, protects skin from free radical damage, and helps to maintain hydration.

Regional Insights

Asia Pacific dominated the market with a revenue share of over 50.0% in 2020 and is expected to witness the fastest growth over the forecast period. This is attributed to the expansion of the end-use industries such as animal feed, pharmaceutical, cosmetics and personal care, and food and beverage, in the developing economies of the region. China is one of the top feed-producing countries in the region, with a production capacity of over 187 million metric tons annually.

The demand for animal feed in countries such as India and China is projected to grow due to the presence of an abundant livestock population. Pork and poultry emerged as the prominent livestock segment in Asia Pacific owing to the growing preference for meat in local cuisines. Vietnam and Thailand are among the most prominent markets for animal feed in the region due to large-scale cattle farming activities.

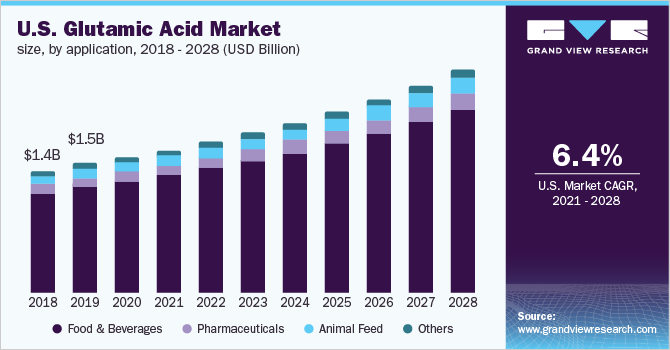

North America accounted for the second-largest market share in 2020. In North America, the demand for glutamic acid is anticipated to be driven by the growing demand for pharmaceuticals and animal feed. In the pharmaceutical sector, the product is utilized to manufacture a variety of drugs for the treatment of various diseases such as epilepsy and cognitive problems. According to a report published by a U.K.-based pharmaceutical manufacturer in 2020, the pharmaceutical market in North America is expected to be valued at USD 633 billion by 2024, recording a CAGR of 3.5% over the forecast period.

According to the Organization for Economic Co-operation and Development (OECD), North America is the second-largest consumer of dairy products such as cheese, after Europe. As per an article published by Dairy Food in April 2019, the per capita consumption of cheese such as Cheddar and Colby-Jack in North America increased from 11.7 pounds in 1995 to 15 pounds in 2017. Thus, the growing demand for various food and beverage products in North America is anticipated to drive the market in the region over the forecast period.

Key Companies & Market Share Insights

The market is characterized by the presence of several large and small-scale manufacturers engaged in the production of glutamic acid. Among these, small-scale local companies do not have a major impact on the overall market demand due to low production volumes. The companies are involved in bulk manufacturing of the product, which is then distributed to global destinations. Several companies are also redefining their supply chains to reduce cost and customer delays.

Key manufacturers in the market are focused on establishing production facilities at strategic locations to reduce the transportation cost, gain benefit from local incentives, and make the product readily available to end users. Industry participants focus on third-party agreements with professional distributors and sell distribution rights to these merchants in order to reach developed markets.

The market is fragmented owing to the well-established players located in developing economies as well. Large-scale companies focus on product development and innovation as well as marketing strategies. Some companies are also redefining their supply chain to reduce cost and customer delays. Some prominent players in the global glutamic acid market include:

Ajinomoto Co., Inc.

Akzo Nobel N.V.

Evonik Industries AG

Sichuan Tongsheng Amino acid Co., Ltd.

KYOWA HAKKO BIO CO., LTD.

Ottokemi

Hefei TNJ Chemical Industry Co., Ltd.

Suzhou Yuanfang Chemical Co., Ltd.

Global Bio-chem Technology Group Company Limited

Ningxia Yipin Biological Technology Co., Ltd.

Glutamic Acid Market Report Scope

Report Attribute |

Details |

Market size value in 2021 |

USD 10.17 billion |

Revenue forecast in 2028 |

USD 17.16 billion |

Growth Rate |

CAGR of 7.6% from 2021 to 2028 |

Base year for estimation |

2020 |

Historical data |

2017 - 2019 |

Forecast period |

2021 - 2028 |

Quantitative units |

Volume in kilotons, revenue in USD million/billion, and CAGR from 2021 to 2028 |

Report coverage |

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Application, region |

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

Country scope |

美国;加拿大;墨西哥;德国;英国;法国;中国; India; Japan; Brazil; Argentina; Saudi Arabia; South Africa |

Key companies profiled |

Ajinomoto Co., Inc.; Akzo Nobel N.V.; Evonik Industries AG; Sichuan Tongsheng Amino acid Co., Ltd.; KYOWA HAKKO BIO CO., LTD.; Ottokemi; Hefei TNJ Chemical Industry Co., Ltd.; Suzhou Yuanfang Chemical Co., Ltd.; Global Bio-chem Technology Group Company Limited; Ningxia Yipin Biological Technology Co., Ltd. |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

这份报告预测数量和收入增长the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the global glutamic acid market report on the basis of application and region:

Application Outlook(Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

Food & Beverages

Pharmaceuticals

Animal Feed

Others

Regional Outlook(Volume, Kilotons; Revenue, USD Million, 2017 - 2028)

North America

U.S.

Canada

Mexico

Europe

U.K.

Germany

France

Asia Pacific

中国

India

Japan

Central & South America

Brazil

Argentina

Middle East & Africa

Saudi Arabia

South Africa

Frequently Asked Questions About This Report

b.The global glutamic acid market size was valued at USD 9.54 billion in 2020 and is expected to reach USD 10.17 billion in 2021.

b.The global glutamic acid market size is projected to grow at a compound annual growth rate (CAGR) of 7.6% in terms of revenue from 2021 to 2028 to reach USD 17.16 billion by 2028.

b.The food & beverages application segment dominated the glutamic acid market with a revenue share of over 80% in 2020. This is attributed to the growing utilization of glutamic acid in the food and beverages industry as a flavor enhancer.

b.Some prominent players in the glutamic acid market include Ajinomoto Co., Inc., Akzo Nobel N.V., Evonik Industries AG, Sichuan Tongsheng Amino acid Co., Ltd., KYOWA HAKKO BIO CO., LTD., Ottokemi, Hefei TNJ Chemical Industry Co., Ltd., Suzhou Yuanfang Chemical Co., Ltd., Global Bio-chem Technology Group Company Limited, and Ningxia Yipin Biological Technology Co., Ltd.

b.Increasing demand for animal feed, coupled with the growing utilization of food additives and food enhancers in the food & beverages industry, is estimated to drive glutamic acid market growth.